|

市场调查报告书

商品编码

1667013

阻隔材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Barrier Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

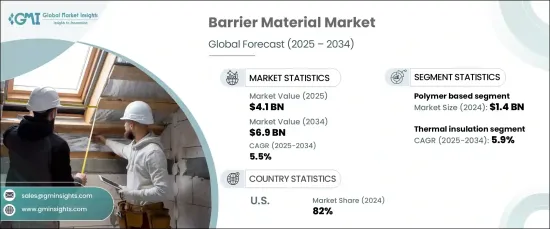

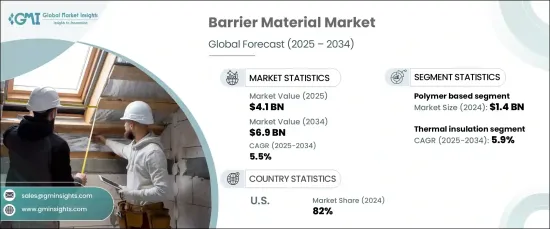

2024 年全球阻隔材料市场价值为 41 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 5.5%。由于这些产业优先保护其产品和结构免受外部威胁,对阻隔材料的依赖持续上升。

阻隔材料对于防止湿气侵入、热波动和声音渗透至关重要,对于提高各种应用的耐用性和效率至关重要。随着监管机构对永续性的审查日益严格,企业正在转向环保、可回收和高性能材料,以满足现代行业标准。此外,技术进步和研发努力正在推动创新,提供满足特定产业需求的尖端解决方案,最终扩大市场潜力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 69亿美元 |

| 复合年增长率 | 5.5% |

根据材料类型,市场分为金属基、矿物基、聚合物基和其他类别。 2024 年聚合物基市场价值为 14 亿美元,预计到 2035 年复合年增长率将达到 5.6%。 聚合物基材料以其卓越的防渗水能力而闻名,是屋顶、地下室和地基系统的首选,可解决人们日益增长的水损害问题。这些材料对于新建建筑和改造工程来说已成为不可或缺的材料,能够为抵御环境因素提供可靠的保护。同时,金属基材料在极端天气条件下的环境中至关重要,例如沿海地区或容易受到高污染的工业区,使其成为结构弹性的重要组成部分。

依功能分类,市场包括防潮、隔热、隔音、防火等部分。 2024 年,隔热材料将占据 41% 的市场份额,预计在预测期内的复合年增长率为 5.9%。不断上升的能源成本和严格的能源效率法规增加了对先进热障的需求。这些材料有助于减少热量损失和优化能源消耗,特别是在加热和冷却系统中,符合全球对永续性和具有成本效益的能源解决方案的关注。

在美国,阻隔材料市场在 2024 年占据了 82% 的区域份额。为满足具有环保意识的消费者的需求,企业越来越多地采用可生物降解、低碳足迹的材料,包括可回收多层薄膜、生物聚合物基塑胶和可堆肥包装。这一转变体现了对环境管理的承诺,并使产业能够按照永续发展目标继续成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增加建筑活动

- 不断成长的产品创新

- 产业陷阱与挑战

- 市场饱和,竞争激烈

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 年至 2035 年

- 主要趋势

- 聚合物基

- 聚偏二氯乙烯(PVDC)

- 乙烯-乙烯醇 (EVOH)

- 聚萘二甲酸乙二醇酯(PEN)

- 其他的

- 金属基

- 矿物质

- 土工合成黏土衬垫 (GCL)

- 石膏

- 其他(矿物木等)

- 其他(纤维材料类等)

第 6 章:市场估计与预测:按功能,2021 年至 2035 年

- 主要趋势

- 防潮

- 隔热

- 隔音

- 防火

- 其他(辐射屏障、密封剂等)

第 7 章:市场估计与预测:按障碍类型,2021 年至 2035 年

- 主要趋势

- 临时屏障

- 永久性屏障

第 8 章:市场估计与预测:按建筑类型,2021 年至 2035 年

- 主要趋势

- 新建筑

- 改造

第 9 章:市场估计与预测:依最终用途,2021-2035 年

- 主要趋势

- 住宅

- 商业的

- 工业和仓储

- 基础设施设施

第 10 章:市场估计与预测:按配销通路,2021-2035 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2035 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 12 章:公司简介

- 3M

- BASF

- Dow

- Geosynthetics

- Gundle/SLT Environmental

- HB Fuller

- Honeywell International

- Owosso

- Pall Corporation

- Renolit

- Saint-Gobain

- Sika

- Solvay

- TenCate Geosynthetics

- Trelleborg

The Global Barrier Material Market was valued at USD 4.1 billion in 2024 and is poised to grow at a CAGR of 5.5% between 2025 and 2034. This upward trajectory is fueled by surging demand for advanced solutions that enhance safety and security across diverse industries such as construction, automotive, pharmaceuticals, and food packaging. As these sectors prioritize protecting their products and structures from external threats, the reliance on barrier materials continues to rise.

Barrier materials, essential for preventing moisture intrusion, thermal fluctuations, and sound penetration, are critical to improving the durability and efficiency of various applications. With increasing regulatory scrutiny on sustainability, businesses are transitioning toward eco-friendly, recyclable, and high-performance materials to meet modern industry standards. Moreover, technological advancements and R&D efforts are driving innovation, offering cutting-edge solutions tailored to meet specific industry needs, ultimately expanding the market's potential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 5.5% |

By material type, the market is segmented into metal-based, mineral-based, polymer-based, and other categories. The polymer-based segment, valued at USD 1.4 billion in 2024, is expected to grow at a CAGR of 5.6% through 2035. Renowned for their superior ability to prevent water infiltration, polymer-based materials are the go-to choice for roofing, basement, and foundation systems, addressing the growing concerns about water damage. These materials have become indispensable for both new construction and renovation projects, offering reliable protection against environmental factors. Meanwhile, metal-based materials are vital in environments exposed to extreme weather conditions, such as coastal regions or industrial zones prone to high pollution, making them an essential component for structural resilience.

When categorized by function, the market includes moisture prevention, thermal insulation, soundproofing, fire protection, and other segments. Thermal insulation commanded a significant 41% market share in 2024 and is projected to grow at a 5.9% CAGR during the forecast period. Rising energy costs and stringent energy efficiency regulations have heightened the demand for advanced thermal barriers. These materials are instrumental in reducing heat loss and optimizing energy consumption, particularly in heating and cooling systems, aligning with the global focus on sustainability and cost-effective energy solutions.

In the United States, the barrier material market accounted for 82% of the regional share in 2024. This dominance is driven by robust regulatory frameworks aimed at reducing plastic waste and encouraging sustainable practices. Businesses are increasingly adopting biodegradable, low-carbon-footprint materials, including recyclable multi-layer films, biopolymer-based plastics, and compostable packaging, to cater to eco-conscious consumers. This shift reflects a commitment to environmental stewardship and positions the industry for continued growth in alignment with sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2035

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymer based

- 5.2.1 Polyvinylidene chloride (PVDC)

- 5.2.2 Ethylene vinyl alcohol (EVOH)

- 5.2.3 Polyethylene naphthalate (PEN)

- 5.3 Others

- 5.4 Metal based

- 5.5 Mineral based

- 5.5.1 Geosynthetic clay liners (GCLs)

- 5.5.2 Gypsum

- 5.6 Others (mineral wood, etc.)

- 5.7 Others (fibrous material based, etc.)

Chapter 6 Market Estimates & Forecast, By Function, 2021-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Moisture prevention

- 6.3 Thermal insulation

- 6.4 Sound proofing

- 6.5 Fire protection

- 6.6 Others (radiation barrier, sealant, etc.)

Chapter 7 Market Estimates & Forecast, By Type of Barrier, 2021-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Temporary barriers

- 7.3 Permanent barriers

Chapter 8 Market Estimates & Forecast, By Type of Construction, 2021-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 New construction

- 8.3 Retrofit

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial and warehousing

- 9.5 Infrastructure facility

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2035 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2035 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 3M

- 12.2 BASF

- 12.3 Dow

- 12.4 Geosynthetics

- 12.5 Gundle/SLT Environmental

- 12.6 H.B. Fuller

- 12.7 Honeywell International

- 12.8 Owosso

- 12.9 Pall Corporation

- 12.10 Renolit

- 12.11 Saint-Gobain

- 12.12 Sika

- 12.13 Solvay

- 12.14 TenCate Geosynthetics

- 12.15 Trelleborg