|

市场调查报告书

商品编码

1666913

采矿浮选化学品市场机会、成长动力、产业趋势分析与预测 2025 - 2034Mining Flotation Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

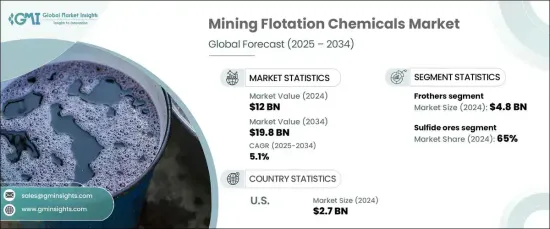

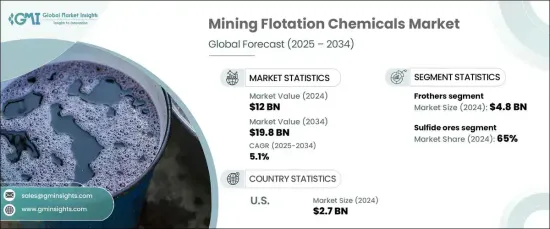

2024 年全球矿业浮选化学品市场价值为 120 亿美元,预计 2025 年至 2034 年期间将以 5.1% 的强劲复合年增长率增长。透过在矿浆表面形成稳定的泡沫层,它们使矿物颗粒黏附在气泡上,从而促进有效萃取。这项技术始终处于采矿业进步的前沿,并支持从建筑到技术等各个行业。

随着工业化和基础设施的快速发展,全球对基本金属和矿物的需求不断增长,从而推动了对采矿浮选化学品的需求。随着各国不断投资大型项目,对高效和永续的开采方法的重视程度也不断提高。浮选化学品对于优化矿物回收率、减少浪费和提高整体加工效率至关重要。随着矿物加工技术的不断创新,市场有望利用全球采矿活动日益增加所带来的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 120亿美元 |

| 预测值 | 198亿美元 |

| 复合年增长率 | 5.1% |

市场按化学品类型细分,包括起泡剂、收集剂、活化剂、分散剂和特殊化学品。起泡器占据了市场的最大份额,对收入的贡献巨大。它们在产生泡沫以促进矿物分离方面发挥着不可或缺的作用。另一个关键类别是捕收剂,其需求量正在上升,因为它们能增强矿物与气泡的附着力,确保浮选过程中的更高效率。其他特种化学品在解决独特的采矿挑战中也发挥关键作用,进一步促进了它们在整个行业中的应用。

按矿石类型分类,市场包括硫化矿石和非硫化矿石。由于硫化矿在采矿作业中普遍存在,因此目前占据主导地位。然而,由于非硫化矿石的工业用途广泛,其需求正在激增。非硫化矿石中含有的磷酸盐和钾盐等矿物越来越多地用于农业肥料和其他工业过程。矿业公司正在进行资源开采多元化,以利用这些经济上可行的替代方案,进一步推动这一领域的成长。

在美国,截至 2024 年,采矿浮选化学品市场价值为 27 亿美元,强劲的国内采矿业推动了市场稳步成长。国家努力减少对进口矿产的依赖并支持国内开采,这是一个重要的动力。矿物加工技术的进步,加上对采矿基础设施的大量投资,正在促进浮选化学品的采用。关键矿物对高科技产业至关重要,是关注的焦点,而促进永续采矿实践的政策进一步加速了市场扩张。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对贱金属和贵金属的需求不断增加

- 矿石品位下降

- 浮选技术的进步

- 产业陷阱与挑战

- 原物料价格波动

- 来自替代品的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按化学类型,2021-2034 年

- 主要趋势

- 起泡器

- 收藏家

- 活化剂

- 分散剂

- 其他(抑制剂、表面改质剂)

第六章:市场估计与预测:依矿石类型,2021-2034 年

- 主要趋势

- 硫化矿

- 非硫化物矿石

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 贱金属开采

- 贵金属开采

- 工业矿物开采

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 铜矿开采

- 金银开采

- 镍和铂族金属开采

- 锌矿开采

- 其他(铁矿石、煤矿)

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Arkema

- BASF SE

- Beijing Hengju

- Cheminova

- Chevron Phillips Chemical

- Clariant

- Cytec Industries

- Dow

- Huntsman

- Kemira

- NASACO

- Nouryon

- Rhodia

- Solvay

- Wacker Chemie

The Global Mining Flotation Chemicals Market, valued at USD 12 billion in 2024, is expected to grow at a robust CAGR of 5.1% from 2025 to 2034. These chemicals play an indispensable role in mineral separation, acting as critical agents in the flotation process. By forming a stable froth layer on the surface of the slurry, they enable mineral particles to adhere to air bubbles, facilitating efficient extraction. This technology remains at the forefront of advancements in the mining sector, supporting industries ranging from construction to technology.

The demand for mining flotation chemicals is fueled by the growing need for base metals and minerals worldwide, driven by rapid industrialization and infrastructure development. As nations continue to invest in large-scale projects, the emphasis on efficient and sustainable extraction methods intensifies. Flotation chemicals are integral to optimizing mineral recovery, reducing waste, and improving overall processing efficiency. With ongoing innovations in mineral processing technologies, the market is poised to capitalize on opportunities stemming from increasing mining activities across the globe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 5.1% |

The market is segmented by chemical types, including frothers, collectors, activators, dispersants, and specialty chemicals. Frothers command the largest share of the market, contributing significantly to revenue. Their role in creating froth that facilitates mineral separation makes them indispensable. Collectors, another key category, are experiencing rising demand as they enhance the attachment of minerals to air bubbles, ensuring higher efficiency during the flotation process. Other specialty chemicals also play pivotal roles in addressing unique mining challenges, further boosting their adoption across the sector.

When categorized by ore type, the market includes sulfide ores and non-sulfide ores. Sulfide ores currently dominate, thanks to their prevalence in mining operations. However, non-sulfide ores are witnessing a surge in demand due to their diverse industrial applications. Minerals like phosphate and potash, found in non-sulfide ores, are increasingly used in agriculture for fertilizers and in other industrial processes. Mining companies are diversifying resource extraction to capitalize on these economically viable alternatives, further driving growth in this segment.

In the United States, the mining flotation chemicals market is valued at USD 2.7 billion as of 2024, with steady growth bolstered by a strong domestic mining sector. The nation's push to reduce reliance on imported minerals and support domestic extraction has been a significant driver. Advancements in mineral processing technologies, coupled with substantial investments in mining infrastructure, are fostering the adoption of flotation chemicals. Critical minerals, essential for high-tech industries, are a focal point, with policies promoting sustainable mining practices further accelerating market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for base and precious metals

- 3.6.1.2 Declining ore grades

- 3.6.1.3 Advancements in flotation technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility of raw material

- 3.6.2.2 Competition from substitute

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Chemical Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Frothers

- 5.3 Collectors

- 5.4 Activators

- 5.5 Dispersants

- 5.6 Others (depressants, surface modifiers)

Chapter 6 Market Estimates & Forecast, By Ore Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Sulfide ores

- 6.3 Non-sulfide ores

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Base metal mining

- 7.3 Precious metal mining

- 7.4 Industrial minerals mining

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Copper mining

- 8.3 Gold and silver mining

- 8.4 Nickel and platinum group metals mining

- 8.5 Zinc mining

- 8.6 Others (iron ore, coal mining)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arkema

- 10.2 BASF SE

- 10.3 Beijing Hengju

- 10.4 Cheminova

- 10.5 Chevron Phillips Chemical

- 10.6 Clariant

- 10.7 Cytec Industries

- 10.8 Dow

- 10.9 Huntsman

- 10.10 Kemira

- 10.11 NASACO

- 10.12 Nouryon

- 10.13 Rhodia

- 10.14 Solvay

- 10.15 Wacker Chemie