|

市场调查报告书

商品编码

1666657

太阳能电缆市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Solar Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

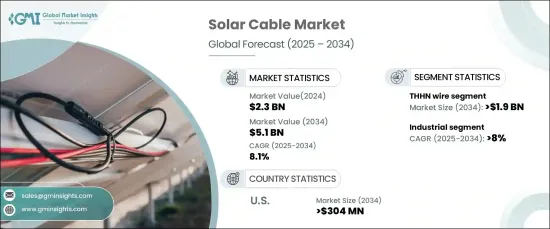

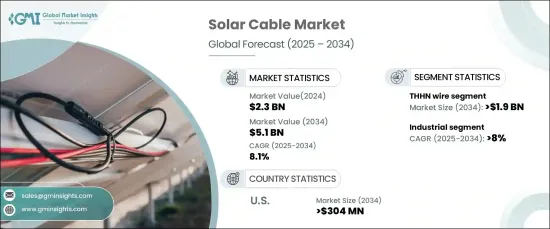

受全球太阳能专案快速扩张的推动,全球太阳能电缆市场预计在 2024 年实现 23 亿美元的强劲复合年增长率,从 2025 年到 2034 年,复合年增长率达 8.1%。随着政府激励措施不断加强、永续发展要求不断加强以及对净零排放的追求,再生能源投资激增。太阳能电缆在住宅、商业和公用事业规模的太阳能装置的连接和传输电力方面发挥关键作用,使其成为再生能源基础设施中不可或缺的一部分。

技术进步大大提高了太阳能电缆的效率、耐用性和安全性。提高抗紫外线能力、耐高温能力和延长使用寿命等创新可确保在恶劣的环境条件下达到最佳性能。这项技术进步与太阳能係统与能源储存解决方案和智慧电网的日益融合相一致,为更永续和可靠的能源生态系统铺平了道路。全球对再生能源目标的承诺日益增加以及太阳能光电 (PV) 系统成本的下降也推动了市场的发展,从而继续扩大其可及性和采用范围。由于中国和印度的大规模太阳能发展,亚太地区引领了这一成长势头,同时,在支持性政策框架和财政激励措施的推动下,北美和欧洲也正在经历稳步增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 51亿美元 |

| 复合年增长率 | 8.1% |

由于其出色的耐用性、多功能性和成本效益,THHN 线材市场的规模预计将在 2034 年超过 19 亿美元。热塑性高耐热尼龙涂层 (THHN) 电线以其强大的绝缘性能而闻名,可确保高效的能量传输,同时减少功率损耗。它们具有优异的耐热、防潮和耐磨性能,是室内和室外太阳能应用的理想选择。随着太阳能光电系统的部署扩展到住宅、商业和公用事业规模的项目,对可靠和高性能 THHN 电线的需求持续上升。

在工业领域,预计到 2034 年,太阳能电缆市场的复合年增长率将超过 8%,这得益于人们迅速采用太阳能来实现永续发展目标并最大限度地降低营运费用。随着企业寻求抵消不断上涨的电力成本并利用政府激励措施,大规模工业太阳能装置变得越来越普遍。这些装置需要强大的基础设施,包括耐用的太阳能电缆,以确保持续的能量传输和系统可靠性。利用太阳能增强的製造和施工流程进一步推动了对高效能电缆解决方案的需求。

随着住宅、商业和公用事业规模项目越来越多地采用太阳能係统,美国太阳能电缆市场规模预计到 2034 年将超过 3.04 亿美元。投资税收抵免(ITC)等联邦倡议和州级激励措施正在刺激太阳能的广泛安装,而雄心勃勃的可再生能源目标(包括到 2050 年实现净零排放)则推动了对太阳能基础设施的持续投资。高品质的太阳能电缆对于实现这些目标至关重要,可确保先进的太阳能係统高效可靠地运作。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第三章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 4 章:市场规模与预测:按类型,2021 – 2034 年

- 主要趋势

- 直流丝

- USE-2 线

- THHN 焊丝

第 5 章:市场规模与预测:依最终用途,2021 – 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第六章:市场规模及预测:依目前,2021 – 2034 年

- 主要趋势

- 交流

- 直流

第 7 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Alpha Wire

- Allied Wire and Cable

- Belden

- Fujikura

- Furukawa Electric

- General Cable

- Havells

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- KEI Industries

- Lapp Group

- Leoni

- LS Cable and System

- Nexans

- Northwire

- Polycab

- Prysmian Group

- RR Kabel

- Southwire Company

- TE Connectivity

The Global Solar Cable Market, valued at USD 2.3 billion in 2024, is poised to grow at a robust CAGR of 8.1% from 2025 to 2034, driven by the rapid expansion of solar energy projects worldwide. Investments in renewable energy have surged in response to escalating government incentives, sustainability mandates, and the pursuit of net-zero emissions. Solar cables play a pivotal role in connecting and transmitting power across residential, commercial, and utility-scale solar installations, making them indispensable to the renewable energy infrastructure.

Technological advancements are significantly enhancing the efficiency, durability, and safety of solar cables. Innovations such as improved UV resistance, temperature tolerance, and enhanced lifespan ensure optimal performance under harsh environmental conditions. This technological progress aligns with the increasing integration of solar energy systems with energy storage solutions and smart grids, paving the way for a more sustainable and reliable energy ecosystem. The market is also buoyed by a growing global commitment to renewable energy targets and the declining cost of solar photovoltaic (PV) systems, which continue to expand accessibility and adoption. While the Asia Pacific region leads this surge, thanks to large-scale solar developments in China and India, North America and Europe are also experiencing steady growth, driven by supportive policy frameworks and financial incentives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 8.1% |

The THHN wire segment is poised to exceed USD 1.9 billion by 2034 due to its exceptional durability, versatility, and cost-effectiveness. Thermoplastic High Heat-Resistant Nylon-coated (THHN) wires are renowned for their robust insulation properties, which ensure efficient energy transmission while reducing power losses. Their superior resistance to heat, moisture, and abrasion makes them ideal for both indoor and outdoor solar applications. As the deployment of solar PV systems expands across residential, commercial, and utility-scale projects, the demand for reliable and high-performance THHN wires continues to rise.

In the industrial sector, the solar cable market is projected to grow at a CAGR exceeding 8% through 2034, fueled by the rapid adoption of solar energy to achieve sustainability goals and minimize operational expenses. Large-scale industrial solar installations are becoming increasingly common as businesses seek to offset rising electricity costs and capitalize on government incentives. These installations require robust infrastructure, including durable solar cables, to ensure consistent energy transmission and system reliability. Enhanced manufacturing and construction processes leveraging solar energy further drive the need for efficient cable solutions.

The U.S. solar cable market is expected to surpass USD 304 million by 2034, driven by the growing adoption of solar energy systems across residential, commercial, and utility-scale projects. Federal initiatives such as the Investment Tax Credit (ITC) and state-level incentives are spurring widespread installations, while ambitious renewable energy targets, including net-zero emissions by 2050, fuel ongoing investments in solar infrastructure. High-quality solar cables are integral to achieving these goals, ensuring the efficient and reliable operation of advanced solar energy systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 4.1 Key trends

- 4.2 PW wire

- 4.3 USE-2 wire

- 4.4 THHN wire

Chapter 5 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Industrial

Chapter 6 Market Size and Forecast, By Current, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Alpha Wire

- 8.2 Allied Wire and Cable

- 8.3 Belden

- 8.4 Fujikura

- 8.5 Furukawa Electric

- 8.6 General Cable

- 8.7 Havells

- 8.8 Helukabel

- 8.9 Hellenic Group

- 8.10 Kabelwerk Eupen

- 8.11 KEI Industries

- 8.12 Lapp Group

- 8.13 Leoni

- 8.14 LS Cable and System

- 8.15 Nexans

- 8.16 Northwire

- 8.17 Polycab

- 8.18 Prysmian Group

- 8.19 RR Kabel

- 8.20 Southwire Company

- 8.21 TE Connectivity