|

市场调查报告书

商品编码

1666665

新生儿护理市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Neonatal Infant Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

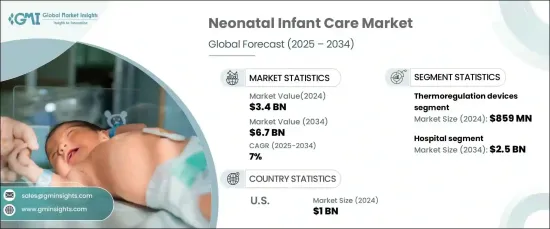

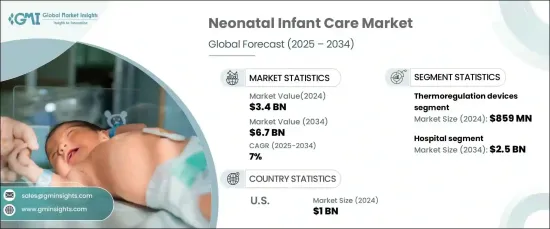

2024 年全球新生儿护理市场价值为 34 亿美元,预计 2025 年至 2034 年期间将实现显着增长,复合年增长率为 7%。旨在提高早产儿存活率、满足这一弱势群体特殊需求的创新推动着新生儿护理的不断发展。随着全球医疗保健格局的不断发展,人们也越来越关注提高新生儿健康的意识和可近性,从而更广泛地采用专业护理解决方案。这反过来又刺激了对能够满足早产儿独特健康需求的新生儿必需设备的需求。

促成市场扩张的一个主要因素是早产的发生率不断上升,早产约占全球分娩总数的 10%。早产儿经常面临器官发育不全等问题,需要专门的照护才能确保他们的生存。他们需要先进的支援系统,包括用于体温调节的孵化器和用于呼吸护理的呼吸机。这些设备的需求激增在新生儿加护病房(NICU)中尤为明显,这些技术对于早产儿的生存和长期健康发挥关键作用。透过提供更好的监测和更精确的治疗选择,这些设备正在彻底改变新生儿护理的模式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 67亿美元 |

| 复合年增长率 | 7% |

新生儿护理市场根据最终用途分为医院、儿科和新生儿诊所以及疗养院。其中,医院占据市场主导地位,到 2024 年将占据相当大的份额。医院,尤其是新生儿加护病房,配备了最先进的设备,例如孵化器、体温调节设备和呼吸支援系统。这些设施对于提供对患有健康併发症或早产的新生儿所需的重症监护至关重要,进一步推动了对先进的新生儿护理技术的需求。

美国新生儿护理市场价值在 2024 年达到 10 亿美元,凭藉其先进的医疗保健基础设施和较高的早产发生率引领全球市场。美国医院对新生儿护理产品(包括体温调节系统、呼吸器和孵化器)的需求尤其强劲。该国专注于改善新生儿护理结果,并结合公共和私营部门的倡议,支持采用这些救生技术。随着新生儿护理设备的不断进步,美国仍然是全球新生儿护理市场的关键参与者,确保早产婴儿获得最佳结果。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球扩大儿科诊所和新生儿加护病房

- 新兴经济体早产率上升

- NICU 装置的安装数量不断增加

- 新生儿护理设备的技术进步

- 产业陷阱与挑战

- 新生儿照护可及性差

- 成长动力

- 成长潜力分析

- 2024 年各国新生儿加护病房数量

- 监管格局

- 技术格局

- 价值链分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 体温调节装置

- 新生儿保温箱

- 暖炉

- 新生儿冷却系统

- 光疗设备

- LED 光疗系统

- CFL 光疗系统

- 监控系统

- 新生儿通气

- 血气监测系统

- 脑部监测

- 其他监控系统

- 新生儿復苏器

- 新生儿听力筛检

- 视力筛检

- 其他产品类型

第 6 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 儿科及新生儿诊所

- 养老院

第 7 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Angelantoni Life Science

- ATOM MEDICAL

- Becton, Dickinson, and Company

- COBAMS

- DAVID

- Drager

- Fanem

- Fisher & Paykel Healthcare

- GE Healthcare

- INSPIRATION HEALTHCARE GROUP

- Masimo

- Medtronic

- natus

The Global Neonatal Infant Care Market is valued at USD 3.4 billion in 2024 and is expected to experience significant growth with a CAGR of 7% from 2025 to 2034. This expansion is driven by several key factors, including the rising rates of premature births, continuous advancements in neonatal care technologies, and the overall increase in healthcare spending. The ongoing evolution of neonatal care is being propelled by innovations designed to improve the survival rates of preterm infants, addressing the specialized needs of this vulnerable population. As the global healthcare landscape continues to advance, there is also a growing focus on enhancing the awareness and accessibility of neonatal health, leading to broader adoption of specialized care solutions. This, in turn, is fueling the demand for essential neonatal equipment that can support the unique health needs of premature infants.

A major factor contributing to the market expansion is the increasing prevalence of preterm births, which account for approximately 10% of all global deliveries. Premature infants often face challenges such as underdeveloped organs, which necessitate specialized care to ensure their survival. They require advanced support systems, including incubators for thermoregulation and ventilators for respiratory care. The surge in demand for these devices is particularly evident in neonatal intensive care units (NICUs), where these technologies play a critical role in the survival and long-term health of preterm infants. By offering better monitoring and more precise treatment options, these devices are revolutionizing the landscape of neonatal care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 7% |

The neonatal infant care market is segmented by end use into hospitals, pediatric and neonatal clinics, and nursing homes. Among these, hospitals dominate the market, accounting for a substantial share in 2024. This segment is expected to generate USD 2.5 billion by 2034, reflecting the widespread adoption of advanced neonatal technologies. Hospitals, particularly NICUs, are equipped with state-of-the-art equipment, such as incubators, thermoregulation devices, and respiratory support systems. These facilities are essential in delivering the intensive care needed to support newborns with health complications or prematurity, further driving the demand for advanced neonatal care technologies.

The U.S. neonatal infant care market, valued at USD 1 billion in 2024, leads the global market due to its advanced healthcare infrastructure and a high incidence of preterm births. The demand for neonatal care products, including thermoregulation systems, ventilators, and incubators, is particularly strong in U.S. hospitals. The country's focus on improving neonatal care outcomes, combined with public and private sector initiatives, supports the adoption of these life-saving technologies. With continuous advancements in neonatal care equipment, the U.S. remains a pivotal player in the global neonatal infant care market, ensuring optimal outcomes for infants born prematurely.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of pediatric clinics and neonatal intensive care units globally

- 3.2.1.2 Rising premature birth rate in emerging economies

- 3.2.1.3 Increasing number of installations for NICU units

- 3.2.1.4 Technological advancements in neonatal infant care devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Poor accessibility for neonatal care

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Number of neonatal intensive care units, by country, 2024

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Value chain analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thermoregulation devices

- 5.2.1 Neonatal incubators

- 5.2.2 Warmers

- 5.2.3 Neonatal cooling systems

- 5.3 Phototherapy devices

- 5.3.1 LED phototherapy system

- 5.3.2 CFL phototherapy system

- 5.4 Monitoring systems

- 5.4.1 Neonatal ventilation

- 5.4.2 Blood gas monitoring system

- 5.4.3 Brain monitoring

- 5.4.4 Other monitoring systems

- 5.5 Neonatal infant resuscitator devices

- 5.6 Neonatal hearing screening

- 5.7 Vision screening

- 5.8 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Pediatric & neonatal clinics

- 6.4 Nursing homes

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Angelantoni Life Science

- 8.2 ATOM MEDICAL

- 8.3 Becton, Dickinson, and Company

- 8.4 COBAMS

- 8.5 DAVID

- 8.6 Drager

- 8.7 Fanem

- 8.8 Fisher & Paykel Healthcare

- 8.9 GE Healthcare

- 8.10 INSPIRATION HEALTHCARE GROUP

- 8.11 Masimo

- 8.12 Medtronic

- 8.13 natus