|

市场调查报告书

商品编码

1666958

直流快速电动车充电站市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测DC Fast Electric Vehicle Charging Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

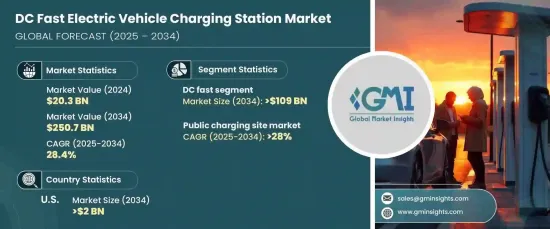

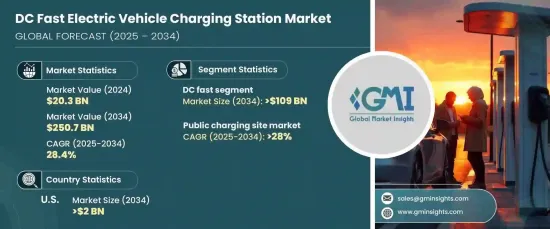

2024 年全球直流快速电动车充电站市场价值为 203 亿美元,预计 2025 年至 2034 年期间将以 28.4% 的强劲复合年增长率增长。直流快速充电器以其快速充电能力而闻名,解决了续航里程焦虑和长充电时间等问题。对于更快充电方式的需求日益增长,提升了电动车的整体拥有体验,使消费者能够更轻鬆、更方便地将电动车融入日常生活。技术进步和公共投资在加速充电基础设施的扩张、进一步推动向电动车的转变以及支持全球向永续未来的转型方面发挥关键作用。

到 2034 年,直流快速电动车充电站市场规模将超过 1,090 亿美元。它们能够利用极高的电压以更快的速度为车辆充电,这增强了它们的吸引力。随着对快速充电基础设施的需求不断增长以及混合动力汽车的普及,该市场呈上升趋势。随着越来越多的消费者寻求更快的充电解决方案,相关电气元件和混合动力技术的不断发展对市场动态产生了积极影响。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 203亿美元 |

| 预测值 | 2507亿美元 |

| 复合年增长率 | 28.4% |

公共充电站市场预计将显着成长,到 2034 年复合年增长率将超过 28%。这些充电站沿着主要道路越来越方便,使得驾驶者在行驶过程中可以更轻鬆地为电动车充电。此外,充电站所有者远端监控、控制和优化能源消耗的能力进一步增强了这些充电站的部署。此功能不仅提高了效率,而且还支援电动车充电基础设施的更广泛发展。

在美国,直流快速电动车充电站市场规模预计到 2034 年将超过 20 亿美元。随着公共和私人充电站的不断扩大以及快速充电标准的采用,对直流快速充电器的需求预计将激增。这些因素对于市场持续扩张以及支持日益增长的电动车数量所需的基础设施的发展至关重要。

在亚太地区,政府的优惠政策(包括电动车税收优惠和退税)正在推动充电站市场的成长。越来越多的跨国零售公司投资建立充电网络,为该产业创造了重大机会。这一趋势有助于加强市场基础设施,进一步加速电动车的普及。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:按充电类型,2021 – 2034 年

- 主要趋势

- 直流快速

- 其他的

第 6 章:市场规模与预测:按充电站点划分,2021 年至 2034 年

- 主要趋势

- 民众

- 私人的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 挪威

- 德国

- 法国

- 荷兰

- 英国

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 新加坡

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Blink Charging

- ChargePoint

- Delta Electronics

- EON

- Eaton

- EVBox

- EVgo

- Fortum

- GreenWay Infrastructure

- Leviton Manufacturing

- Siemens

- Starvo Global Energi

- Tesla

- Volta

The Global DC Fast Electric Vehicle Charging Station Market was valued at USD 20.3 billion in 2024 and is projected to grow at a robust CAGR of 28.4% between 2025 and 2034. As the adoption of electric vehicles (EVs) rises, the demand for faster charging solutions becomes increasingly critical. DC fast chargers, known for their rapid charging capabilities, are addressing concerns like range anxiety and long charging times. This growing demand for quicker recharging options is enhancing the overall EV ownership experience, making it easier and more convenient for consumers to incorporate electric vehicles into their daily routines. Technological advancements and public investments are playing pivotal roles in accelerating the expansion of the charging infrastructure, further driving the shift toward electric vehicles, and supporting the global transition to a sustainable future.

The DC fast EV charging station market is set to surpass USD 109 billion by 2034. These chargers are designed to seamlessly integrate with charging stations and offer additional storage capacity to hold extra charge. Their ability to charge vehicles at significantly faster speeds, using very high voltage, boosts their appeal. With the increasing demand for rapid charging infrastructure and the growing adoption of hybrid vehicles, this market is on an upward trajectory. As more consumers seek faster charging solutions, the market dynamics are being positively influenced by the continuous development of related electrical components and hybrid technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.3 Billion |

| Forecast Value | $250.7 Billion |

| CAGR | 28.4% |

The public charging station segment is expected to witness significant growth, with a CAGR of over 28% through 2034. The increasing availability of public EV charging stations is a major factor driving this expansion. These stations are becoming more accessible along major roadways, making it easier for drivers to charge their electric vehicles while on the go. Additionally, the ability of charging station owners to remotely monitor, control, and optimize energy consumption is further enhancing the deployment of these stations. This functionality not only improves efficiency but also supports the broader growth of EV charging infrastructure.

In the U.S., the DC fast EV charging station market is anticipated to exceed USD 2 billion by 2034. Rising consumer awareness about the environmental benefits of electric vehicles, combined with government regulations promoting the installation of charging stations, will propel market growth. As both public and private charging stations continue to expand and fast charging standards are adopted, the demand for DC fast chargers is expected to surge. These factors are key to the market's continued expansion and the evolution of the infrastructure needed to support the growing number of electric vehicles.

In the Asia Pacific region, favorable government policies, including tax incentives and rebates for electric vehicle adoption, are driving the growth of the charging station market. The increasing number of multinational retail corporations investing in the development of charging networks is creating significant opportunities for the industry. This trend is helping to strengthen the market's infrastructure, further accelerating the adoption of electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Charging Type, 2021 – 2034 (Units, USD Billion)

- 5.1 Key trends

- 5.2 DC Fast

- 5.3 Others

Chapter 6 Market Size and Forecast, By Charging Site, 2021 – 2034 (Units, USD Billion)

- 6.1 Key trends

- 6.2 Public

- 6.3 Private

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.3.6 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Singapore

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Blink Charging

- 8.3 ChargePoint

- 8.4 Delta Electronics

- 8.5 EON

- 8.6 Eaton

- 8.7 EVBox

- 8.8 EVgo

- 8.9 Fortum

- 8.10 GreenWay Infrastructure

- 8.11 Leviton Manufacturing

- 8.12 Siemens

- 8.13 Starvo Global Energi

- 8.14 Tesla

- 8.15 Volta