|

市场调查报告书

商品编码

1666953

货车市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Cargo Vans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

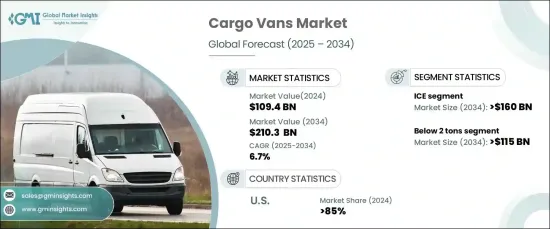

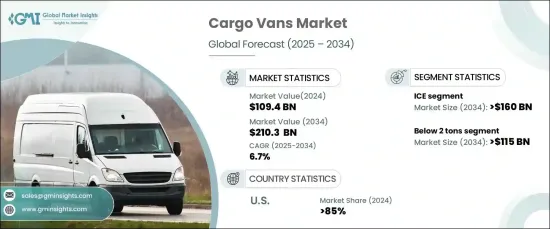

2024 年全球货车市场价值为 1,094 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.7%。消费者对网上购物的偏好日益增加以及快速送货服务的兴起进一步推动了零售、食品配送和医疗保健等行业的成长。城市化和人口密度的提高正在重塑需求,从而推动更小型、更灵活的车辆的发展,以适应拥挤的城市的通行。此外,製造商正在采用电动和混合动力技术来满足环境法规、提高燃油效率并减少排放,使市场适应现代城市物流。

在推进方面,内燃机 (ICE) 汽车占据主导地位,到 2024 年将占据 80% 以上的市场份额。轻度混合动力和插电式系统等混合动力技术也越来越受到重视。这些系统将内燃机与电动马达结合在一起,以提高能源效率并减少排放,在动力和永续性之间实现最佳化平衡。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1094亿美元 |

| 预测值 | 2103亿美元 |

| 复合年增长率 | 6.7% |

厢型车依载重量又分为2吨以下、2-3吨、3吨以上。预计到 2034 年,2 吨以下细分市场的规模将超过 1,150 亿美元。增强的电池技术可以实现更长的续航里程和更快的充电速度,使这些货车成为最后一哩配送和市政车队营运的理想选择。自适应巡航控制、车道辅助和自动煞车等安全功能越来越多地整合,以提高营运效率和车队管理。

在严格的环境法规和企业永续发展的推动下,美国将在 2024 年占据 85% 以上的收入份额。由于营运成本较低、排放减少以及政府激励措施,电动货车越来越受欢迎。欧洲正专注于模组化和可自订的设计,以实现冷藏运输和移动车间等应用。同时,亚太地区正瞄准成本敏感市场,提供多功能且价格实惠的设计,以满足小型企业和企业家的需求。先进的製造技术有助于在保持品质的同时降低生产成本,确保这些车辆满足城市和农村环境中的多样化营运需求。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 零件製造商

- 汽车OEM

- 一级供应商

- 最终用途

- 利润率分析

- 技术差异化

- 电动动力系统

- 远端资讯处理解决方案

- 模组化和可自订的设计

- 先进的货物管理系统

- 其他的

- 重要新闻及倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 电子商务产业的成长

- 最后一哩配送供应链的改进

- 增加国际贸易

- 货车电气化程度不断提高

- 产业陷阱与挑战

- 电动车基础设施的限制

- 监理复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电的

- 纯电动车

- 油电混合车

- 插电式混合动力汽车

第六章:市场估计与预测:以吨位容量,2021 - 2034 年

- 主要趋势

- 2吨以下

- 2至3吨

- 3吨以上

第 7 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 个人的

- 商业的

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Citroen

- Dongfeng

- Ford

- General Motors

- Honda

- Hyundai

- Isuzu

- Iveco

- JAC Motors

- Kia

- Mahindra & Mahindra

- MAN

- Mercedes-Benz

- Nissan

- Peugeot

- Renault

- Stellantis

- Tata Motors

- TOYOTA

- Volkswagen

The Global Cargo Vans Market was valued at USD 109.4 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2034. The rapid expansion of e-commerce and associated logistics operations is driving demand for these vehicles. Increasing consumer preference for online shopping and the rise of fast delivery services are further fueling growth across industries like retail, food delivery, and healthcare. Urbanization and higher population density are reshaping requirements, leading to the development of smaller, more agile vehicles suited for navigating congested cities. Additionally, manufacturers are incorporating electric and hybrid technologies to meet environmental regulations, enhance fuel efficiency, and reduce emissions, enabling the market to adapt to modern urban logistics.

In terms of propulsion, internal combustion engine (ICE) vehicles dominate, accounting for over 80% of the market share in 2024. This segment is projected to surpass USD 160 billion by 2034. Advancements in compact and efficient diesel and gasoline engines, along with innovations like turbocharging and precision fuel injection systems, are enhancing performance. Hybrid technologies, such as mild-hybrid and plug-in systems, are also gaining traction. These systems combine ICEs with electric motors to improve energy efficiency and reduce emissions, offering an optimized balance between power and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $109.4 Billion |

| Forecast Value | $210.3 Billion |

| CAGR | 6.7% |

Cargo vans are further categorized based on tonnage capacity into below 2 tons, 2-3 tons, and above 3 tons. The below 2 tons segment is expected to exceed USD 115 billion by 2034. Electrification is a major factor driving growth in this category, with manufacturers developing lightweight batteries, efficient motors, and advanced energy management systems to cater to urban delivery and short-range applications. Enhanced battery technology is enabling longer ranges and faster charging, making these vans ideal for last-mile delivery and municipal fleet operations. Safety features like adaptive cruise control, lane assistance, and automated braking are increasingly integrated to improve operational efficiency and fleet management.

The US accounted for over 85% of the revenue share in 2024, driven by stringent environmental regulations and the push for corporate sustainability. Electric vans are gaining traction due to lower operational costs, reduced emissions, and government incentives. Europe is focusing on modular and customizable designs, enabling applications like refrigerated transport and mobile workshops. Meanwhile, the Asia Pacific region is targeting cost-sensitive markets with versatile and affordable designs that cater to small businesses and entrepreneurs. Advanced manufacturing techniques are helping reduce production costs while maintaining quality, ensuring these vehicles meet diverse operational needs in both urban and rural settings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Automotive OEM

- 3.2.3 Tier-1 suppliers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 Electric powertrains

- 3.4.2 Telematics solutions

- 3.4.3 Modular and customizable designs

- 3.4.4 Advanced cargo management systems

- 3.4.5 Others

- 3.5 Key news & initiatives

- 3.6 Patent analysis

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growth of e-commerce sector

- 3.8.1.2 Improvements in last mile delivery supply chains

- 3.8.1.3 Increasing international trade

- 3.8.1.4 Growing electrification of cargo vans

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Electric vehicle infrastructure limitations

- 3.8.2.2 Regulatory complexity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 ICE

- 5.3 Electric

- 5.3.1 Battery electric vehicle

- 5.3.2 Hybrid Electric vehicle

- 5.3.3 Plug-in hybrid electric vehicle

Chapter 6 Market Estimates & Forecast, By Tonnage Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 2 tons

- 6.3 2 to 3 tons

- 6.4 Above 3 tons

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Personal

- 7.3 Commercial

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Citroen

- 9.2 Dongfeng

- 9.3 Ford

- 9.4 General Motors

- 9.5 Honda

- 9.6 Hyundai

- 9.7 Isuzu

- 9.8 Iveco

- 9.9 JAC Motors

- 9.10 Kia

- 9.11 Mahindra & Mahindra

- 9.12 MAN

- 9.13 Mercedes-Benz

- 9.14 Nissan

- 9.15 Peugeot

- 9.16 Renault

- 9.17 Stellantis

- 9.18 Tata Motors

- 9.19 TOYOTA

- 9.20 Volkswagen