|

市场调查报告书

商品编码

1666894

云端原生应用程式保护平台 (CNAPP) 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Cloud-native Application Protection Platform (CNAPP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球云端原生应用程式保护平台市场价值为 34 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到惊人的 32.6%。随着企业采用具有容器化应用程式和复杂云端配置的云端原生环境,新的安全挑战也随之出现。其中包括配置错误和日益复杂的攻击面等问题,导致组织容易受到进阶威胁。作为回应,CNAPP 解决方案正在不断发展以满足现代云端基础设施的需求,为抵御不断演变的网路风险提供急需的保护。

市场分为解决方案和服务,其中解决方案占据最大份额,到 2024 年将占据 70% 的市场份额。这些平台正在转向预测安全模型,这有助于预测漏洞并在新出现的威胁造成损害之前主动应对它们。情境感知工具正日益受到关注,它提供跨域威胁关联,以增强风险评估并更灵活地应对安全漏洞。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 571亿美元 |

| 复合年增长率 | 32.6% |

根据部署类型,市场分为混合云环境和多云环境。到 2034 年,混合安全市场的规模预计将达到 300 亿美元,这得益于对本地和云端基础设施的一致安全治理的需求日益增长。随着企业采用多云策略,对统一安全管理工具的需求正在激增。这些工具确保集中的可视性,使企业能够有效地执行合规性并跨不同系统管理风险。 CNAPP 平台正在不断发展,以弥合传统资料中心安全与现代云端原生架构之间的差距,确保安全措施的无缝集成,同时不影响合规性或风险管理标准。

美国在 CNAPP 市场占据主导地位,由于日益增长的网路威胁和严格的联邦法规,美国将在 2024 年占据 85% 的份额。在这种高度监管的环境中,组织越来越重视强调持续验证、最小权限存取和细粒度可见性的安全框架。随着企业寻求保护其分散式云端生态系统免受潜在的网路攻击,对自适应身份验证工具和即时风险评估功能的投资变得越来越普遍。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 云端服务供应商

- 技术提供者

- 应用程式开发人员

- 系统整合商

- 最终用途

- 利润率分析

- 技术差异化

- 统一平台方法

- DevSecOps 集成

- 零信任安全模型

- 运行时应用程式自我保护 (RASP)

- 其他的

- 重要新闻及倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 基于云端的平台的采用日益增多

- 网路安全威胁不断上升

- 严格的资料保护法规

- 采用 DevSecOps 实践

- 产业陷阱与挑战

- 复杂的云端环境

- 效能开销

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 基于身分的安全性和云端基础架构授权管理 (CIEM)

- 云端工作负载保护 CWPP

- 基础设施即代码 (IAC)

- Kubernetes 安全态势管理 (KSPM)

- 云端安全态势管理 (CSPM)

- 服务

- 专业服务

- 託管服务

第六章:市场估计与预测:按云分类,2021 - 2034 年

- 主要趋势

- 混合云端

- 多云

第 7 章:市场估计与预测:按组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 零售

- 金融保险业协会

- 卫生保健

- 政府

- 资讯科技和电信

- 製造业

- 其他的

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aqua Security

- Checkpoint Security

- CrowdStrike

- Data Theorem

- Fortinet

- LaceWorks

- McAfee

- Orca Security

- Palo Alto Networks

- Qualys

- Runecast Solutions

- Skyhigh Security

- Sonrai

- Sysdig

- Tenable

- Tigera

- Trend Micro

- Uptycs

- Wiz.io

- Zscaler

- Others

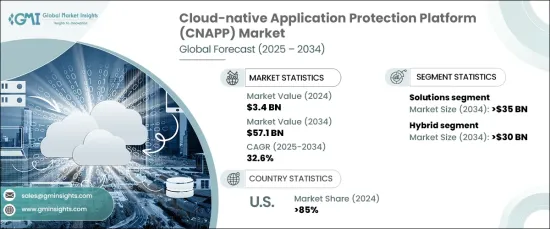

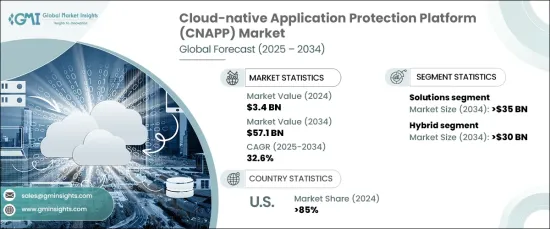

The Global Cloud-Native Application Protection Platform Market, valued at USD 3.4 billion in 2024, is projected to expand at a staggering CAGR of 32.6% from 2025 to 2034. This growth is primarily driven by the increasing sophistication of phishing attempts and cyberattacks targeting cloud infrastructure. As businesses adopt cloud-native environments with containerized applications and complex cloud configurations, new security challenges are emerging. These include issues like misconfigurations and increasingly intricate attack surfaces, leaving organizations vulnerable to advanced threats. In response, CNAPP solutions are evolving to meet the demands of modern cloud infrastructures, offering a much-needed shield against evolving cyber risks.

The market is segmented into solutions and services, with solutions commanding the largest share, accounting for 70% of the market in 2024. This segment is expected to generate USD 35 billion by 2034. As threats continue to escalate, CNAPP solutions are incorporating cutting-edge threat intelligence by integrating global databases and collective intelligence. These platforms are shifting towards predictive security models, which help anticipate vulnerabilities and proactively address emerging threats before they can cause damage. Context-aware tools are gaining traction, offering cross-domain threat correlation for enhanced risk assessments and more agile responses to security breaches.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $57.1 Billion |

| CAGR | 32.6% |

By deployment type, the market is divided between hybrid and multi-cloud environments. The hybrid segment is set to reach USD 30 billion by 2034, driven by the increasing need for consistent security governance across both on-premises and cloud infrastructures. As enterprises adopt multi-cloud strategies, the demand for unified security management tools is surging. These tools ensure centralized visibility, enabling businesses to enforce compliance and manage risk across diverse systems effectively. CNAPP platforms are evolving to bridge the gap between traditional data center security and modern cloud-native architectures, ensuring a seamless integration of security measures without compromising on compliance or risk management standards.

The U.S. dominates the CNAPP market, capturing 85% of the share in 2024, bolstered by growing cyber threats and stringent federal regulations. In this highly regulated environment, organizations are increasingly prioritizing security frameworks that emphasize continuous verification, least-privilege access, and granular visibility. Investments in adaptive authentication tools and real-time risk assessment capabilities are becoming more common as organizations look to protect their distributed cloud ecosystems from potential cyberattacks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Cloud service providers

- 3.2.2 Technology providers

- 3.2.3 Application developers

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 Unified platform approach

- 3.4.2 DevSecOps integration

- 3.4.3 Zero-trust security models

- 3.4.4 Runtime Application Self-Protection (RASP)

- 3.4.5 Others

- 3.5 Key news & initiatives

- 3.6 Patent analysis

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growing adoption of cloud-based platforms

- 3.8.1.2 Rising cybersecurity threats

- 3.8.1.3 Stringent data protection regulations

- 3.8.1.4 Adoption of DevSecOps practices

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Complex cloud environments

- 3.8.2.2 Performance overhead

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Identity-Based Security and Cloud Infrastructure Entitlement Management (CIEM)

- 5.2.2 cloud workload protection CWPP

- 5.2.3 Infrastructure as a Code (IAC)

- 5.2.4 Kubernetes Security Posture Management (KSPM)

- 5.2.5 Cloud Security Posture Management (CSPM)

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Cloud, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hybrid cloud

- 6.3 Multi-cloud

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large Enterprise

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Retail

- 8.3 BFSI

- 8.4 Healthcare

- 8.5 Government

- 8.6 IT & Telecom

- 8.7 Manufacturing

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aqua Security

- 10.2 Checkpoint Security

- 10.3 CrowdStrike

- 10.4 Data Theorem

- 10.5 Fortinet

- 10.6 LaceWorks

- 10.7 McAfee

- 10.8 Orca Security

- 10.9 Palo Alto Networks

- 10.10 Qualys

- 10.11 Runecast Solutions

- 10.12 Skyhigh Security

- 10.13 Sonrai

- 10.14 Sysdig

- 10.15 Tenable

- 10.16 Tigera

- 10.17 Trend Micro

- 10.18 Uptycs

- 10.19 Wiz.io

- 10.20 Zscaler

- 10.21 Others