|

市场调查报告书

商品编码

1666989

搜救 (SAR) 设备市场机会、成长动力、产业趋势分析与预测 2025 - 2034Search and Rescue (SAR) Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

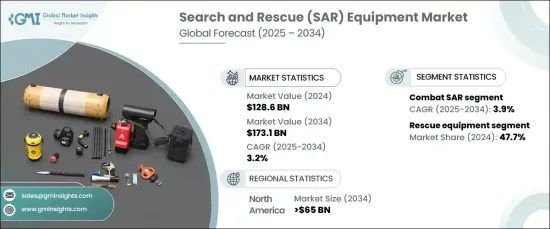

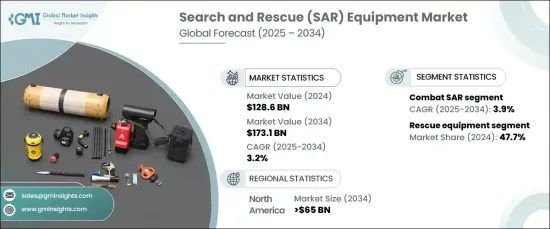

2024 年全球搜救设备市场价值为 1,286 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 3.2%。卫星通讯系统和物联网平台等先进的连接解决方案实现了救援队、指挥中心和设备之间的无缝互动。这些创新透过实现 GPS 追踪、即时视讯传送和即时资料共享,增强了态势感知能力,尤其是在具有挑战性的条件下。搜救无人机和穿戴式装置等工具现在可以即时传输关键资料,有助于快速决策并提高成功率。随着人们对高效救援工作的重视程度不断提高,即时通讯系统已成为搜救设备的重要组成部分。

气候变迁导致的自然灾害增多,刺激了全球对搜救设备的需求。飓风、洪水、地震和野火发生的频率日益增加,凸显了对先进工具支援灾害应变的迫切需求。政府、人道组织和国防机构正在大力投资创新技术,以提高其灾害管理能力。这种向高度准备和迅速行动的转变是市场的主要驱动力,重点是保障生命安全并在危机情况下最大限度地减少损失。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1286亿美元 |

| 预测值 | 1731亿美元 |

| 复合年增长率 | 3.2% |

2024年,救援设备占据市场主导地位,占有47.7%的份额。这些工具在搜救任务中发挥着至关重要的作用,为从危险境地中救出受害者提供了必要的支持。轻质材料和人体工学设计的创新提高了担架、救生筏和安全带等物品的功能性和耐用性。模组化系统可根据不同的救援场景进行定制,具有适应山地、洪水和海洋环境的能力。 GPS、通讯设备和热成像的整合进一步提高了救援行动的精度和效率,减少了回应时间并实现了在危险区域的远端部署。

战斗搜救领域成为 2024 年成长最快的应用类别,预测期内预计复合年增长率为 3.9%。该部门专注于从高风险区域撤回人员,通常需要先进的技术来快速执行。增强的 GPS 追踪和即时通讯系统改善了各部门之间的协调,而先进的医疗设备则支援拔牙期间的即时护理。军方对战术无人机和装甲车的投资不断扩大战斗搜救行动的能力,优先考虑危险条件下的安全性和作战速度。

北美仍然是一个重要的市场,预计到 2034 年将超过 650 亿美元。公共和私营部门之间的合作努力正在促进创新并确保能够获得尖端救援设备。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 即时通讯技术的进步正在彻底改变搜救设备的操作

- 随着天灾不断升级,全球对搜救设备的需求激增

- 世界各国政府正在加大对 SAR 技术开发项目的投资

- 无人机在当代搜救任务中变得越来越重要

- 技术创新正在增强 SAR 设备系统的有效性

- 产业陷阱与挑战

- 高成本阻碍SAR设备技术的采用

- SAR 设备在极端环境下面临运作挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按设备,2021 年至 2034 年

- 主要趋势

- 救援设备

- 搜寻设备

- 雷达

- 声纳

- 相机

- 信标

- 通讯设备

- 电信设备

- 便携式收音机

- 应答器

- 中继器

- 医疗设备

- 其他的

第 6 章:市场估计与预测:按平台,2021-2034 年

- 主要趋势

- 空降

- 固定翼

- 旋翼机

- 无人驾驶飞行器(UAVS)

- 海洋

- 自主水下航行器(AUVS)

- 遥控水下机器人 (ROVS)

- 两栖船

- 救生筏

- 特别艇艇队 (SBU) 艇

- 地面

- 救护车

- 消防和救援车辆

- 无人地面车辆(UGVS)

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 战斗搜救

- 城市特区

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Acr Electronics, Inc

- Aeromarine Srt

- Cubic Corporation

- Elbit Systems Ltd.

- Garmin Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Leonardo SPA

- Raytheon Company

- Rockwell Collins, Inc.

- Thales Group

The Global Search And Rescue Equipment Market was valued at USD 128.6 billion in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2034. The integration of real-time communication technologies is transforming search and rescue operations, enabling faster coordination and improved response times. Advanced connectivity solutions, such as satellite communication systems and IoT platforms, allow seamless interaction between rescue teams, command centers, and equipment. These innovations enhance situational awareness, particularly in challenging conditions, by enabling GPS tracking, live video feeds, and instant data sharing. Tools like SAR drones and wearable devices now transmit critical data in real-time, facilitating quick decision-making and higher success rates. The rising emphasis on efficient rescue efforts has positioned real-time communication systems as an essential component of SAR equipment.

Increasing natural disasters caused by climate change have spurred global demand for search and rescue equipment. The growing frequency of hurricanes, floods, earthquakes, and wildfires underscores the urgent need for advanced tools to support disaster response. Governments, humanitarian organizations, and defense agencies are heavily investing in innovative technologies to improve their disaster management capabilities. This shift towards heightened preparedness and swift action is a key driver for the market, with a significant focus on safeguarding lives and minimizing damage in crisis scenarios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128.6 billion |

| Forecast Value | $173.1 billion |

| CAGR | 3.2% |

In 2024, rescue equipment dominated the market, holding a 47.7% share. These tools play a critical role in SAR missions, providing essential support for extracting victims from perilous situations. Innovations in lightweight materials and ergonomic designs have improved the functionality and durability of items such as stretchers, life rafts, and harnesses. Modular systems allow customization for different rescue scenarios, offering adaptability across mountain, flood, and maritime environments. The integration of GPS, communication devices, and thermal imaging further enhances the precision and efficiency of rescue operations, reducing response times and enabling remote deployments in hazardous areas.

The combat search and rescue segment emerged as the fastest-growing application category in 2024, with a CAGR of 3.9% projected during the forecast period. This sector focuses on retrieving personnel from high-risk zones, often requiring advanced technologies for rapid execution. Enhanced GPS tracking and real-time communication systems improve coordination between units, while advanced medical equipment supports immediate care during extractions. Military investments in tactical drones and armored vehicles continue to expand the capabilities of combat SAR operations, prioritizing safety and operational speed in dangerous conditions.

North America remains a significant market, expected to surpass USD 65 billion by 2034. The region's growing focus on disaster readiness is driving investments in advanced SAR technologies to strengthen emergency response efforts. Collaborative efforts between public and private sectors are fostering innovation and ensuring access to cutting-edge rescue equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Real-time communication advancements are revolutionizing SAR equipment operations

- 3.6.1.2 Global demand for SAR equipment surges in response to escalating natural disasters

- 3.6.1.3 Governments worldwide are ramping up investments in SAR technology development programs

- 3.6.1.4 Drones are becoming increasingly integral to contemporary search and rescue missions

- 3.6.1.5 Technological innovations are amplifying the effectiveness of SAR equipment systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs hinder the adoption of SAR equipment technology

- 3.6.2.2 SAR equipment faces operational challenges in extreme environments

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Rescue equipment

- 5.3 Search Equipment

- 5.3.1 Radar

- 5.3.2 Sonar

- 5.3.3 Cameras

- 5.3.4 Beacons

- 5.4 Communication Equipment

- 5.4.1 Telecommunications equipment

- 5.4.2 Portable radios

- 5.4.3 Transponders

- 5.4.4 Repeaters

- 5.5 Medical equipment

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Airborne

- 6.2.1 Fixed wing

- 6.2.2 Rotary wing

- 6.2.3 Unmanned Aerial Vehicles (UAVS)

- 6.3 Marine

- 6.3.1 Autonomous Underwater Vehicles (AUVS)

- 6.3.2 Remotely Operated Underwater Vehicles (ROVS)

- 6.3.3 Amphibious crafts

- 6.3.4 Life Rafts

- 6.3.5 Special Boat Unit (SBU) Crafts

- 6.4 Ground-based

- 6.4.1 Ambulances

- 6.4.2 Fire & Rescue vehicles

- 6.4.3 Unmanned Ground Vehicles (UGVS)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Combat SAR

- 7.3 Urban SAR

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acr Electronics, Inc

- 9.2 Aeromarine Srt

- 9.3 Cubic Corporation

- 9.4 Elbit Systems Ltd.

- 9.5 Garmin Ltd.

- 9.6 General Dynamics Corporation

- 9.7 Honeywell International Inc.

- 9.8 Leonardo S.P.A.

- 9.9 Raytheon Company

- 9.10 Rockwell Collins, Inc.

- 9.11 Thales Group