|

市场调查报告书

商品编码

1666890

生命征象监测设备市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Vital Sign Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

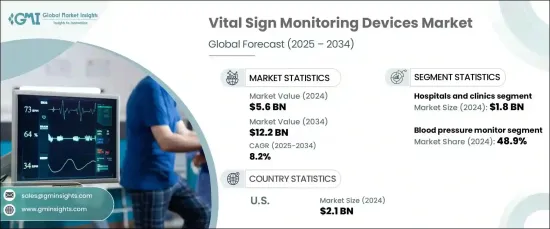

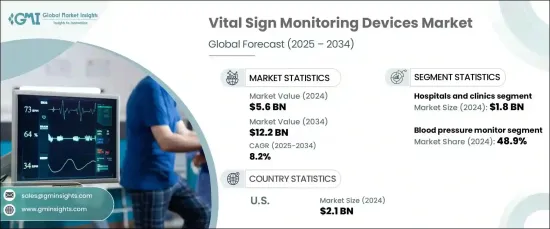

2024 年全球生命征象监测设备市场规模达到 56 亿美元,预计将经历大幅成长,2025 年至 2034 年的复合年增长率为 8.2%。这些设备透过提供心率、血压和氧气水平等关键参数的即时资料,在管理患者健康方面发挥着至关重要的作用。

随着全球医疗保健系统努力推行更积极主动的照护模式,对生命征象监测设备的需求预计将会激增。无线和便携式解决方案等技术创新也促进了市场的扩张,为医疗保健提供者和患者提供了更大的可及性和便利性。尤其是在全球大流行之后,向家庭医疗保健和远距医疗的转变预计将进一步推动这一成长,为市场参与者创造重大机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 56亿美元 |

| 预测值 | 122亿美元 |

| 复合年增长率 | 8.2% |

市场主要按产品类型细分,包括血压监测仪、脉搏血氧仪、温度监测设备和其他相关类别。 2024年血压计占据主导地位,占整个市场份额的48.9%。这是由于全球高血压及相关健康状况的发生率不断上升所致。这些监测器进一步细分为子类别,包括无液体监测器、数位监测器和配件。其中,数位监视器越来越受欢迎,因其易于使用、便携性和高精度而受到广泛关注。

按最终用户划分,市场服务于多个领域,包括医院和诊所、家庭护理、门诊手术中心等。 2024 年,医院和诊所占最大份额,价值 18 亿美元。这些医疗机构尤其依赖持续的生命征象监测来管理大量患有急性和慢性疾病的患者。医院数量的不断增加以及医疗保健基础设施的不断进步进一步支持了对这些设备的需求。即时监控的需求持续上升,以确保有效的患者管理和及时的干预。

在美国,生命体征监测设备市场规模在 2024 年将达到 21 亿美元。心血管疾病、高血压和糖尿病等慢性疾病负担日益加重,推动了对血压和血氧饱和度等重要参数的持续监测的需求。对预防性医疗保健和早期诊断的重视也极大地促进了市场成长,使得生命征象监测成为整体医疗保健方法不可或缺的一部分。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球慢性病发生率不断上升

- 新兴国家可支配所得和医疗支出不断增加

- 已开发国家的技术进步

- 远端生命征象监测设备的普及率不断提高

- 产业陷阱与挑战

- 设备成本高

- 严格的监管框架

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 血压监测

- 无液体血压计

- 数位血压计

- 血压计配件

- 脉搏血氧仪

- 指尖脉搏血氧仪

- 手持式脉搏血氧仪

- 腕戴式脉搏血氧仪

- 桌上型/床边脉搏血氧仪

- 脉搏血氧仪配件

- 温度监控装置

- 水银温度计

- 数位温度计

- 红外线温度计

- 温度监控装置配件

- 其他产品

第 6 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 居家护理

- 门诊手术中心

- 其他最终用途

第 7 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- A&D Company

- Baxter International

- Beurer

- BPL Medical Technologies

- Contec Medical Systems

- Dr Trust

- GE Healthcare

- Koninklijke Philips

- Masimo Corporation

- Medtronic

- Nihon Kohden Corporation

- Nonin Medical

- Omron Healthcare

- Smiths Group

- SunTech Medical

The Global Vital Sign Monitoring Devices Market reached USD 5.6 billion in 2024 and is expected to experience substantial growth, advancing at a CAGR of 8.2% from 2025 to 2034. The increasing prevalence of chronic diseases, such as hypertension, diabetes, and cardiovascular conditions, has made continuous health monitoring more essential than ever. These devices play a vital role in managing patient health by providing real-time data on critical parameters like heart rate, blood pressure, and oxygen levels.

As healthcare systems worldwide strive for more proactive care models, the demand for vital signs monitoring devices is expected to skyrocket. Innovations in technology, such as wireless and portable solutions, are also contributing to the market's expansion, providing greater accessibility and convenience for both healthcare providers and patients. The shift toward home-based healthcare and telemedicine, particularly in the wake of the global pandemic, is expected to further fuel this growth, creating significant opportunities for market players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 8.2% |

The market is primarily segmented by product type, which includes blood pressure monitors, pulse oximeters, temperature monitoring devices, and other related categories. In 2024, blood pressure monitors took the lead, accounting for 48.9% of the total market share. This is driven by the growing incidence of hypertension and related health conditions worldwide. These monitors are further broken down into subcategories, including aneroid monitors, digital monitors, and accessories. Among these, digital monitors are becoming increasingly popular, gaining traction for their ease of use, portability, and high level of accuracy.

By end-user, the market serves a diverse range of sectors, including hospitals and clinics, homecare, ambulatory surgery centers, and others. Hospitals and clinics represented the largest share in 2024, valued at USD 1.8 billion. These healthcare facilities are particularly reliant on continuous vital signs monitoring to manage the high volume of patients dealing with both acute and chronic conditions. The growing number of hospitals, along with ongoing advancements in healthcare infrastructure, further supports the need for these devices. The demand for real-time monitoring continues to rise, ensuring effective patient management and timely interventions.

In the United States, the vital sign monitoring devices market reached USD 2.1 billion in 2024. A robust healthcare infrastructure and widespread adoption of these devices across various healthcare settings, including hospitals, clinics, and home care, are major factors behind this growth. The increasing burden of chronic diseases, such as cardiovascular issues, hypertension, and diabetes, is driving the demand for continuous monitoring of vital parameters like blood pressure and oxygen saturation. The emphasis on preventive healthcare and early diagnosis is also significantly contributing to market growth, making vital signs monitoring an integral part of the overall healthcare approach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases across the globe

- 3.2.1.2 Rising disposable income and healthcare expenditure in emerging countries

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Growing adoption of remote vital signs monitoring devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood pressure monitoring

- 5.2.1 Aneroid blood pressure monitors

- 5.2.2 Digital blood pressure monitor

- 5.2.3 Blood pressure instrument accessories

- 5.3 Pulse oximeters

- 5.3.1 Fingertip pulse oximeters

- 5.3.2 Hand-held pulse oximeters

- 5.3.3 Wrist-worn pulse oximeters

- 5.3.4 Table-top/Bedside pulse oximeters

- 5.3.5 Pulse oximeter accessories

- 5.4 Temperature monitoring devices

- 5.4.1 Mercury filled thermometers

- 5.4.2 Digital thermometers

- 5.4.3 Infrared thermometers

- 5.4.4 Temperature monitoring device accessories

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Homecare

- 6.4 Ambulatory surgery centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 A&D Company

- 8.2 Baxter International

- 8.3 Beurer

- 8.4 BPL Medical Technologies

- 8.5 Contec Medical Systems

- 8.6 Dr Trust

- 8.7 GE Healthcare

- 8.8 Koninklijke Philips

- 8.9 Masimo Corporation

- 8.10 Medtronic

- 8.11 Nihon Kohden Corporation

- 8.12 Nonin Medical

- 8.13 Omron Healthcare

- 8.14 Smiths Group

- 8.15 SunTech Medical