|

市场调查报告书

商品编码

1666706

工业石榴石市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Industrial Garnet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

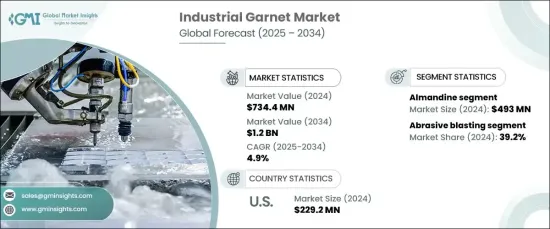

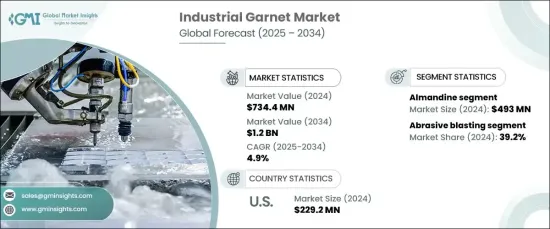

2024 年全球工业石榴石市场价值为 7.344 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。它在各种应用中发挥关键作用,包括水刀切割、表面处理和过滤系统。

市场主要受到建筑和基础设施产业的成长所推动,这些产业对精确、高效的切削工具的需求越来越大。工业石榴石广泛应用于水刀切割,该技术具有精度高、不产生热量的特点,从而最大限度地减少材料浪费。这种方法符合各行各业对经济高效且环保的解决方案日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.344 亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 4.9% |

此外,随着人们对水污染和资源管理的担忧日益加剧,石榴石在水过滤中的作用也日益凸显。其去除杂质的能力使其成为采矿、食品加工和废水处理等行业的宝贵材料。透过为过滤和表面处理领域的尖端技术做出贡献,Garnet 支援永续发展计划和工业效率。

就类型而言,市场上包括铁铝榴石、钙铁榴石、钙铝榴石、镁铝榴石、锰铝榴石和钙铬榴石。铁铝榴石以其耐用性和广泛可用性而闻名,在 2024 年以 4.93 亿美元的估值占据了市场主导地位。它的成本效益和适合要求苛刻的应用使其成为需要高性能磨料的行业的首选。

基于应用的细分突出了喷砂、水刀切割、过滤和磨料粉等关键领域。 2024 年,喷砂占据最大的市场份额,占 39.2%。石榴石的可回收性和效率使其成为表面处理的理想选择,满足了人们对更清洁、更永续方法日益增长的需求。

2024 年,美国工业石榴石市场创收 2.292 亿美元,这得益于其在水刀切割、喷砂和过滤过程中的应用日益广泛。不断扩大的建筑和基础设施产业,加上对采用环保技术的重视,对这一成长起到了重要作用。美国凭藉其强大的工业基础和技术进步继续引领市场。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 基础建设开发建设

- 水刀切割的技术进步

- 水过滤和环境问题

- 产业陷阱与挑战

- 供应链中断

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:按类型,2021-2034 年

- 主要趋势

- 铁铝榴石

- 钙铁榴石

- 钙铝榴石

- 镁铝榴石

- 锰铝榴石

- 钙铬榴石

第 6 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 喷砂

- 水刀切割

- 滤

- 磨料粉末

- 其他的

第 7 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Balaji Group

- Barton International

- GMA Garnet

- Krystal Abrasive

- Opta Group

- Rizhao Garnet

- Super Garnet Services

- Trimex Sands

- VV Mineral

- Wester Carbon

The Global Industrial Garnet Market was valued at USD 734.4 million in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Industrial garnet is a natural mineral widely recognized for its hardness, durability, and angular structure, making it an essential abrasive material. It plays a critical role in various applications, including waterjet cutting, surface preparation, and filtration systems.

The market is primarily driven by the growth of the construction and infrastructure sectors, which increasingly require precise and efficient cutting tools. Industrial garnet is extensively used in waterjet cutting, a technology that offers high precision without generating heat, thereby minimizing material wastage. This method aligns with the growing demand for cost-effective and environmentally friendly solutions across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $734.4 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 4.9% |

Additionally, garnet's role in water filtration is gaining prominence as concerns about water pollution and resource management intensify. Its ability to remove impurities makes it an invaluable material for industries such as mining, food processing, and wastewater treatment. By contributing to cutting-edge technologies in filtration and surface preparation, Garnet supports sustainability initiatives and industrial efficiency.

In terms of type, the market includes almandine, andradite, grossular, pyrope, spessartine, and uvarovite. Almandine, known for its durability and widespread availability, dominated the market in 2024 with a valuation of USD 493 million. Its cost-effectiveness and suitability for demanding applications have established it as the preferred choice for industries requiring high-performance abrasives.

The application-based segmentation highlights key areas such as abrasive blasting, waterjet cutting, filtration, and abrasive powders. Abrasive blasting held the largest market share in 2024, accounting for 39.2%. Garnet's recyclability and efficiency make it ideal for surface preparation, addressing the rising need for cleaner and more sustainable methods.

In 2024, the U.S. industrial garnet market generated USD 229.2 million, driven by its growing use across waterjet cutting, abrasive blasting, and filtration processes. The expanding construction and infrastructure sectors, combined with a focus on adopting eco-friendly technologies, have been instrumental in this growth. The U.S. continues to lead the market due to its robust industrial base and technological advancements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Infrastructure development and construction

- 3.6.1.2 Technological advancements in waterjet cutting

- 3.6.1.3 Water filtration and environmental concerns

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Supply chain disruptions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Almandine

- 5.3 Andradite

- 5.4 Grossular

- 5.5 Pyrope

- 5.6 Spessartine

- 5.7 Uvarovite

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Abrasive blasting

- 6.3 Water jet cutting

- 6.4 Filtration

- 6.5 Abrasive powders

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Balaji Group

- 8.2 Barton International

- 8.3 GMA Garnet

- 8.4 Krystal Abrasive

- 8.5 Opta Group

- 8.6 Rizhao Garnet

- 8.7 Super Garnet Services

- 8.8 Trimex Sands

- 8.9 VV Mineral

- 8.10 Wester Carbon