|

市场调查报告书

商品编码

1666942

DNA 取证市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测DNA Forensics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

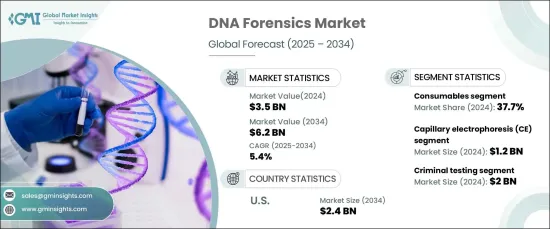

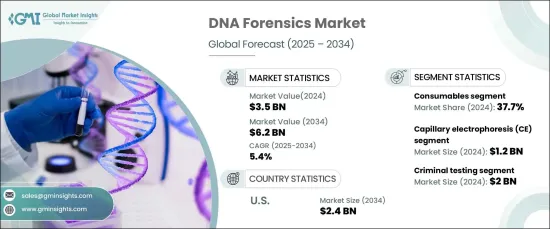

2024 年全球 DNA 取证市场价值为 35 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.4%。 DNA 取证可透过使用遗传物质进行身分识别目的(例如刑事调查、亲子鑑定和灾难受害者身分识别)来帮助法律环境。

市场按解决方案类型分类,包括套件、分析仪、定序仪、软体和消耗品。耗材部分引领市场,在 2024 年贡献了 37.7% 的最大份额。这些改进导致对这些过程至关重要的消耗品的需求增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 62亿美元 |

| 复合年增长率 | 5.4% |

从方法来看,DNA 取证市场分为毛细管电泳 (CE)、次世代定序 (NGS)、聚合酶炼式反应 (PCR) 扩增和其他方法。毛细管电泳 (CE) 占有最大的份额,2024 年的收入为 12 亿美元。其处理降解或混合 DNA 样本的能力是其一大优势,使其成为法医实验室不可或缺的一部分。执法机构持续投资 DNA 取证技术,旨在侦破悬案和解决检测积压问题,这进一步推动了对 CE 的需求,因为它可以提供快速可靠的 DNA 分析。

美国 DNA 取证市场预计将大幅成长,预计到 2034 年将达到 24 亿美元。预计这些投资将加速全国尖端 DNA 法医技术的应用。此外,专注于解决悬案和减少法医实验室积压案件的措施正在加剧对 DNA 法医解决方案的需求。执法机构越来越多地将 DNA 证据作为重新审理悬案的工具,从而进一步促进市场成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 政府为法医计画提供的措施和资金

- 亲子鑑定与家族鑑定的技术进步

- 犯罪活动增多

- 产业陷阱与挑战

- 设备成本高

- 发展中国家缺乏熟练的专业人员

- 成长动力

- 主要国家法医实验室数量

- 成长潜力分析

- 监管格局

- 我们

- 加拿大

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 中国

- 日本

- 印度

- 巴西

- 墨西哥

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按解决方案,2021 年至 2034 年

- 主要趋势

- 套件

- 分析仪和定序仪

- 软体

- 实验室资讯管理系统

- 其他软体类型

- 耗材

第 6 章:市场估计与预测:依方法,2021 年至 2034 年

- 主要趋势

- 毛细管电泳(CE)

- 下一代定序(NGS)

- PCR 扩增

- 其他方法

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 刑事测试

- 亲子鑑定和家族史检测

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Abbott Laboratories

- Bio-Rad Laboratories

- Danaher Corporation

- GORDIZ

- Illumina

- Laboratory Corporation of America Holdings

- LabVantage Solution

- LabWare

- Promega Corporation

- Qiagen

- Thermo Fisher Scientific

- VERISIS

The Global DNA Forensics Market was valued at USD 3.5 billion in 2024 and is projected to grow at a 5.4% CAGR between 2025 and 2034. DNA forensics helps in legal settings by using genetic material for identification purposes, such as criminal investigations, paternity testing, and disaster victim identification.

The market is categorized by solution types, including kits, analyzers, sequencers, software, and consumables. The consumables segment leads the market, contributing the largest share of 37.7% in 2024. This is largely due to the advancements in Next-Generation Sequencing and other technologies, which have enhanced the speed and precision of DNA analysis. These improvements have led to an increased demand for consumables essential for these processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.4% |

Method-wise, the DNA forensics market is divided into capillary electrophoresis (CE), next-generation sequencing (NGS), polymerase chain reaction (PCR) amplification, and other methods. Capillary electrophoresis (CE) holds the largest share, generating a revenue of USD 1.2 billion in 2024. CE is favored for its high-resolution separation of DNA fragments, offering precise results critical for forensic applications. Its ability to handle degraded or mixed DNA samples is a major advantage, making it indispensable in forensic laboratories. The continued investment in DNA forensics technology by law enforcement agencies, aimed at solving cold cases and addressing testing backlogs, has further driven the demand for CE, as it delivers rapid and reliable DNA analysis.

U.S. DNA forensics market is poised for significant growth, with projections reaching USD 2.4 billion by 2034. The U.S. government has been investing heavily in upgrading forensic technology and expanding laboratory facilities to support enhanced criminal investigations. Such investments are expected to accelerate the adoption of cutting-edge DNA forensic technologies across the country. Additionally, initiatives focused on resolving cold cases and minimizing backlogs in forensic labs are intensifying the demand for DNA forensics solutions. Law enforcement agencies increasingly prioritize DNA evidence as a tool to revisit unsolved cases, further contributing to market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government initiatives and funds for forensic programs

- 3.2.1.2 Technological advancements in paternity and familial testing

- 3.2.1.3 Increasing criminal activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment

- 3.2.2.2 Dearth of skilled professional in developing countries

- 3.2.1 Growth drivers

- 3.3 Number of forensic labs, by prominent countries

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Canada

- 3.5.3 Germany

- 3.5.4 UK

- 3.5.5 France

- 3.5.6 Italy

- 3.5.7 Spain

- 3.5.8 China

- 3.5.9 Japan

- 3.5.10 India

- 3.5.11 Brazil

- 3.5.12 Mexico

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Solution, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits

- 5.3 Analyzers and sequencers

- 5.4 Software

- 5.4.1 LIMS

- 5.4.2 Other software types

- 5.5 Consumables

Chapter 6 Market Estimates and Forecast, By Method, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capillary electrophoresis (CE)

- 6.3 Next generation sequencing (NGS)

- 6.4 PCR amplification

- 6.5 Other methods

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Criminal testing

- 7.3 Paternity and familial testing

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Bio-Rad Laboratories

- 9.3 Danaher Corporation

- 9.4 GORDIZ

- 9.5 Illumina

- 9.6 Laboratory Corporation of America Holdings

- 9.7 LabVantage Solution

- 9.8 LabWare

- 9.9 Promega Corporation

- 9.10 Qiagen

- 9.11 Thermo Fisher Scientific

- 9.12 VERISIS