|

市场调查报告书

商品编码

1822614

建筑隔热市场机会、成长动力、产业趋势分析及2025-2034年预测Building Thermal Insulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

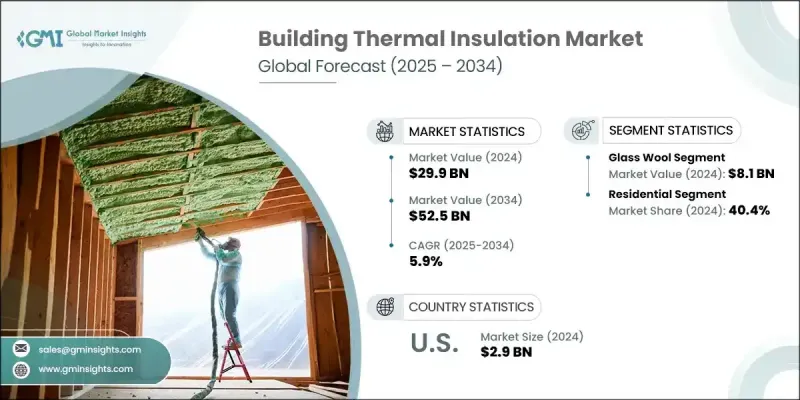

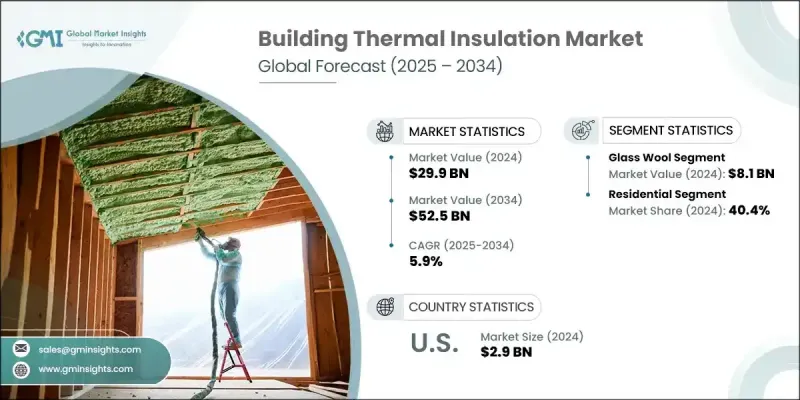

2024年,全球建筑隔热市场规模达299亿美元,预计2034年将以5.9%的复合年增长率成长,达到525亿美元。日益增强的环保意识和对气候变迁的担忧,推动了建筑节能解决方案的需求。建筑物是能源消耗的主要来源,而隔热材料可以减少暖气和冷气需求,有效降低温室气体排放。这符合全球永续发展倡议,并推动了环保隔热材料的普及。

消费者、开发商和承包商越来越青睐可持续和节能的选择,这刺激了对天然或再生材料製成的产品的需求。 LEED 和 BREEAM 等监管框架和绿色建筑认证进一步推动了节能隔热材料的使用,而退税等财务激励措施也鼓励了人们的采用。因此,对节能住宅和商业建筑的投资持续成长,使得隔热材料成为降低能源成本和最大程度减少环境影响的关键要素。市场的成长反映了人们对建造更永续建筑的共同关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 299亿美元 |

| 预测值 | 525亿美元 |

| 复合年增长率 | 5.9% |

市场依材料细分为开孔型和闭孔型。开孔型材料市场发展迅猛,2024 年贡献了 129.6 亿美元的市场规模,预计到 2034 年将达到 238.4 亿美元。这些材料经济高效,广泛应用于住宅和商业建筑,尤其是在预算有限的项目中。它们还能增强隔音效果,并支撑绿色建筑,其环保方案由可回收材料製成。开孔型材料因其易于安装和强大的隔热性能而备受青睐,成为改造老建筑以提高能源效率的首选。

按配销通路划分,市场分为直接销售和间接销售。间接通路在2024年占据45.01%的市场份额,占据市场主导地位,预计到2034年将达到196.9亿美元。製造商受益于分销商、批发商和零售商的广泛网络,这些网络简化了产品供应和客户覆盖范围。这些中间商减少了物流挑战,提高了市场渗透率,并帮助製造商专注于产品开发和品牌建立。间接管道还可以透过线上平台满足日益增长的需求,提高买家的可及性和便利性。

2024年,美国占全球市场收入的53.5%,预计到2034年,复合年增长率将达到6.3%。美国多元化的建筑业和严格的能源效率法规推动了对先进隔热解决方案的需求。税收抵免和绿色认证等政府措施进一步支持了隔热材料的使用。美国对隔热技术创新的重视以及对不同气候区节能解决方案的需求,将继续推动市场成长。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 能源效率法规不断提高

- 不断增长的建筑业和城市化

- 环境议题与永续发展倡议

- 产业陷阱与挑战

- 初期投资成本高

- 替代技术的可用性

- 机会

- 环保再生材料的开发

- 改造和翻新市场的成长

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按材质

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 玻璃棉

- 岩棉

- 发泡聚苯乙烯

- 挤塑聚苯乙烯

- 聚氨酯

- 其他的

第六章:市场估计与预测:依形式,2021 - 2034

- 主要趋势

- 毯子

- 面板

- 泡棉

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 墙体保温

- 内墙

- 外墙

- 空心墙

- 帷幕墙

- 屋顶隔热

- 平屋顶

- 坡屋顶

- 楼板/楼板

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Armacell

- Burnett & Co

- Firestone Building Products

- GLT Products

- Johns Manville

- Kingspan Group

- Knauf Insulation

- Mapei

- NICHIAS Corporation

- Owens Corning

- Recticel Insulation

- Rockwool International

- Saint-Gobain Isover

- Siltherm

- URSA

The global building thermal insulation market was valued at USD 29.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 52.5 billion by 2034. Growing environmental awareness and concerns about climate change are driving the demand for energy-efficient solutions in construction. Buildings account for substantial energy consumption, and insulation reduces the need for heating and cooling, effectively lowering greenhouse gas emissions. This aligns with global sustainability initiatives and fuels the adoption of eco-friendly insulation materials.

Consumers, developers, and contractors increasingly prefer sustainable and energy-efficient options, spurring demand for products made from natural or recycled materials. Regulatory frameworks and green building certifications, such as LEED and BREEAM, further promote energy-efficient insulation, while financial incentives like tax rebates encourage adoption. As a result, investment in energy-efficient homes and commercial structures continues to rise, making insulation a critical component in reducing energy costs and minimizing environmental impact. The market's growth reflects a collective focus on building more sustainable structures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.9 Billion |

| Forecast Value | $52.5 Billion |

| CAGR | 5.9% |

The market is segmented by material into open-cell and closed-cell types. Open-cell materials have gained substantial traction, contributing USD 12.96 billion in 2024 and projected to reach USD 23.84 billion by 2034. These materials are cost-effective and widely adopted in residential and commercial applications, especially in budget-conscious projects. They also enhance soundproofing and support green construction with eco-friendly options made from recycled materials. Open-cell materials are favored for their ease of installation and strong thermal performance, making them a preferred choice for retrofitting older buildings to improve energy efficiency.

By distribution channel, the market is divided into direct and indirect sales. Indirect channels led the market with a 45.01% share in 2024 and are expected to reach USD 19.69 billion by 2034. Manufacturers benefit from the extensive networks of distributors, wholesalers, and retailers, who streamline product availability and customer reach. These intermediaries reduce logistical challenges and improve market penetration, helping manufacturers focus on product development and branding. Indirect channels also cater to the growing demand through online platforms, enhancing accessibility and convenience for buyers.

The United States accounted for 53.5% of the global market's revenue in 2024 and is projected to grow at a CAGR of 6.3% through 2034. The nation's diverse construction industry and stringent energy-efficiency regulations drive demand for advanced insulation solutions. Government initiatives, including tax credits and green certifications, further support the use of thermal insulation. The country's emphasis on innovation in insulation technologies and the need for energy-saving solutions across varying climate zones continue to bolster market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising energy efficiency regulations

- 3.2.1.2 Growing construction and urbanization

- 3.2.1.3 Environmental concerns and sustainability initiatives

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Availability of alternative technologies

- 3.2.3 Opportunities

- 3.2.3.1 Development of eco-friendly and recycled materials

- 3.2.3.2 Retrofitting and renovation market growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By material

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 5.1 Key trends

- 5.2 Glass wool

- 5.3 Stone wool

- 5.4 Expanded polystyrene

- 5.5 Extruded polystyrene

- 5.6 Polyurethanes

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 6.1 Key trends

- 6.2 Blankets

- 6.3 Panels

- 6.4 Foam

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 7.1 Key trends

- 7.2 Wall insulation

- 7.2.1 Internal wall

- 7.2.2 External wall

- 7.2.3 Cavity wall

- 7.2.4 Curtain wall

- 7.3 Roof insulation

- 7.3.1 Flat roof

- 7.3.2 Pitch roof

- 7.4 Floor/Slab

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Armacell

- 11.2 Burnett & Co

- 11.3 Firestone Building Products

- 11.4 GLT Products

- 11.5 Johns Manville

- 11.6 Kingspan Group

- 11.7 Knauf Insulation

- 11.8 Mapei

- 11.9 NICHIAS Corporation

- 11.10 Owens Corning

- 11.11 Recticel Insulation

- 11.12 Rockwool International

- 11.13 Saint-Gobain Isover

- 11.14 Siltherm

- 11.15 URSA