|

市场调查报告书

商品编码

1666637

船用柴油引擎市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Marine Diesel Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

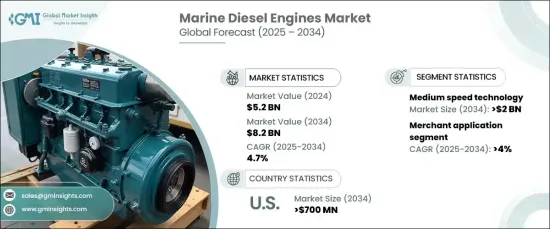

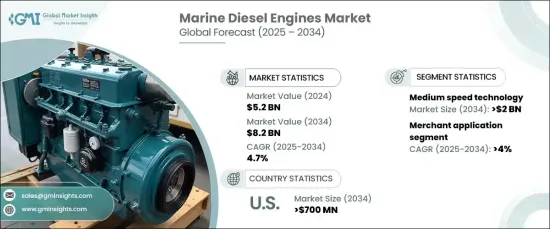

全球船用柴油引擎市场预计将大幅成长,2024 年价值估计为 52 亿美元,2025 年至 2034年复合成长率(CAGR) 为 4.7%。这种激增与在全球贸易中发挥关键作用的航运业的强劲扩张相一致。柴油因其价格低廉、广泛普及而仍然是海运应用的首选燃料,为长途和商业航运提供了经济高效的解决方案。此外,技术进步的重点是提高燃油效率、减少排放和确保遵守严格的环境法规,同时提高这些引擎的性能和可靠性。

船用柴油引擎是船舶的重要部件,为推进和发电提供动力。这些引擎因其效率、可靠性和承受恶劣海洋条件的能力而受到重视。由于能够使用多种燃料,它们变得灵活多变,成为海上作业的实用选择。该领域的创新满足了对更绿色解决方案的需求,同时保持了营运效率,符合不断发展的全球环境标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 52亿美元 |

| 预测值 | 82亿美元 |

| 复合年增长率 | 4.7% |

中速船用柴油引擎领域预计将显着成长,预计到 2034 年其市场份额将超过 20 亿美元。随着对性能改进和遵守不断发展的排放标准的要求的提高,对高效能、省油引擎的需求持续上升。

到 2034 年,船用柴油引擎市场中的商用部分预计将以超过 4% 的复合年增长率增长。可支配收入的增加和对海上旅游日益增长的兴趣进一步推动了对这些引擎的需求。消费者对高端旅行体验的兴趣日益浓厚,促进了行业的扩张,并且越来越注重为船舶配备高性能柴油引擎。

在美国,船用柴油引擎市场规模预计到 2034 年将超过 7 亿美元。随着勘探和生产活动的增加,用环保技术改造旧船的努力正在推动需求。这些因素将支持柴油引擎在各种海上作业中的日益广泛的使用,凸显其在满足当代产业需求方面的重要性。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模及预测:依技术分类,2021 – 2034 年

- 主要趋势

- 低速

- 中速

- 高速

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 商人

- 货柜船

- 油轮

- 散货船

- 气体运输船

- 滚装船

- 其他的

- 海上

- 钻井平台和船舶

- 起锚船

- 离岸支援船

- 浮式生产装置

- 平台供应船

- 游轮和渡轮

- 邮轮

- 客船

- 客船/货船

- 其他的

- 海军

- 其他的

第 7 章:市场规模及预测:按功率,2021 – 2034 年

- 主要趋势

- < 1,000 生命值

- 1,000 - 5,000 匹马力

- 5,001 - 10,000 匹马力

- 10,001 - 20,000 点生命值

- > 20,000 生命值

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 挪威

- 俄罗斯

- 丹麦

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 越南

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 伊朗

- 安哥拉

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第九章:公司简介

- AB Volvo

- Anglo Belgian Corporation

- Caterpillar

- Cummins

- Daihatsu Diesel

- Deere & Company

- DEUTZ

- Hyundai

- IHI Corporation

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Rolls-Royce

- Scania

- Siemens

- STX Heavy Industries

- Wartsila

- Yanmar

- Yuchai International

The Global Marine Diesel Engines Market is projected to grow significantly, with its value estimated at USD 5.2 billion in 2024 and a compound annual growth rate (CAGR) of 4.7% from 2025 to 2034. The rising global seaborne trade, especially in emerging economies, is anticipated to be a major driver of market growth. This surge aligns with the robust expansion of the shipping industry, which plays a pivotal role in global commerce. Diesel remains a preferred fuel choice for maritime applications due to its affordability and widespread availability, offering cost-effective solutions for long-distance and commercial shipping. Additionally, advancements in technology have focused on enhancing fuel efficiency, minimizing emissions, and ensuring compliance with stringent environmental regulations, all while improving the performance and reliability of these engines.

Marine diesel engines serve as critical components in ships and vessels, delivering power for propulsion and electricity generation. These engines are valued for their efficiency, dependability, and capability to endure harsh marine conditions. Their versatility in operating on various fuels makes them a practical option for maritime operations. Innovations in this sector are catering to the need for greener solutions while maintaining operational efficiency, aligning with evolving global environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 4.7% |

The medium-speed segment of marine diesel engines is poised for notable growth, with its market share expected to exceed USD 2 billion by 2034. These engines, known for their balanced speed and performance, are gaining popularity due to their lightweight construction and reduced maintenance requirements. The demand for efficient, fuel-saving engines continues to rise, driven by a need for improved performance and adherence to evolving emission norms.

The merchant segment within the marine diesel engines market is projected to grow at a CAGR exceeding 4% through 2034. This trend reflects increasing government initiatives aimed at bolstering national security by investing in advanced fleets and fostering maritime infrastructure. Rising disposable incomes and growing interest in maritime tourism are further propelling demand for these engines. Enhanced consumer interest in premium travel experiences contributes to the industry's expansion, with an increasing focus on equipping vessels with high-performance diesel engines.

In the United States, the marine diesel engines market is forecasted to surpass USD 700 million by 2034. The country benefits from access to abundant raw materials and cost-effective labor, creating favorable conditions for market growth. Efforts to retrofit older vessels with environmentally friendly technologies are driving demand, alongside heightened activities in exploration and production. These factors are set to support the increasing use of diesel engines in a variety of maritime operations, highlighting their importance in addressing contemporary industry needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Low speed

- 5.3 Medium speed

- 5.4 High speed

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Merchant

- 6.2.1 Container vessels

- 6.2.2 Tankers

- 6.2.3 Bulk carriers

- 6.2.4 Gas carriers

- 6.2.5 RO-RO

- 6.2.6 Others

- 6.3 Offshore

- 6.3.1 Drilling RIGS & ships

- 6.3.2 Anchor handling vessels

- 6.3.3 Offshore support vessels

- 6.3.4 Floating production units

- 6.3.5 Platform supply vessels

- 6.4 Cruise & ferry

- 6.4.1 Cruise vessels

- 6.4.2 Passenger vessels

- 6.4.3 Passenger/cargo vessels

- 6.4.4 Others

- 6.5 Navy

- 6.6 Others

Chapter 7 Market Size and Forecast, By Power, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 < 1,000 HP

- 7.3 1,000 - 5,000 HP

- 7.4 5,001 - 10,000 HP

- 7.5 10,001 - 20,000 HP

- 7.6 > 20,000 HP

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Norway

- 8.3.6 Russia

- 8.3.7 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 Iran

- 8.5.4 Angola

- 8.5.5 Egypt

- 8.5.6 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 AB Volvo

- 9.2 Anglo Belgian Corporation

- 9.3 Caterpillar

- 9.4 Cummins

- 9.5 Daihatsu Diesel

- 9.6 Deere & Company

- 9.7 DEUTZ

- 9.8 Hyundai

- 9.9 IHI Corporation

- 9.10 Kawasaki Heavy Industries

- 9.11 MAN Energy Solutions

- 9.12 Rolls-Royce

- 9.13 Scania

- 9.14 Siemens

- 9.15 STX Heavy Industries

- 9.16 Wartsila

- 9.17 Yanmar

- 9.18 Yuchai International