|

市场调查报告书

商品编码

1667018

纤维水泥市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fiber Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

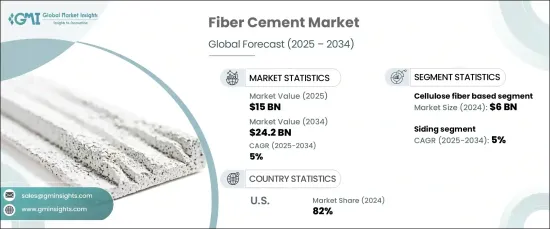

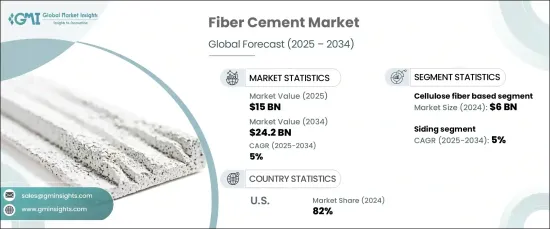

2024 年全球纤维水泥市场价值 150 亿美元,将大幅成长,预计 2025 年至 2034 年的复合年增长率为 5%。纤维水泥因其强度高、多功能性和低环境影响而闻名,已在住宅、商业和工业建筑等各个领域中广泛应用。随着消费者和建筑专业人士继续优先考虑绿色建筑实践,纤维水泥的受欢迎程度飙升。它能够将成本效益与恶劣天气条件下的卓越性能相结合,使其成为现代建筑专案的首选解决方案。除了耐用之外,纤维水泥还具有维护成本低、持久防风雨等显着优点,巩固了其作为环保意识强的建筑商的首选地位。

市场按产品类型划分,主要类别包括纤维素纤维基、合成纤维基、矿物纤维基和其他。其中,纤维素纤维基市场预计将占据领先地位,到 2024 年将产生约 60 亿美元的收入。纤维素基纤维水泥由植物纤维製成,由于其环保特性而越来越受到关注,在永续性成为建筑业首要任务的时代尤其具有吸引力。随着建筑业寻求减少碳足迹,纤维素纤维的可回收性、可生物降解性和可再生特性继续促进该领域的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 150亿美元 |

| 预测值 | 242亿美元 |

| 复合年增长率 | 5% |

在应用方面,纤维水泥用于墙板、屋顶、装饰线条、地板等。其中,壁板部分最为突出,占 2024 年总市场份额的约 40%。纤维水泥壁板以其耐用性和抗腐烂、抗白蚁和防潮性能而闻名,是需要经常维护和处理的传统木材的绝佳替代品。由于纤维水泥壁板使用寿命长、维护需求低,越来越多的建筑商和房主选择使用纤维水泥壁板,使其成为永续、耐候建筑实践的理想解决方案。

美国纤维水泥市场是最大的市场之一,到 2024 年将占高达 82% 的份额。纤维水泥由沙子、水泥和纤维素纤维等天然材料组成,被视为木材和乙烯基等含碳量高的材料的更环保的替代品。该材料的可回收性、生产过程中对环境的较小影响以及长寿命是绿色建筑日益流行的关键卖点。预计环保建筑的推动将继续推动纤维水泥的需求,确保其在未来几年持续成长和广泛应用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增加建筑活动

- 不断成长的产品创新

- 产业陷阱与挑战

- 市场饱和且竞争激烈

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 纤维素纤维基

- 合成纤维基

- 矿物纤维基

- 其他(天然纤维等)

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 壁板

- 屋顶

- 造型和装饰

- 地板

- 其他的

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- ArcelorMittal

- Boral Limited

- China National Building Material

- CSR Limited

- Etex Group

- Everest Industries Limited

- Finolex Industries

- Hume Cement

- James Hardie Industries

- Mahaphant Fibre Cement Public

- Nichiha Corporation

- Pioneer Cement Limited

- Saint-Gobain

- Siam Cement Group

- Toray Industries

The Global Fiber Cement Market, valued at USD 15 billion in 2024, is set for substantial growth with an anticipated CAGR of 5% from 2025 to 2034. This positive trajectory is being driven by the increasing demand for sustainable, durable construction materials, especially as industries shift toward eco-friendly alternatives. Fiber cement, recognized for its strength, versatility, and low environmental impact, has garnered widespread adoption across diverse sectors, including residential, commercial, and industrial construction. As consumers and construction professionals continue to prioritize green building practices, fiber cement's popularity has surged. Its ability to combine cost-effectiveness with exceptional performance in harsh weather conditions makes it a go-to solution for modern construction projects. In addition to being durable, fiber cement also offers significant advantages, such as low maintenance and long-lasting protection against the elements, solidifying its position as a prime choice for eco-conscious builders.

The market is divided by product type, with key categories including cellulose fiber-based, synthetic fiber-based, mineral fiber-based, and others. Among these, the cellulose fiber-based segment is expected to lead, generating approximately USD 6 billion in 2024. This segment is projected to grow at a CAGR of 5.2% over the forecast period, benefiting from the rising demand for renewable and biodegradable materials. Made from plant-derived fibers, cellulose-based fiber cement is gaining traction due to its eco-friendly nature, making it particularly appealing in an age when sustainability is becoming a top priority in construction. The cellulose fibers' recyclability, biodegradability, and renewable properties continue to contribute to the segment's growth as the building industry looks to reduce its carbon footprint.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15 Billion |

| Forecast Value | $24.2 Billion |

| CAGR | 5% |

When it comes to applications, fiber cement is used in siding, roofing, molding and trim, flooring, and more. Of these, the siding segment is the most prominent, accounting for approximately 40% of the total market share in 2024. With a growth rate expected to match the overall market at a CAGR of 5%, fiber cement siding is becoming the preferred option in areas prone to extreme weather conditions. Renowned for its durability and resistance to rot, termites, and moisture, fiber cement siding provides an excellent alternative to traditional wood, which requires frequent maintenance and treatment. Builders and homeowners are increasingly opting for fiber cement siding due to its long lifespan and low maintenance needs, making it an ideal solution for sustainable, weather-resistant building practices.

The U.S. market for fiber cement is one of the largest, holding an impressive 82% share in 2024. This strong market presence is attributed to the rising demand for green building materials as more projects aim for sustainability certifications. Fiber cement is seen as a more eco-friendly alternative to carbon-heavy materials like wood and vinyl, thanks to its composition of natural materials such as sand, cement, and cellulose fibers. The material's recyclability, lower environmental impact during production, and longevity are key selling points in the growing trend of green construction. The push for eco-conscious construction is expected to keep driving demand for fiber cement, ensuring its continued growth and widespread adoption in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cellulose fiber based

- 5.3 Synthetic fiber based

- 5.4 Mineral fiber based

- 5.5 Others (natural fiber based, etc.)

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Siding

- 6.3 Roofing

- 6.4 Molding & trim

- 6.5 Flooring

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ArcelorMittal

- 10.2 Boral Limited

- 10.3 China National Building Material

- 10.4 CSR Limited

- 10.5 Etex Group

- 10.6 Everest Industries Limited

- 10.7 Finolex Industries

- 10.8 Hume Cement

- 10.9 James Hardie Industries

- 10.10 Mahaphant Fibre Cement Public

- 10.11 Nichiha Corporation

- 10.12 Pioneer Cement Limited

- 10.13 Saint-Gobain

- 10.14 Siam Cement Group

- 10.15 Toray Industries