|

市场调查报告书

商品编码

1666943

自动转换开关市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Automatic Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

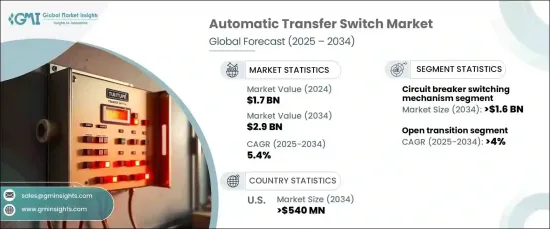

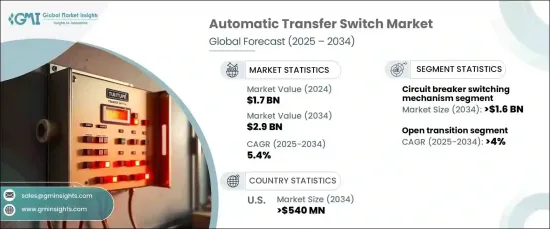

2024 年全球自动转换开关市场规模将达到 17 亿美元,预计 2025-2034 年期间将以 5.4% 的复合年增长率稳步成长。这一成长主要由住宅、商业和工业领域对不间断电源的需求不断增长所推动。再生能源和分散式发电系统的不断整合进一步加速了市场扩张,因为 ATS 在确保电网和备用电源之间的无缝电源切换方面发挥着至关重要的作用。

受可靠、高效的电力传输解决方案的需求推动,断路器开关机制部门预计到 2034 年将产生 16 亿美元的收入。混合系统结合了接触器和断路器的功能,由于其能够提供快速切换和增强保护(特别是对于关键基础设施)而越来越受到关注。这些机制中电子控制的采用越来越多,支援了更智慧的 ATS 系统的发展,提供远端监控、诊断和预测性维护等先进功能。这些进步凸显了市场对自动化、提高可靠性和有效电源管理的关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 29亿美元 |

| 复合年增长率 | 5.4% |

开放式过渡领域预计将显着成长,到 2034 年复合年增长率将达到 4%。自适应传输模式可以根据特定的断电情况进行动态调整,这种模式也变得越来越普遍,为电源管理提供了更高的灵活性和效率。这些进步满足了各行各业对营运连续性和节能解决方案日益增长的需求。

受各类应用对可靠电源解决方案的需求不断增长的推动,美国自动转换开关市场规模到 2034 年将达到 5.4 亿美元。资料中心、医疗保健和製造业等领域的基础设施扩张是推动这一成长的关键因素。先进的 ATS 系统越来越多地被采用来支持这些发展,确保关键设施的强大和可靠的电源管理。

在技术进步、智慧功能的整合以及对能源效率和系统可靠性日益重视的支持下,ATS 市场有望实现持续成长。随着电力基础设施的不断创新和投资的增加,预计未来几年市场将大幅扩张。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:按转换机制,2021 – 2034 年

- 主要趋势

- 接触器

- 断路器

第六章:市场规模与预测:依转型,2021 – 2034 年

- 主要趋势

- 关闭

- 打开

第 7 章:市场规模及预测:依安培等级,2021 年至 2034 年

- 主要趋势

- ≤ 400 安培

- 401 安培至 1600 安培

- > 1600 安培

第 8 章:市场规模及预测:依安装量,2021 – 2034 年

- 主要趋势

- 紧急系统

- 法律要求的製度

- 关键操作电力系统

- 可选备用系统

第 9 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 中东和非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ABB

- AEG Power Solutions

- Briggs & Stratton

- Caterpillar

- Cummins

- Eaton

- Generac Power Systems

- General Electric

- Global Power Supply

- Kohler

- One Two Three Electric

- Schneider Electric

- Siemens

- Vertiv Group

The Global Automatic Transfer Switch Market reached USD 1.7 billion in 2024 and is expected to grow at a steady CAGR of 5.4% during 2025-2034. This growth is primarily driven by the increasing need for uninterrupted power supply across residential, commercial, and industrial sectors. The rising integration of renewable energy and distributed generation systems further accelerates market expansion, as ATS plays a crucial role in ensuring seamless power switching between grid and backup sources.

The circuit breaker switching mechanism segment is anticipated to generate USD 1.6 billion through 2034, fueled by the demand for reliable and efficient power transfer solutions. Hybrid systems, combining the capabilities of contactors and circuit breakers, are gaining traction due to their ability to provide rapid switching with enhanced protection, particularly for critical infrastructure. The increasing adoption of electronic controls in these mechanisms supports the development of smarter ATS systems, offering advanced features such as remote monitoring, diagnostics, and predictive maintenance. These advancements highlight the market's focus on automation, improved reliability, and effective power management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 billion |

| Forecast Value | $2.9 Billion |

| CAGR | 5.4% |

The open transition segment is projected to witness significant growth, with a CAGR of 4% through 2034. Innovations in transition features, such as load shedding, soft transfers, and programmable delays, are enhancing energy optimization and ensuring smoother power transitions. Adaptive transfer modes, which adjust dynamically to specific outage scenarios, are also becoming more prevalent, offering improved flexibility and efficiency in power management. These advancements address the increasing demand for operational continuity and energy-efficient solutions across various industries.

U.S. automatic transfer switch market is set to reach USD 540 million by 2034, driven by the rising need for dependable power supply solutions across diverse applications. The expansion of infrastructure in sectors like data centers, healthcare, and manufacturing is a key factor contributing to this growth. Advanced ATS systems are being increasingly adopted to support these developments, ensuring robust and reliable power management in critical facilities.

ATS market is poised for sustained growth, supported by technological advancements, the integration of smart features, and the rising emphasis on energy efficiency and system reliability. With ongoing innovations and increasing investments in power infrastructure, the market is expected to expand significantly in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Switching Mechanism, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Contactor

- 5.3 Circuit breaker

Chapter 6 Market Size and Forecast, By Transition, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Closed

- 6.3 Open

Chapter 7 Market Size and Forecast, By Ampere Rating, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 ≤ 400 Amp

- 7.3 401 Amp to 1600 Amp

- 7.4 > 1600 Amp

Chapter 8 Market Size and Forecast, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 Emergency systems

- 8.3 Legally required systems

- 8.4 Critical operations power systems

- 8.5 Optional standby systems

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 South Africa

- 9.5.3 Saudi Arabia

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AEG Power Solutions

- 10.3 Briggs & Stratton

- 10.4 Caterpillar

- 10.5 Cummins

- 10.6 Eaton

- 10.7 Generac Power Systems

- 10.8 General Electric

- 10.9 Global Power Supply

- 10.10 Kohler

- 10.11 One Two Three Electric

- 10.12 Schneider Electric

- 10.13 Siemens

- 10.14 Vertiv Group