|

市场调查报告书

商品编码

1666683

数位取证市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Digital Forensics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

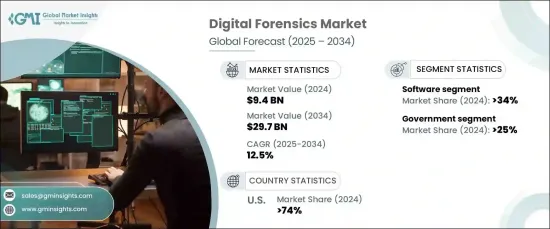

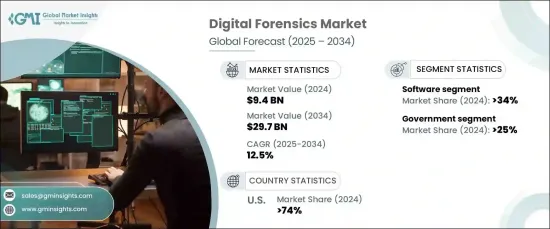

2024 年全球数位鑑识市场价值为 94 亿美元,预计将经历强劲增长,2025 年至 2034 年的复合年增长率为 12.5%。随着企业接受数位转型,它们面临网路威胁的激增,包括资料外洩、勒索软体攻击和内部风险。这些挑战凸显了对先进的数位鑑识解决方案的迫切需求,以便有效地调查、缓解和预防安全事件。

云端运算和物联网设备的日益普及进一步加速了市场的成长。由于企业和个人严重依赖云端平台和互联繫统,面临风险的数位资料量急剧增加。数位取证工具对于分析复杂的资料环境和解决云端和物联网生态系统特有的安全挑战至关重要。与物联网设备相关的漏洞越来越多,这也增加了对保障资料完整性和重要基础设施的取证解决方案的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 94亿美元 |

| 预测值 | 297亿美元 |

| 复合年增长率 | 12.5% |

数位鑑识市场分为硬体、软体和服务。 2024 年,软体领域占据了 34% 的市场份额,预计到 2034 年将创造 100 亿美元的市场价值。这些先进的工具使调查人员能够分析海量资料集,恢復已删除的信息,并追踪各种网路和设备上的恶意活动。

该市场涵盖多个关键垂直行业,包括政府、BFSI(银行、金融服务和保险)、IT 和电信、零售和医疗保健。 2024 年,政府部门占据了 25% 的份额,反映了其在国家安全和监管合规方面的关键作用。政府机构正在增加对取证技术的投资,以打击网路犯罪、恐怖主义和数位诈欺。用于情报和防御目的的恢復证据和安全调查的复杂工具的需求日益增长,进一步推动了这一领域的发展。

美国数位取证市场在 2024 年占据了 74% 的份额,预计到 2034 年将达到 60 亿美元。大力投资研发,加上政府的倡议,推动了其主导。这些因素使美国成为数位鑑识创新和应用领域的全球领导者。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 数位取证硬体供应商

- 软体供应商

- 经销商

- 最终用途

- 利润率分析

- 定价分析

- 专利格局

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 网路犯罪不断增加

- 智慧型手机的广泛使用

- 金融诈欺调查需求不断增长

- 严格的法规和合规要求

- 产业陷阱与挑战

- 缺乏熟练的数位鑑识专业人员

- 加密技术的使用日益广泛

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 电脑取证

- 网路取证

- 行动装置取证

- 云取证

- 其他的

第 6 章:市场估计与预测:按工具,2021 - 2034 年

- 主要趋势

- 数据采集与保存

- 法医资料分析

6.4 审查和报告

- 法医解密

- 其他的

第七章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 软体

- 服务

第 8 章:市场估计与预测:按垂直产业,2021 - 2034 年

- 主要趋势

- 金融保险业协会

- 卫生保健

- 政府

- 资讯科技和电信

- 零售

- 其他的

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Autopsy

- Cellebrite

- Cisco

- Check Point Software

- Cyrebro

- ExtraHop

- Exterro

- Global Digital Forensics

- IBM Corporation

- Imperva

- KLDiscovery

- LogRythm

- Magnet Forensics

- Microsoft

- MSAB

- Nuix

- OpenText

- Oxygen Forensics

- Paraben

- Parrot Security

- Sanyo Special Steel Co.,

- Shriram Pistons & Rings

- Thyssenkrupp

- Tupy SA

- Wiseco Piston Company

- Yasunaga

The Global Digital Forensics Market, valued at USD 9.4 billion in 2024, is projected to experience robust growth, with a CAGR of 12.5% from 2025 to 2034. This expansion is fueled by the increasing complexity and prevalence of cybercrimes. As businesses embrace digital transformation, they face a surge in cyber threats, including data breaches, ransomware attacks, and insider risks. These challenges highlight the critical need for advanced digital forensics solutions to investigate, mitigate, and prevent security incidents effectively.

The rising adoption of cloud computing and IoT devices further accelerates market growth. With businesses and individuals heavily relying on cloud platforms and interconnected systems, the volume of digital data at risk has surged dramatically. Digital forensics tools are indispensable in analyzing intricate data environments and addressing security challenges unique to cloud and IoT ecosystems. The growing vulnerabilities linked to IoT devices have amplified the demand for forensic solutions that safeguard data integrity and protect vital infrastructures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 12.5% |

The digital forensics market is segmented into hardware, software, and services. In 2024, the software segment accounted for 34% of the market share and is on track to generate USD 10 billion by 2034. Software solutions lead the market due to their ability to streamline and automate investigative processes, delivering enhanced accuracy and efficiency. These advanced tools empower investigators to analyze massive datasets, recover deleted information, and trace malicious activities across various networks and devices.

The market spans several key industry verticals, including government, BFSI (banking, financial services, and insurance), IT and telecom, retail, and healthcare. In 2024, the government sector claimed a 25% share, reflecting its pivotal role in national security and regulatory compliance. Government agencies are increasingly investing in forensic technologies to combat cybercrime, terrorism, and digital fraud. The growing demand for sophisticated tools to recover evidence and secure investigations for intelligence and defense purposes is further propelling this segment.

The U.S. digital forensics market accounted for a commanding 74% share in 2024 and is projected to reach USD 6 billion by 2034. The country's advanced technological infrastructure and high cybercrime rates have created a significant demand for cutting-edge digital forensics solutions. Strong investments in research and development, coupled with government initiatives, drive its dominance. These factors position the U.S. as a global leader in digital forensics innovation and adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Digital forensics hardware providers

- 3.2.2 Software providers

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Pricing analysis

- 3.5 Patent Landscape

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising cybercrimes

- 3.9.1.2 The wide use of smartphones

- 3.9.1.3 Rising demand in financial fraud investigation

- 3.9.1.4 Stringent regulations and compliance requirements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Shortage of skilled digital forensic professionals

- 3.9.2.2 Increasing use of encryption technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Computer forensics

- 5.3 Network forensics

- 5.4 Mobile device forensics

- 5.5 Cloud forensics

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Tools, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Data acquisition & preservation

- 6.3 Forensic data analysis

- 6.4 Review and reporting

- 6.5 Forensic decryption

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hardware

- 7.3 Software

- 7.4 Service

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Healthcare

- 8.4 Government

- 8.5 IT & telecom

- 8.6 Retail

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Autopsy

- 10.2 Cellebrite

- 10.3 Cisco

- 10.4 Check Point Software

- 10.5 Cyrebro

- 10.6 ExtraHop

- 10.7 Exterro

- 10.8 Global Digital Forensics

- 10.9 IBM Corporation

- 10.10 Imperva

- 10.11 KLDiscovery

- 10.12 LogRythm

- 10.13 Magnet Forensics

- 10.14 Microsoft

- 10.15 MSAB

- 10.16 Nuix

- 10.17 OpenText

- 10.18 Oxygen Forensics

- 10.19 Paraben

- 10.20 Parrot Security

- 10.21 Sanyo Special Steel Co.,

- 10.22 Shriram Pistons & Rings

- 10.23 Thyssenkrupp

- 10.24 Tupy S.A.

- 10.25 Wiseco Piston Company

- 10.26 Yasunaga