|

市场调查报告书

商品编码

1666901

真空镀膜设备市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Vacuum Coating Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

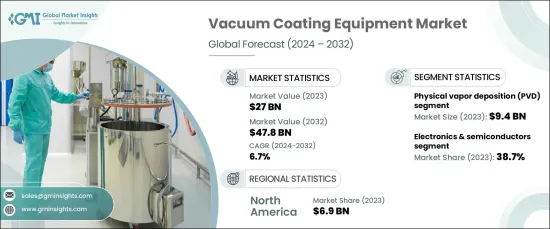

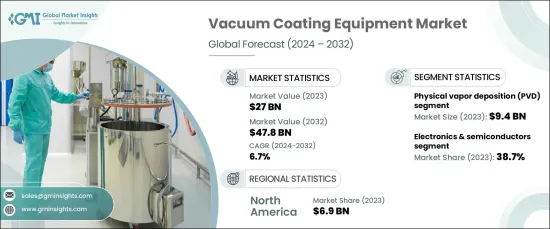

2023 年全球真空镀膜设备市场价值为 270 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 6.7%。物理气相沉积 (PVD) 和化学气相沉积 (CVD) 方法的创新一直是关键驱动因素,可提高涂层的耐久性、均匀性和品质。此外,等离子辅助製程的引入透过提供更高的效率和精度来应用专用涂层,从而改变了整个产业。

对小型电子设备的需求不断增长,极大地促进了市场扩张。真空涂层对于製造高性能电子元件(包括半导体和先进显示器)至关重要。随着设备变得越来越紧凑和复杂,对能够满足严格性能标准的涂层的需求也激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 270亿美元 |

| 预测值 | 478亿美元 |

| 复合年增长率 | 6.7% |

儘管真空镀膜系统具有诸多优势,但由于前期成本较高,市场也面临挑战。 PVD和CVD系统等先进设备的购买、安装和维护需要大量投资。这些财务障碍通常会限制中小企业和对成本限制敏感的地区的采用。透过具有成本效益的解决方案和灵活的融资选择来解决这些问题对于扩大市场覆盖范围和推动这项技术的更广泛应用至关重要。

在设备方面,PVD 部门在 2023 年的收入为 94 亿美元,预计在预测期内的复合年增长率为 7.2%。它能够生产出高品质、精确且耐用的涂层,成为多个行业的首选。该技术的环保特性进一步支持了它的采用,因为它符合更严格的环境法规和全球永续发展目标。

电子和半导体行业在 2023 年占据了 38.7% 的市场份额,预计到 2032 年将以 7.1% 的复合年增长率增长。日益增长的技术进步推动了对创新涂层方法的投资,以满足日益增长的需求。

2023 年北美的市场收入为 69 亿美元,预计到 2032 年的复合年增长率将达到 7.3%。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 涂层方法的技术进步

- 电子产业需求不断成长

- 对永续和节能涂料的需求

- 汽车产业成长

- 产业陷阱与挑战

- 初期投资成本高

- 严格的监管和环境标准

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按设备类型,2021 – 2032 年

- 主要趋势

- 物理气相沉积 (PVD)

- 化学气相沉积 (CVD)

- 磁控溅射

- 电子束蒸发

- 热蒸发

第 6 章:市场估计与预测:按最终用途产业,2021 年至 2032 年

- 主要趋势

- 电子和半导体

- 汽车

- 航太和国防

- 能源(包括太阳能)

- 医疗的

- 其他的

第七章:市场估计与预测:按地区,2021 – 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第八章:公司简介

- Adler Pelzer

- Autoneum

- BASF

- Borgers

- Charlotte Baur Formschaumtechnik

- Continental

- DBW Advanced Fiber Technologies

- ElringKlinger

- Greiner Foam

- Röchling

- SA Automotive

- TROCELLEN Automotive

- UFP Technologies

- Unitex India

- Woco Industrietechnik

The Global Vacuum Coating Equipment Market, valued at USD 27 billion in 2023, is projected to grow at a CAGR of 6.7% from 2024 to 2032. This growth is fueled by advancements in coating technologies and the evolving needs of modern industries. Innovations in Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) methods have been key drivers, offering enhanced coating durability, uniformity, and quality. Additionally, the introduction of plasma-assisted processes has transformed the industry by providing greater efficiency and precision in applying specialized coatings.

The rising demand for miniaturized electronic devices has significantly contributed to the market expansion. Vacuum coatings have become essential in manufacturing high-performance electronic components, including semiconductors and advanced displays. As devices become more compact and intricate, the need for coatings capable of meeting demanding performance criteria has surged.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $27 Billion |

| Forecast Value | $47.8 Billion |

| CAGR | 6.7% |

Despite its advantages, the market faces challenges due to the high upfront costs associated with vacuum coating systems. The purchase, installation, and maintenance of advanced equipment such as PVD and CVD systems require substantial investment. These financial barriers often restrict adoption among small and medium-sized enterprises and in regions sensitive to cost constraints. Efforts to address these issues through cost-efficient solutions and flexible financing options are critical to broadening the market's reach and enabling wider adoption of this technology.

In terms of equipment, the PVD segment accounted for USD 9.4 billion in 2023 and is anticipated to grow at a CAGR of 7.2% during the forecast period. Its ability to produce high-quality, precise, and durable coatings has made it a preferred choice across multiple industries. The eco-friendly nature of this technology further supports its adoption as it aligns with stricter environmental regulations and global sustainability goals.

The electronics and semiconductor sector held a 38.7% market share in 2023 and is set to grow at a CAGR of 7.1% through 2032. Vacuum coatings play a pivotal role in improving the performance and reliability of electronic devices by ensuring precise and durable layering. Growing technological advancements drive investments in innovative coating methods to meet the increasing demand.

North America accounted for USD 6.9 billion in market revenue in 2023 and is projected to grow at a CAGR of 7.3% by 2032. Regional growth is supported by advancements in high-tech manufacturing, government initiatives for clean energy, and robust R&D activities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in coating methods

- 3.2.1.2 Rising demand from electronics industry

- 3.2.1.3 Demand for sustainable and energy-efficient coatings

- 3.2.1.4 Automotive industry growth

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Stringent regulatory and environmental standards

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 – 2032, (USD Billion)

- 5.1 Key trends

- 5.2 Physical vapor deposition (PVD)

- 5.3 Chemical vapor deposition (CVD)

- 5.4 Magnetron sputtering

- 5.5 Electron beam evaporation

- 5.6 Thermal evaporation

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021 – 2032, (USD Billion)

- 6.1 Key trends

- 6.2 Electronics & semiconductors

- 6.3 Automotive

- 6.4 Aerospace & defense

- 6.5 Energy (including solar)

- 6.6 Medical

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021 – 2032, (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Malaysia

- 7.4.7 Indonesia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 South Africa

Chapter 8 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 8.1 Adler Pelzer

- 8.2 Autoneum

- 8.3 BASF

- 8.4 Borgers

- 8.5 Charlotte Baur Formschaumtechnik

- 8.6 Continental

- 8.7 DBW Advanced Fiber Technologies

- 8.8 ElringKlinger

- 8.9 Greiner Foam

- 8.10 Röchling

- 8.11 SA Automotive

- 8.12 TROCELLEN Automotive

- 8.13 UFP Technologies

- 8.14 Unitex India

- 8.15 Woco Industrietechnik