|

市场调查报告书

商品编码

1666668

手动升降灯塔市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Manual Lifting Light Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

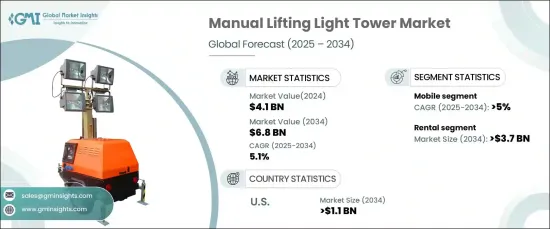

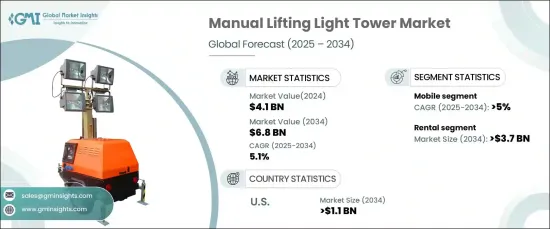

2024 年全球手动升降灯塔市场价值为 41 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.1%。

这些塔提供了简单且易于在偏远地区部署的功能。基础建设推动市场成长,美国交通部将在2023年为基础建设项目拨款1850亿美元。 LED 照明整合、耐用性和燃油效率的提高增加了全球手动升降灯塔的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 68亿美元 |

| 复合年增长率 | 5.1% |

由于各行各业对灵活且经济高效的照明解决方案的需求不断增加,租赁行业的规模预计到 2034 年将超过 37 亿美元。租赁灯塔适用于短期项目,例如建筑、采矿和户外活动,这些项目需要临时照明而不需要长期投资。基础设施项目数量的不断增加(特别是在新兴经济体)刺激了对租赁设备的需求。此外,救灾和紧急应变行动对便携式照明的需求进一步促进了市场的成长。由于维护成本较低且部署速度较快,设备租赁服务日益流行,这是推动租赁市场扩张的另一个关键因素。

到 2034 年,行动手动升降灯塔的复合年增长率预计将超过 5%。移动式灯塔具有增强的灵活性、便携性和易于运输的特点,使其成为偏远或具有挑战性的环境中专案的理想选择。紧急应变、救灾和大型户外活动临时照明的兴起趋势进一步刺激了需求。此外,燃油效率、LED 照明技术和耐用性的进步也促进了移动式手动升降灯塔的普及。

随着各行业对便携式高效照明解决方案的需求不断增加,美国手动升降灯塔市场规模预计到 2034 年将超过 11 亿美元。不断增长的基础设施开发、建设和户外活动是推动这一市场扩张的关键因素。手动升降灯塔因其价格便宜、使用方便、可在电力有限的地区快速部署而受到青睐。此外,紧急状况和自然灾害发生的频率不断增加,也导致临时照明的需求不断增加。节能 LED 照明技术的进步以及燃油效率和耐用性的提高进一步支持了美国市场对手动升降灯塔的采用。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:按通路,2021 – 2034 年

- 主要趋势

- 销售量

- 租赁

第 6 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 固定式

- 移动的

第 7 章:市场规模及预测:依明,2021 – 2034 年

- 主要趋势

- 金属卤化物

- 引领

- 电的

- 其他的

第 8 章:市场规模及预测:依电源分类,2021 年至 2034 年

- 主要趋势

- 柴油引擎

- 太阳的

- 直接的

- 其他的

第 9 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 建造

- 基础建设发展

- 石油和天然气

- 矿业

- 军事与国防

- 紧急及灾难救援

- 其他的

第 10 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司简介

- Allmand Bros

- Aska Equipments

- Atlas Copco

- Caterpillar

- Chicago Pneumatic

- Colorado Standby

- DMI

- Doosan Portable Power

- Generac Power Systems

- HIMOINSA

- Inmesol gensets

- JC Bamford Excavators

- LARSON Electronics

- Light Boy

- LTA Projects

- Multiquip

- Olikara Lighting Towers

- Progress Solar Solutions

- The Will Burt Company

- Trime

- United Rentals

- Wacker Neuson

- Youngman Richardson

The Global Manual Lifting Light Tower Market was valued at USD 4.1 billion in 2024 and is expected to witness a CAGR of 5.1% from 2025 to 2034. The industry is expanding as construction, mining, and emergency response operations demand portable, cost-effective lighting solutions.

These towers provide simplicity and easy deployment in remote locations. Infrastructure development drives market growth, as evidenced by the U.S. Department of Transportation's allocation of USD 185 billion for infrastructure projects in 2023. The need for temporary lighting in disaster relief operations and outdoor events further propels market demand. LED lighting integration, improved durability, and enhanced fuel efficiency increase the adoption of manual lifting light towers globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 5.1% |

The rental segment is expected to surpass USD 3.7 billion by 2034, driven by increasing demand for flexible and cost-effective lighting solutions across various industries. Rental light towers are favored for short-term projects, such as construction, mining, and outdoor events, where temporary lighting is required without long-term investment. The rising number of infrastructure projects, particularly in emerging economies, fuels the demand for rental equipment. Additionally, the need for portable lighting in disaster relief and emergency response operations further contributes to market growth. The growing trend of equipment rental services, supported by lower maintenance costs and quick deployment, is another key factor driving the expansion of the rental market.

The mobile manual lifting light towers are expected to grow at a CAGR of over 5% through 2034. This growth is driven by the increasing demand for versatile and easily deployable lighting solutions in various industries, including construction, mining, and outdoor events. Mobile light towers offer enhanced flexibility, portability, and ease of transport, making them ideal for projects in remote or challenging environments. The rising trend of temporary lighting for emergency response, disaster relief, and large-scale outdoor events further fuels demand. Additionally, advancements in fuel efficiency, LED lighting technology, and durability contribute to the growing adoption of mobile manual lifting light towers.

The U.S. manual lifting light tower market is expected to surpass USD 1.1 billion by 2034, driven by increasing demand for portable and efficient lighting solutions across various sectors. Growing infrastructure development, construction, and outdoor events are key factors fueling this market expansion. Manual lifting light towers are favored for their affordability, ease of use, and quick deployment in areas with limited access to power. Additionally, the rising frequency of emergency response situations and natural disasters contributes to the growing demand for temporary lighting. Technological advancements in energy-efficient LED lighting, along with improvements in fuel efficiency and durability, further support the adoption of manual lifting light towers across the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Sales

- 5.3 Rental

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Size and Forecast, By Lighting, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Metal halide

- 7.3 LED

- 7.4 Electric

- 7.5 Others

Chapter 8 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Diesel

- 8.3 Solar

- 8.4 Direct

- 8.5 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Infrastructure development

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Military & defense

- 9.7 Emergency & disaster relief

- 9.8 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million and ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 Allmand Bros

- 11.2 Aska Equipments

- 11.3 Atlas Copco

- 11.4 Caterpillar

- 11.5 Chicago Pneumatic

- 11.6 Colorado Standby

- 11.7 DMI

- 11.8 Doosan Portable Power

- 11.9 Generac Power Systems

- 11.10 HIMOINSA

- 11.11 Inmesol gensets

- 11.12 J C Bamford Excavators

- 11.13 LARSON Electronics

- 11.14 Light Boy

- 11.15 LTA Projects

- 11.16 Multiquip

- 11.17 Olikara Lighting Towers

- 11.18 Progress Solar Solutions

- 11.19 The Will Burt Company

- 11.20 Trime

- 11.21 United Rentals

- 11.22 Wacker Neuson

- 11.23 Youngman Richardson