|

市场调查报告书

商品编码

1667005

牵引电池市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Traction Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

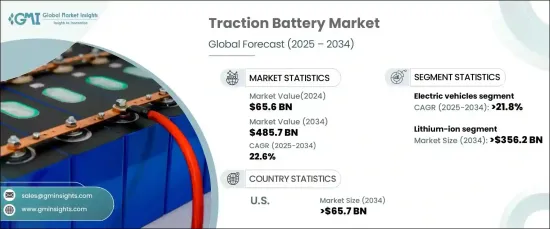

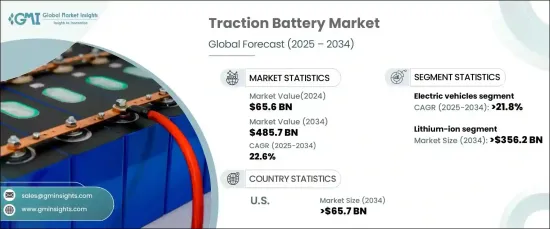

2024 年全球牵引电池市场价值为 656 亿美元,预计 2025 年至 2034 年期间将以 22.6% 的强劲复合年增长率成长。这些电池具有双重用途——为汽车提供动力并充当能源储存解决方案,以支持清洁能源转型。它们的融合对于专注于再生能源基础设施和永续能源管理实践的地区至关重要。

技术进步推动牵引电池市场的发展,电池材料和化学成分的创新显着提高了性能。锂离子电池目前因其高能量密度、耐用性和效率而引领市场。固态电池等新兴技术提供了增强的安全性能和更快的充电速度,使其成为未来应用的有力替代品。製造商也正在探索永续解决方案,开发采用硅阳极和无钴阴极的电池,旨在降低成本并最大限度地减少对环境的影响。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 656亿美元 |

| 预测值 | 4857亿美元 |

| 复合年增长率 | 22.6% |

从电池化学角度来看,锂离子领域预计将经历显着成长,到 2034 年市场规模将达到 3,562 亿美元。锂离子电池的卓越性能,加上对成本效益和环保设计的持续研究,巩固了其在市场上的地位。

在应用方面,牵引电池市场在交通运输领域正在显着扩张。随着排放政策越来越严格以及人们对环保替代品的认识不断提高,向永续行动解决方案的转变推动了这些电池的普及。电池技术的持续改进,包括更好的储能容量、更快的充电速度和更长的使用寿命,满足了交通运输领域对高效能能源解决方案日益增长的需求。

从地区来看,美国预计将主导牵引电池市场,到 2034 年市场规模将超过 657 亿美元。先进电池技术的发展不断提高能源效率并符合更广泛的环境目标。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:依化学成分,2021 – 2034 年

- 主要趋势

- 铅酸

- 锂离子

- 镍基

- 其他的

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 电动车

- 纯电动车

- 插电式混合动力汽车

- 工业的

- 堆高机

- 铁路

- 其他的

- 电动自行车

- 电动滑板车

- 电动摩托车

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Aliant Battery

- Amara Raja Batteries

- BYD

- Camel Group

- Ecovolta

- EnerSys

- Exide Industries

- Farasis Energy

- Guoxuan High-tech Power Energy

- Hitachi Energy

- Hoppecke Batteries

- LG Energy

- Midac

- Mutlu

- Panasonic

- Samsung

- Sunwoda Electronic

- Toshiba

The Global Traction Battery Market, valued at USD 65.6 billion in 2024, is projected to grow at a robust CAGR of 22.6% from 2025 to 2034. Traction batteries are gaining prominence as a critical component of renewable energy systems, especially for their role in enhancing energy efficiency and grid reliability. These batteries support clean energy transitions by serving dual purposes-powering vehicles and acting as energy storage solutions. Their integration is vital for regions focusing on renewable energy infrastructure and sustainable energy management practices.

Advancements in technology are driving the evolution of the traction battery market, with innovations in battery materials and chemistries significantly improving performance. Lithium-ion batteries currently lead the market due to their high energy density, durability, and efficiency. Emerging technologies, such as solid-state batteries, offer enhanced safety features and faster charging, positioning them as a strong alternative for future applications. Manufacturers are also exploring sustainable solutions by developing batteries with silicon anodes and cobalt-free cathodes, which aim to reduce costs and minimize environmental impact.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.6 Billion |

| Forecast Value | $485.7 Billion |

| CAGR | 22.6% |

By battery chemistry, the lithium-ion segment is expected to experience remarkable growth, reaching a market size of USD 356.2 billion by 2034. This growth is fueled by increasing demand for advanced battery solutions across industries, especially for sustainable energy applications. The superior performance of lithium-ion batteries, combined with ongoing research into cost-efficient and environmentally friendly designs, strengthens their position in the market.

In terms of application, the traction battery market is witnessing significant expansion in the transportation sector. The shift toward sustainable mobility solutions has driven higher adoption of these batteries as stricter emission policies and increased awareness of eco-friendly alternatives gain momentum. The consistent improvement in battery technology, including better energy storage capacity, faster charging, and enhanced lifespan, supports the growing need for efficient energy solutions in the transportation sector.

Regionally, the U.S. is expected to dominate the traction battery market, surpassing USD 65.7 billion by 2034. A strong focus on sustainable energy strategies, coupled with favorable government initiatives and technological innovations, is propelling market growth. The development of advanced battery technologies continues to enhance energy efficiency and align with broader environmental goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Chemistry, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Lead acid

- 5.3 Lithium-ion

- 5.4 Nickel-based

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Electric vehicles

- 6.2.1 BEV

- 6.2.2 PHEV

- 6.3 Industrial

- 6.3.1 Forklifts

- 6.3.2 Railroads

- 6.3.3 Others

- 6.4 E-bike

- 6.4.1 E-scooters

- 6.4.2 E-motorcycles

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Aliant Battery

- 8.2 Amara Raja Batteries

- 8.3 BYD

- 8.4 Camel Group

- 8.5 Ecovolta

- 8.6 EnerSys

- 8.7 Exide Industries

- 8.8 Farasis Energy

- 8.9 Guoxuan High-tech Power Energy

- 8.10 Hitachi Energy

- 8.11 Hoppecke Batteries

- 8.12 LG Energy

- 8.13 Midac

- 8.14 Mutlu

- 8.15 Panasonic

- 8.16 Samsung

- 8.17 Sunwoda Electronic

- 8.18 Toshiba