|

市场调查报告书

商品编码

1666946

金属卤化物灯塔市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Metal Halide Light Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

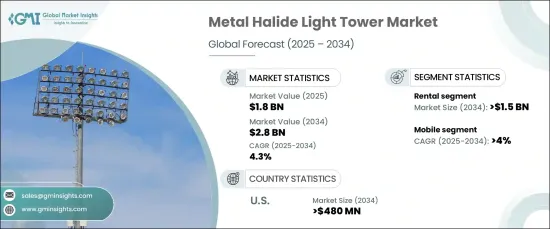

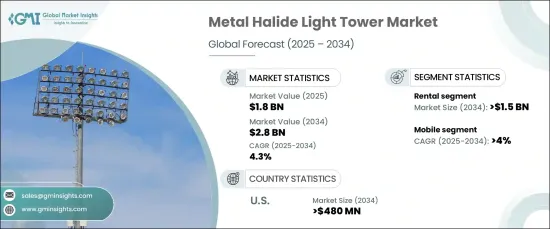

2024 年全球金属卤化物灯塔市场价值为 18 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.3%。然而,在需要高强度照明的行业中,尤其是在大型专案和夜间作业中,金属卤化物塔仍然占据主导地位。新兴市场对基础设施和建筑项目的需求不断增长,推动了对这些灯塔的需求,它们在确保具有挑战性的环境中持续照明方面发挥关键作用。

智慧技术,包括远端控制、监控和自动灯光调节等功能,正越来越多地融入金属卤化物灯塔中。这些创新有助于优化能源消耗,美国能源部报告称,智慧系统可减少高达 50% 的能源使用。此外,製造商正在提高灯塔的便携性,提供紧凑、轻巧的型号,以便更轻鬆地运送到各个工作地点。这一趋势在建筑和户外活动领域尤其重要,便携式照明解决方案对于维持安全性和生产力至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 4.3% |

金属卤化物灯塔市场主要分为两个管道:租赁和销售。租赁业预计将大幅成长,到 2034 年将达到 15 亿美元以上。租赁设备的灵活性确保企业能够快速获得必要的照明,而无需长期投资。

金属卤化物灯塔也分为固定式和移动式。行动市场预计将保持强劲成长,到 2034 年复合年增长率将超过 4%。这些塔具有便携性和可靠性,确保有效满足离网地点的照明需求。

在美国,金属卤化物灯塔的市场规模预计到 2034 年将超过 4.8 亿美元。建筑业和采矿业尤其依赖这些高强度照明解决方案来满足严格的安全标准并确保在具有挑战性的工作现场环境中的可见性。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:按通路,2021 – 2034 年

- 主要趋势

- 销售量

- 租赁

第 6 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 固定式

- 移动的

第 7 章:市场规模及预测:依电源分类,2021 年至 2034 年

- 主要趋势

- 柴油引擎

- 太阳的

- 直接的

- 其他的

第 8 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 手动升降

- 油压升降

第 9 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 建造

- 基础建设发展

- 石油和天然气

- 矿业

- 军事与国防

- 紧急及灾难救援

- 其他的

第 10 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司简介

- Allmand Bros

- Aska Equipments

- Atlas Copco

- Caterpillar

- Chicago Pneumatic

- Colorado Standby

- DMI

- Doosan Portable Power

- Generac Power Systems

- Himoinsa

- Inmesol Gensets

- JC Bamford Excavators

- Larson Electronics

- Light Boy

- LTA Projects

- Multiquip

- Olikara Lighting Towers

- Progress Solar Solutions

- The Will Burt Company

- Trime

- United Rentals

- Wacker Neuson

- Youngman Richardson

The Global Metal Halide Light Tower Market was valued at USD 1.8 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Metal halide light towers face strong competition from LED lighting, which provides superior energy efficiency, longer lifespan, and lower maintenance costs. However, metal halide towers remain dominant in industries requiring high-intensity lighting, especially in large-scale projects and nighttime operations. The increasing demand for infrastructure and construction projects in emerging markets is driving the need for these light towers, which play a critical role in ensuring consistent illumination in challenging environments.

Smart technologies, including features like remote control, monitoring, and automated light adjustments, are increasingly being integrated into metal halide light towers. These innovations are helping optimize energy consumption, with the U.S. Department of Energy reporting that smart systems can reduce energy use by up to 50%. Furthermore, manufacturers are enhancing the portability of light towers, offering compact, lightweight models for easier transport to various job sites. This trend is particularly relevant in the construction and outdoor event sectors, where portable lighting solutions are vital for maintaining safety and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 4.3% |

The market for metal halide light towers is divided into two main channels: rental and sales. The rental segment is expected to grow significantly, reaching over USD 1.5 billion by 2034. Renting light towers allows businesses to avoid the heavy upfront costs associated with purchasing equipment, which is particularly appealing for companies engaged in short-term projects like construction or events. The flexibility of renting equipment ensures that companies can quickly access the necessary lighting without the need for long-term investments.

Metal halide light towers are also categorized into stationary and mobile types. The mobile segment is projected to grow at a robust pace, with a CAGR exceeding 4% through 2034. Mobile towers provide essential lighting solutions for temporary or seasonal projects, allowing industries such as mining and oil and gas to operate in remote areas lacking infrastructure. These towers offer portability and reliability, ensuring that lighting requirements are met efficiently in off-grid locations.

In the United States, the market for metal halide light towers is expected to surpass USD 480 million by 2034. The demand for these towers is driven by advancements in engine technology and fuel efficiency, reducing operational costs while extending the duration of lighting during night shifts. The construction and mining industries, in particular, are relying on these high-intensity lighting solutions to meet stringent safety standards and ensure visibility in challenging worksite environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Sales

- 5.3 Rental

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Solar

- 7.4 Direct

- 7.5 Others

Chapter 8 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Manual lifting

- 8.3 Hydraulic lifting

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Infrastructure development

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Military & defense

- 9.7 Emergency & disaster relief

- 9.8 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million and ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 Allmand Bros

- 11.2 Aska Equipments

- 11.3 Atlas Copco

- 11.4 Caterpillar

- 11.5 Chicago Pneumatic

- 11.6 Colorado Standby

- 11.7 DMI

- 11.8 Doosan Portable Power

- 11.9 Generac Power Systems

- 11.10 Himoinsa

- 11.11 Inmesol Gensets

- 11.12 JC Bamford Excavators

- 11.13 Larson Electronics

- 11.14 Light Boy

- 11.15 LTA Projects

- 11.16 Multiquip

- 11.17 Olikara Lighting Towers

- 11.18 Progress Solar Solutions

- 11.19 The Will Burt Company

- 11.20 Trime

- 11.21 United Rentals

- 11.22 Wacker Neuson

- 11.23 Youngman Richardson