|

市场调查报告书

商品编码

1666997

鱿鱼市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Squid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

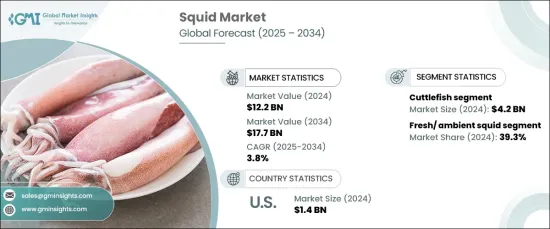

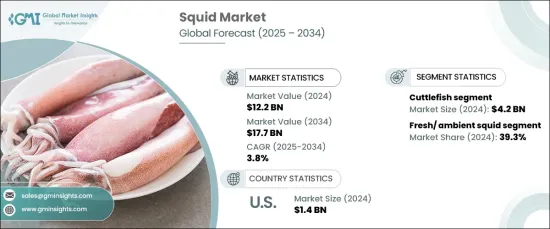

2024 年全球鱿鱼市场价值为 122 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 3.8%。鱿鱼以其独特的风味和多功能性而闻名,其形态多种多样,从整隻新鲜鱿鱼到流行的加工食品,如干鱿鱼零食、鱿鱼圈和鱿鱼排。由于消费者对新烹饪体验的兴趣日益浓厚,对优质海鲜的需求激增,进一步推动了鱿鱼市场的扩张。

由于包装、分销和物流方面的进步,鱿鱼市场取得了显着增长,确保新鲜和加工鱿鱼比以往更有效地进入国际市场。消费者对海鲜高蛋白、低脂肪等健康益处的认识不断提高,也导致了海鲜需求的激增。此外,鱿鱼在许多高檔餐厅和地中海、日本和其他亚洲美食中扮演着重要的角色,巩固了其在全球美食界的地位。然而,该行业面临重大障碍,包括过度捕捞和气候变迁的威胁,这些都影响了供应链和供应。为了应对这些挑战,永续水产养殖措施和渔业法规正在帮助稳定市场,并为长期确保鱿鱼供应提供解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 122亿美元 |

| 预测值 | 177亿美元 |

| 复合年增长率 | 3.8% |

鱿鱼产品依品种分类,主要有日本飞鱼、乌贼、阿根廷短鳍鱿鱼、欧洲鱿鱼等。乌贼类产品是 2024 年最大的市场贡献者,创造了 42 亿美元的收入。墨鱼以其肉质细嫩、味道浓郁而闻名,受到广泛的消费者欢迎,并继续占据主导地位。欧洲鱿鱼由于其多功能性和烹饪价值而在市场上占有重要地位,尤其是在欧洲家庭和餐厅中。

市场根据产品形式进一步划分,主要包括新鲜/常温鱿鱼、冰鲜鱿鱼和冷冻鱿鱼。 2024 年新鲜/常温鱿鱼占总市场份额的 39.3%,是成长最快的细分市场。随着对高品质、低加工海鲜的需求不断增长,新鲜鱿鱼在高檔食品店中特别受欢迎。这些产品在地中海、日本和其他亚洲美食中尤其受欢迎,因为鱿鱼是这些美食中必不可少的食材。

在美国市场,鱿鱼的价值将在 2024 年达到 14 亿美元,这得益于消费者对海鲜作为健康蛋白质替代品的偏好日益增加。以鱿鱼为主食的地中海和亚洲菜餚的流行也促进了这一增长。美国海岸线的可持续捕鱼实践和冷链物流的改善确保了新鲜和冷冻鱿鱼的稳定可靠供应,以满足日益增长的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 海鲜消费量上升

- 民族美食越来越受欢迎

- 鱿鱼的健康益处

- 产业陷阱与挑战

- 过度捕捞

- 鱿鱼价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 乌贼

- 欧洲鱿鱼

- 阿根廷短鳍鱿鱼

- 巨型飞鱿鱼

- 日本飞鱿鱼

- 其他的

第六章:市场估计与预测:依类别,2021-2034 年

- 主要趋势

- 新鲜/常温鱿鱼

- 冷冻鱿鱼

- 冰鲜鱿鱼

- 其他的

第 7 章:市场估计与预测:依包装,2021-2034 年

- 主要趋势

- 罐头

- 托盘

- 其他的

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 食品零售

- 超市场

- 大卖场

- 专卖店

- 其他的

- 餐饮服务

- 食品零售

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Bigsams

- Freshkatch

- Holmes

- Holt

- Lee Fishing

- Minh Khue

- Pescanova

- Qingdao Seaflying Food

- Seafood Pride International

- Seaquest

- Thai Union

- Xiamen Taiseng

The Global Squid Market was valued at USD 12.2 billion in 2024 and is set to grow at a steady CAGR of 3.8% from 2025 to 2034. As consumer appetite for exotic seafood continues to rise, squid has earned its place as a highly sought-after delicacy in many cuisines around the world. Known for its unique flavor profile and versatility, squid is featured in a variety of forms, from whole fresh squid to popular processed items like dried squid snacks, calamari rings, and squid steaks. The surge in demand for premium seafood options, driven by growing consumer interest in new culinary experiences, has further propelled the squid market expansion.

The squid market has seen notable growth thanks to advancements in packaging, distribution, and logistics, ensuring that fresh and processed squid reach international markets more effectively than ever before. Increased consumer awareness of seafood's health benefits, including high protein and low-fat content, has also contributed to this surge in demand. Additionally, squid plays a vital role in many high-end restaurants and Mediterranean, Japanese, and other Asian cuisines, strengthening its place in the global food scene. However, the industry faces significant hurdles, including the threats posed by overfishing and climate change, which impact supply chains and availability. In response to these challenges, sustainable aquaculture initiatives and fisheries regulations are helping stabilize the market, offering solutions to secure the squid supply in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 3.8% |

Squid products are categorized by species type, with Japanese flying squid, cuttlefish, Argentine shortfin squid, and European squid being the main contenders. The cuttlefish segment was the leading market contributor in 2024, generating USD 4.2 billion in revenue. Cuttlefish, known for their tender texture and rich flavor, continue to dominate due to their broad consumer appeal. European squid is also a prominent player in the market, especially in European households and restaurants, thanks to its versatility and culinary value.

The market is further divided by product form, with fresh/ambient squid, chilled squid, and frozen squid being the primary categories. Fresh/ambient squid accounted for 39.3% of the total market share in 2024 and is the fastest-growing segment. The rising demand for high-quality, minimally processed seafood has made fresh squid particularly popular among premium food establishments. These products are especially coveted in Mediterranean, Japanese, and other Asian cuisines, where squid is an essential ingredient.

In the U.S. market, squid was valued at USD 1.4 billion in 2024, driven by an increasing consumer preference for seafood as a healthy protein alternative. The popularity of Mediterranean and Asian dishes featuring squid-based meals has also contributed to this growth. Sustainable fishing practices along the U.S. coastline and improvements in cold-chain logistics have ensured a steady and reliable supply of both fresh and frozen squid to meet growing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising seafood consumption

- 3.6.1.2 Growing popularity of ethnic cuisines

- 3.6.1.3 Health benefits associated with squid

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Overfishing

- 3.6.2.2 Price volatility of squid

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cuttlefish

- 5.3 European squid

- 5.4 Argentine shortfin squid

- 5.5 Jumbo flying squid

- 5.6 Japanese flying squid

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fresh/ ambient squid

- 6.3 Frozen squid

- 6.4 Chilled squid

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Packaging, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cans

- 7.3 Trays

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.1.1 Food retail

- 8.1.1.1 Supermarket

- 8.1.1.2 Hypermarket

- 8.1.1.3 Specialty store

- 8.1.1.4 Others

- 8.1.2 Food service

- 8.1.1 Food retail

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bigsams

- 10.2 Freshkatch

- 10.3 Holmes

- 10.4 Holt

- 10.5 Lee Fishing

- 10.6 Minh Khue

- 10.7 Pescanova

- 10.8 Qingdao Seaflying Food

- 10.9 Seafood Pride International

- 10.10 Seaquest

- 10.11 Thai Union

- 10.12 Xiamen Taiseng