|

市场调查报告书

商品编码

1666974

开放式转换开关市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Open Transition Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

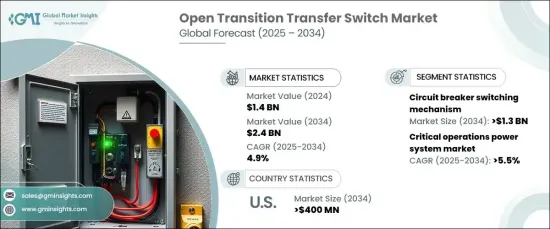

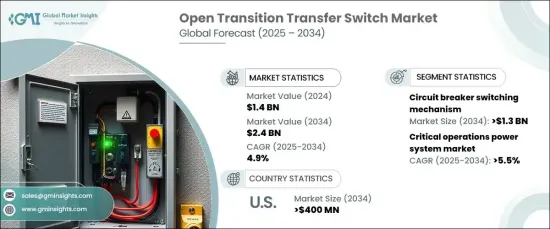

2024 年全球开放式转换开关市场价值为 14 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.9%。对安全性、效率和遵守监管标准的日益重视继续鼓励了创新。政府推动再生能源整合的措施为该产业进一步开闢了新的途径。自动化和连接技术的进步极大地改善了市场的产品,实现了无缝过渡和即时远端监控。

智慧技术与这些系统的结合正透过应对现代能源挑战来改变整个产业。旨在检测和应对电力波动的自动化解决方案已获得关注,并提供了增强的性能和可靠性。消费者对客製化的期望日益增长,以及遵守严格安全标准的需求促使製造商专注于创造满足不断变化的需求的稳健、高效的设计。这些进步与向可持续和有弹性的能源基础设施的更广泛转变相一致,将开放式转换开关定位为当代电力系统的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 4.9% |

预计到 2034 年,基于断路器的开关机制市场规模将超过 13 亿美元。 它们能够处理更高的故障电流并提供卓越的保护,因此成为许多应用中的首选。此外,自动化和智慧控制的不断整合增强了这些系统的功能,进一步推动了它们的应用。製造商继续透过专注于创新来竞争,提供优先考虑营运效率和可靠性的解决方案。

美国将继续在市场上扮演重要角色,预计到 2034 年,该国开放式转换开关产业的规模将超过 4 亿美元。再生能源(尤其是太阳能)的采用不断增加,进一步加速了需求,因为这些系统可以无缝地整合到混合能源设定中。美国製造商正专注于采用远端诊断和监控功能等尖端技术,以改善产品功能并满足日益增长的智慧能源解决方案需求。

随着对可靠、高效和智慧电力传输系统的需求不断增长,全球开放式转换开关市场预计将持续成长。该行业对创新、安全和永续性的关注确保了其在现代能源管理系统中发挥的关键作用。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:依营运方式,2021 – 2034 年

- 主要趋势

- 手动的

- 非自动

- 自动的

- 旁路隔离

第 6 章:市场规模与预测:依转换机制,2021 – 2034 年

- 主要趋势

- 接触器

- 断路器

第 7 章:市场规模及预测:依安培等级,2021 年至 2034 年

- 主要趋势

- ≤ 400 安培

- 401 安培至 1600 安培

- > 1600 安培

第 8 章:市场规模与预测,市场:按安装,2021 – 2034 年

- 主要趋势

- 紧急系统

- 法律要求的製度

- 关键操作电力系统

- 可选备用系统

第 9 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ABB

- AEG Power Solutions

- Briggs & Stratton

- Caterpillar

- Cummins

- Eaton

- Generac Power Systems

- General Electric

- Kohler

- Midwest Electric Products

- One Two Three Electric

- Schneider Electric

- Siemens

- Vertiv Group

- Victron Energy

The Global Open Transition Transfer Switch Market, valued at USD 1.4 billion in 2024, is projected to grow at a CAGR of 4.9% between 2025 and 2034. This growth is fueled by the rising need for dependable power backup systems across residential, commercial, and industrial applications. The increasing emphasis on safety, efficiency, and adherence to regulatory standards continues to encourage innovation. Government initiatives promoting renewable energy integration further open new avenues for the industry. Advancements in automation and connectivity technologies have significantly improved the market's offerings, enabling seamless transitions and real-time remote monitoring.

The integration of smart technologies into these systems is transforming the industry by addressing modern energy challenges. Automated solutions designed to detect and respond to power fluctuations have gained traction, providing enhanced performance and reliability. Growing consumer expectations for customization and the need for compliance with stringent safety standards drive manufacturers to focus on creating robust, efficient designs tailored to evolving demands. These advancements align with the broader shift toward sustainable and resilient energy infrastructure, positioning open transition transfer switches as essential components in contemporary power systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 4.9% |

Circuit breaker-based switching mechanisms are expected to exceed USD 1.3 billion by 2034. Their ability to handle higher fault currents and deliver superior protection has made them a preferred choice in many applications. Additionally, the growing incorporation of automation and intelligent controls is enhancing the functionality of these systems, further driving their adoption. Manufacturers continue to compete by focusing on innovation, offering solutions that prioritize operational efficiency and reliability.

The United States is set to remain a key player in the market, with the country's open transition transfer switch sector forecasted to surpass USD 400 million by 2034. Heightened concerns about power reliability and increasing reliance on backup power systems across multiple industries are key drivers in the region. The rise in renewable energy adoption, particularly solar, is further accelerating demand as these systems can seamlessly integrate into hybrid energy setups. US-based manufacturers are concentrating on incorporating cutting-edge technologies such as remote diagnostics and monitoring capabilities to improve product functionality and cater to the growing need for smart energy solutions.

As the demand for reliable, efficient, and intelligent power transfer systems continues to rise, the global open transition transfer switch market is poised for sustained growth. The industry's focus on innovation, safety, and sustainability ensures its role as a critical player in modern energy management systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Operations, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Non-automatic

- 5.4 Automatic

- 5.5 By-pass isolation

Chapter 6 Market Size and Forecast, By Switching Mechanism, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Contactor

- 6.3 Circuit Breaker

Chapter 7 Market Size and Forecast, By Ampere Rating, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 ≤ 400 Amp

- 7.3 401 Amp to 1600 Amp

- 7.4 > 1600 Amp

Chapter 8 Market Size and Forecast, Market, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 Emergency systems

- 8.3 Legally required systems

- 8.4 Critical operations power systems

- 8.5 Optional standby systems

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AEG Power Solutions

- 10.3 Briggs & Stratton

- 10.4 Caterpillar

- 10.5 Cummins

- 10.6 Eaton

- 10.7 Generac Power Systems

- 10.8 General Electric

- 10.9 Kohler

- 10.10 Midwest Electric Products

- 10.11 One Two Three Electric

- 10.12 Schneider Electric

- 10.13 Siemens

- 10.14 Vertiv Group

- 10.15 Victron Energy