|

市场调查报告书

商品编码

1666636

电动车车载充电器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Vehicle On-Board Charger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

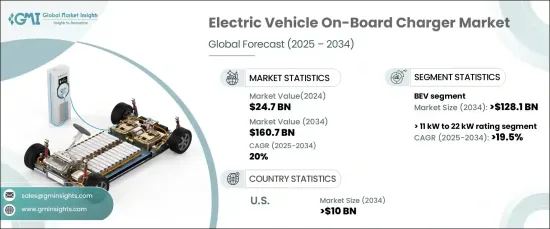

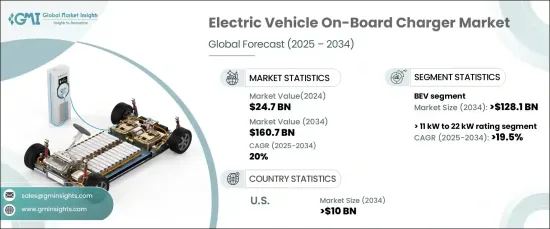

全球电动车车载充电器市场正经历显着成长,到 2024 年将达到 247 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 20%。 这一快速扩张反映了全球电动车普及率的激增,推动因素包括环境问题、政府推行清洁能源的政策以及进步。由于电动车的环保优势和成本效益,世界各地的消费者越来越青睐电动车,对尖端充电解决方案的需求庞大。高性能车载充电器的开发是推动这一成长的关键因素,它可以简化充电流程并减少停机时间。透过标准化充电协议和增强基础设施的努力,该行业得到了进一步的支持,为用户提供了更大的便利性和相容性,从而确保了向电动车的无缝过渡。

製造商正在透过创新具有更高功率额定值的车载充电器来应对不断增长的电动车需求,旨在大幅缩短充电时间并增强整体驾驶体验。对更快、更有效率的充电系统的承诺符合日益增长的消费者期望,并强调了技术进步对于推进电动车生态系统的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 247亿美元 |

| 预测值 | 1607亿美元 |

| 复合年增长率 | 20% |

预计到 2034 年,纯电动车 (BEV) 车载充电器市场规模将达到 1,281 亿美元。充电技术和基础设施的进步,以及消费者对永续替代品兴趣的激增,为纯电动车及其车载充电器实现前所未有的成长铺平了道路。公共充电网路的日益普及和政府激励措施进一步激励消费者转向这些环保汽车,从而增强了市场发展势头。

预计到 2034 年,额定功率为 11 kW 至 22 kW 的车载充电器的复合年增长率将达到 19.5%,这反映出消费者对更快、更强大的充电解决方案的偏好发生了明显转变。这些充电器专为满足时间敏感的用户的需求而设计,可确保更快、更有效率地补充能量,使电动车成为更广泛用户的实用选择。作为回应,製造商正在突破创新的界限,提供更高功率的充电器来满足这些不断变化的需求。

在全国范围内对电气化和永续交通的重视的推动下,仅美国电动汽车车载充电器市场就有望在 2034 年前创下 100 亿美元的产值。联邦和州级激励措施、消费者意识以及双向充电功能等技术进步等因素是推动这一成长的主要因素。旨在减少排放和促进清洁交通的政策为电动车的普及奠定了坚实的基础,使美国成为全球向电动车转变的关键参与者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模及预测:以推进方式,2021 – 2034 年

- 主要趋势

- 纯电动车

- 插电式混合动力汽车

- 其他的

第六章:市场规模及预测:依评级,2021 – 2034 年

- 主要趋势

- < 11 千瓦

- > 11 千瓦至 22 千瓦

- > 22 千瓦

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 挪威

- 德国

- 法国

- 荷兰

- 英国

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Bel Fuse

- BorgWarner

- Brusa Elektronik

- Delta Energy Systems

- Eaton

- Ficosa Internacional

- Hyundai Motor

- Infineon Technologies

- Innolectric

- Nissan Motor

- Phinia

- Stercom Power Solutions

- STMicroelectronics

- Tesla

- Toyota Industries

- Valeo

- Xepics Italia

The Global Electric Vehicle On-Board Charger Market is experiencing remarkable growth, reaching USD 24.7 billion in 2024, with projections indicating a CAGR of 20% between 2025 and 2034. This rapid expansion reflects a global surge in EV adoption, driven by environmental concerns, government policies promoting clean energy, and technological advancements. Consumers worldwide are increasingly embracing EVs for their eco-friendly benefits and cost efficiency, creating significant demand for cutting-edge charging solutions. The development of high-performance on-board chargers, which streamline charging processes and reduce downtime, is a pivotal factor in driving this growth. The industry is further bolstered by efforts to standardize charging protocols and enhance infrastructure, enabling greater convenience and compatibility for users, thus ensuring a seamless transition to electric mobility.

Manufacturers are responding to rising EV demand by innovating on-board chargers with higher power ratings, designed to drastically reduce charging times and enhance the overall driving experience. The commitment to faster, more efficient charging systems aligns with growing consumer expectations and underscores the importance of technological progress in advancing the EV ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.7 Billion |

| Forecast Value | $160.7 Billion |

| CAGR | 20% |

The on-board charger market for battery electric vehicles (BEVs) is expected to reach USD 128.1 billion by 2034. BEVs, powered exclusively by electric energy stored in batteries, represent a zero-emission solution that actively contributes to reducing greenhouse gas emissions and combating air pollution. Advances in charging technologies and infrastructure, alongside a surge in consumer interest in sustainable alternatives, are paving the way for BEVs and their on-board chargers to achieve unprecedented growth. The increasing availability of public charging networks and government incentives further incentivize consumers to transition to these eco-friendly vehicles, strengthening market momentum.

On-board chargers in the 11 kW to 22 kW power rating category are forecasted to grow at a CAGR of 19.5% through 2034, reflecting a clear shift in consumer preferences for faster, more powerful charging solutions. These chargers, designed to meet the demands of time-conscious users, ensure quicker and more efficient energy replenishment, making EVs a practical choice for a broader audience. In response, manufacturers are pushing the boundaries of innovation to deliver higher-powered chargers that meet these evolving needs.

The U.S. EV on-board charger market alone is poised to generate USD 10 billion by 2034, driven by a nationwide emphasis on electrification and sustainable transportation. Factors such as federal and state-level incentives, consumer awareness, and technological advancements-like bidirectional charging capabilities-are key contributors to this growth. Policies targeting emissions reduction and promoting clean transportation are laying a strong foundation for the adoption of EVs, positioning the U.S. as a critical player in the global shift toward electric mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Propulsion, 2021 – 2034 (Units, USD Billion)

- 5.1 Key trends

- 5.2 BEV

- 5.3 PHEV

- 5.4 Others

Chapter 6 Market Size and Forecast, By Rating, 2021 – 2034 (Units, USD Billion)

- 6.1 Key trends

- 6.2 < 11 kW

- 6.3 > 11 kW to 22 kW

- 6.4 > 22 kW

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.3.6 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Bel Fuse

- 8.2 BorgWarner

- 8.3 Brusa Elektronik

- 8.4 Delta Energy Systems

- 8.5 Eaton

- 8.6 Ficosa Internacional

- 8.7 Hyundai Motor

- 8.8 Infineon Technologies

- 8.9 Innolectric

- 8.10 Nissan Motor

- 8.11 Phinia

- 8.12 Stercom Power Solutions

- 8.13 STMicroelectronics

- 8.14 Tesla

- 8.15 Toyota Industries

- 8.16 Valeo

- 8.17 Xepics Italia