|

市场调查报告书

商品编码

1667021

酯基季铵盐市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Esterquats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

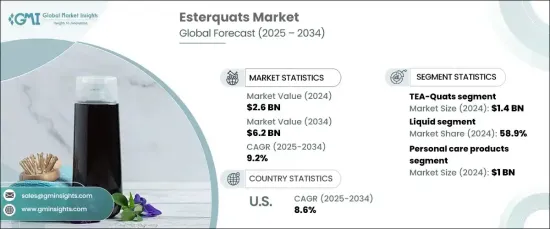

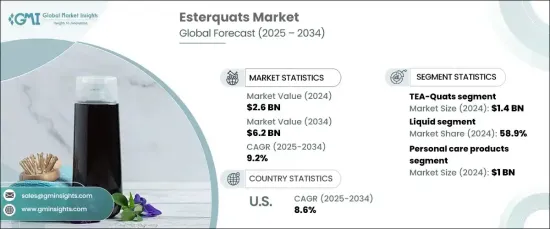

2024 年全球酯基季铵盐市场价值为 26 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.2%。消费者越来越意识到他们使用的产品对环境的影响,并推动品牌寻求符合其永续发展目标的成分。酯基季铵盐以其可生物降解性和有效性而闻名,正在成为头髮和皮肤护理产品配方的首选,因为性能和环保意识同样重要。

除了环保优势以外,酯基季铵盐还具有增强皮肤和头髮调理能力等创新特性,吸引了越来越多消费者的注意,他们越来越倾向于购买高端产品。随着对高品质个人护理的需求不断增长,酯基季铵盐已成为关键成分,製造商专注于配製具有卓越性能的产品。这在织物柔软剂和调理剂市场尤其明显,酯基季铵盐具有卓越的调理作用,并为消费者提供更有效、更持久的效果。随着消费者逐渐青睐那些将奢华与永续性结合的产品,酯基季铵盐预计将继续在个人护理和家庭护理产品的配方中发挥关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 62亿美元 |

| 复合年增长率 | 9.2% |

TEA-Quats 领域在 2024 年的价值为 14 亿美元,预计在 2025 年至 2034 年期间将实现 8.9% 的复合年增长率。这些化合物因其多功能性而闻名,使其成为寻求满足日益增长的高性能产品需求的製造商的首选成分。它们的广泛使用证明了它们的受欢迎程度和有效性,确保了它们在酯基季铵盐市场上的持续主导地位。

就产品形式而言,液体酯基季铵盐占据市场主导地位,到 2024 年将占据 58.9% 的份额。製造商更喜欢液体,因为它们可以使生产过程更加顺畅和高效,尤其是对于护髮素和织物柔软剂等消费品。液体形式还可以无缝整合到个人护理配方中,使其成为寻求快速有效使用产品的品牌和消费者的首选。

美国的酯基季铵盐市场也呈现上升趋势,2024 年价值将达到 7.571 亿美元,预估成长率为 8.6%。在美国,个人护理和家庭护理行业是酯基季铵盐需求的主要贡献者,越来越多的消费者选择符合其高性能和永续性需求的高端产品。酯基季铵盐在织物护理领域尤其受欢迎,它们是织物柔软剂配方中不可或缺的一部分,在洗衣护理市场中发挥关键作用。随着对环保和有效解决方案的需求不断增长,美国酯季铵盐市场将在整个预测期内保持强劲成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 个人护理产品需求不断增加

- 可支配所得增加

- 工业应用需求不断成长

- 产业陷阱与挑战

- 原物料价格波动

- 替代产品的可用性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 季铵盐

- 季铵盐

- 其他的

第六章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 干燥

- 液体

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 个人护理产品

- 织物护理产品

- 居家护理产品

- 工业应用

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ABITEC Corporation

- AkzoNobel

- BASF

- Clariant

- Chemelco

- Dongnam Chemical Industries

- Evonik Industries

- Hangzhou Fandachem

- Italmatch Chemicals

- Kao Corporation

- Stepan Company

- Solvay

- The Lubrizol Corporation

The Global Esterquats Market, valued at USD 2.6 billion in 2024, is expected to expand at a CAGR of 9.2% from 2025 to 2034. The surge in demand for sustainable, eco-friendly, and biodegradable ingredients is one of the primary drivers of market growth, particularly in the personal care sector. Consumers are becoming more aware of the environmental impact of the products they use, pushing brands to seek ingredients that align with their sustainability goals. Esterquats, known for their biodegradability and effectiveness, are emerging as top choices for formulations in hair and skin care products, where performance and eco-consciousness are equally important.

In addition to the eco-friendly appeal, esterquats' innovative properties, such as their ability to enhance skin and hair conditioning, have caught the attention of consumers who are increasingly gravitating toward premium products. As the demand for high-quality personal care continues to rise, esterquats are positioned as a key ingredient, with manufacturers focusing on formulating products that deliver exceptional performance. This is particularly noticeable in the fabric softener and conditioner markets, where esterquats offer superior conditioning and provide consumers with more effective, long-lasting results. As consumers shift their preferences toward products that combine luxury with sustainability, esterquats are expected to continue playing a critical role in the formulation of personal care and home care products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 billion |

| Forecast Value | $6.2 billion |

| CAGR | 9.2% |

The TEA-Quats segment, valued at USD 1.4 billion in 2024, is set to experience a steady growth rate of 8.9% CAGR between 2025 and 2034. Known for their superior conditioning abilities, TEA-Quats (triethanolamine quaternary ammonium compounds) are indispensable in many personal care applications such as fabric softeners, hair conditioners, and various skincare products. These compounds are recognized for their versatility, making them a go-to ingredient for manufacturers looking to meet the growing demand for high-performance products. Their widespread use is a testament to their popularity and effectiveness, ensuring their continued dominance in the esterquats market.

In terms of product format, liquid esterquats dominate the market, accounting for 58.9% of the share in 2024. Liquid formulations are especially favored due to their ease of use and compatibility with high-volume manufacturing processes. Manufacturers prefer liquids because they facilitate a smoother and more efficient production process, especially for consumer goods like hair conditioners and fabric softeners. The liquid form also integrates seamlessly into personal care formulations, making it the go-to choice for both brands and consumers looking for quick and effective product use.

The esterquats market in the U.S. is also on the rise, valued at USD 757.1 million in 2024, with a projected growth rate of 8.6% CAGR. In the U.S., the personal care and home care sectors are major contributors to the demand for esterquats, with consumers increasingly opting for premium products that align with their desire for high performance and sustainability. Esterquats are particularly popular in fabric care, where they are integral to the formulation of fabric softeners, playing a key role in the laundry care market. As demand for eco-friendly and effective solutions continues to grow, the U.S. esterquats market is set to maintain strong growth throughout the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for personal care products

- 3.6.1.2 Rising disposable income

- 3.6.1.3 Increasing demand in industrial applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility of raw materials

- 3.6.2.2 Availability of substitute products

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 TEA-Quats

- 5.3 MDEA-Quats

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Liquid

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Personal care products

- 7.3 Fabric care products

- 7.4 Home care products

- 7.5 Industrial applications

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABITEC Corporation

- 9.2 AkzoNobel

- 9.3 BASF

- 9.4 Clariant

- 9.5 Chemelco

- 9.6 Dongnam Chemical Industries

- 9.7 Evonik Industries

- 9.8 Hangzhou Fandachem

- 9.9 Italmatch Chemicals

- 9.10 Kao Corporation

- 9.11 Stepan Company

- 9.12 Solvay

- 9.13 The Lubrizol Corporation