|

市场调查报告书

商品编码

1667022

人工耳蜗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cochlear Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

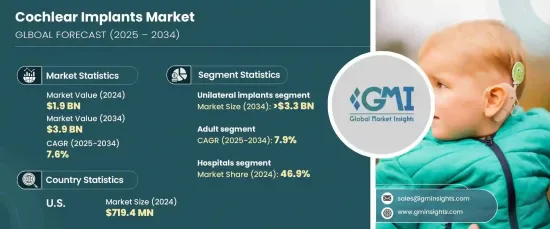

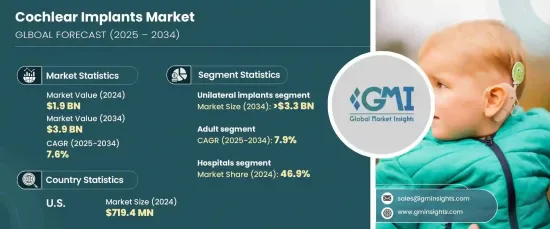

2024 年全球人工耳蜗市场价值为 19 亿美元,预计将实现显着增长,预计 2025 年至 2034 年的复合年增长率为 7.6%。人工耳蜗为患有重度至极重度听力损失的人提供了变革性的解决方案,越来越被认为是一种改变生活的干预措施。

由政府、医疗保健组织和非政府组织主导的教育活动正在极大地提高公众对人工耳蜗的益处和功能的理解。此外,各地区提供补贴和加强保险覆盖的努力使得这些设备更容易获得,从而进一步推动市场成长。无线连接和人工智慧驱动的声音处理等尖端技术的日益融合也有望增强人工耳蜗的功能,确保其持续的吸引力和采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 39亿美元 |

| 复合年增长率 | 7.6% |

市场依植入物类型细分,主要分为两类:单侧植入物和双侧植入物。预计单侧植入物将经历强劲增长,预计复合年增长率为 7.4%,到 2034 年将达到 33 亿美元。单侧植入物对于单耳听力损失的人特别有效,可以显着改善声音处理和沟通能力。单侧植入物的成本效益和目标效益使其成为市场扩张的主要驱动力。

人工耳蜗的最终用途应用包括耳鼻喉诊所、医院和门诊手术中心,其中医院占据最大的市场份额,到 2024 年将达到 46.9%。这些设施确保了精确的植入程序和有效的术后护理,有助于其在市场上占据主导地位。

美国人工耳蜗市场价值在 2024 年将达到 7.194 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 6.8%。领先的人工耳蜗製造商的存在和全面的保险覆盖进一步加强了市场的地位,使得人工耳蜗成为美国听力障碍人士越来越可行的解决方案。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 听力损失盛行率不断上升

- 技术进步

- 提高认识和早期诊断

- 政府支持及报销情况改善

- 产业陷阱与挑战

- 人工耳蜗费用高

- 缺乏有关听力损失的知识

- 成长动力

- 成长潜力分析

- 2024 年定价分析

- 报销场景

- 监管格局

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东及非洲

- 消费者路径

- 技术格局

- 政策格局

- 风险管理分析

- 研究与开发

- 营运

- 行销和销售

- 品质

- 智慧财产

- 监管

- 资讯科技

- 气候

- 金融的

- 波特的分析

- 差距分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 公司市占率分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 单侧植入

- 双侧植入

第 6 章:市场估计与预测:按病患类型,2021 - 2034 年

- 主要趋势

- 成人

- 儿科

第 7 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 耳鼻喉诊所

- 门诊手术中心

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Cochlear

- Envoy Medical

- MED-EL

- Nurotron

- Sonova

The Global Cochlear Implants Market, valued at USD 1.9 billion in 2024, is poised for remarkable growth, with projections indicating a CAGR of 7.6% from 2025 to 2034. This expansion is fueled by several factors, including the rising prevalence of hearing loss worldwide, advancements in audiology technology, and a growing focus on early diagnosis and treatment. Cochlear implants, which offer a transformative solution for individuals with severe to profound hearing loss, are becoming increasingly recognized as a life-changing intervention.

Educational campaigns led by governments, healthcare organizations, and NGOs are significantly improving public understanding of the benefits and functionality of cochlear implants. Additionally, efforts to provide subsidies and enhance insurance coverage in various regions are making these devices more accessible, further driving market growth. The increasing integration of cutting-edge technologies, such as wireless connectivity and AI-driven sound processing, is also expected to enhance the functionality of cochlear implants, ensuring their continued appeal and adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 7.6% |

The market is segmented by implant type, with two primary categories: unilateral and bilateral implants. Unilateral implants are anticipated to experience robust growth, with a projected CAGR of 7.4%, reaching USD 3.3 billion by 2034. Their affordability compared to bilateral options makes them an attractive choice for patients, particularly in regions with limited reimbursement options. Unilateral implants are particularly effective for individuals with hearing loss in one ear, offering significant improvements in sound processing and communication abilities. The cost-effectiveness and targeted benefits of unilateral implants position them as a key driver of market expansion.

End-use applications for cochlear implants include ENT clinics, hospitals, and ambulatory surgical centers, with hospitals commanding the largest share of the market at 46.9% in 2024. Hospitals are the preferred choice for cochlear implant surgeries due to their access to specialized otolaryngologists, advanced diagnostic tools, and state-of-the-art surgical equipment. These facilities ensure precise implantation procedures and effective post-operative care, contributing to their dominant role in the market.

The US cochlear implants market, valued at USD 719.4 million in 2024, is projected to grow at a CAGR of 6.8% from 2025 to 2034. Increased awareness of hearing loss, greater accessibility to audiological care, and government initiatives promoting hearing healthcare are key factors driving this growth. The presence of leading cochlear implant manufacturers and comprehensive insurance coverage further strengthen the market's position, making cochlear implants an increasingly viable solution for individuals with hearing impairments in the United States.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of hearing loss

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising awareness and early diagnosis

- 3.2.1.4 Facilitative government support and improving reimbursement scenario

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cochlear implants

- 3.2.2.2 Lack of knowledge regarding hearing loss

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.5 Reimbursement scenario

- 3.6 Regulatory landscape

- 3.7 Market size in terms of volume, 2021 - 2034 (Units)

- 3.7.1 Global

- 3.7.2 North America

- 3.7.3 Europe

- 3.7.4 Asia Pacific

- 3.7.5 Latin America

- 3.7.6 MEA

- 3.8 Consumer pathway

- 3.9 Technology landscape

- 3.10 Policy landscape

- 3.10.1 Risk management analysis

- 3.10.2 Research and development

- 3.10.3 Operations

- 3.10.4 Marketing and sales

- 3.10.5 Quality

- 3.10.6 Intellectual property rights

- 3.10.7 Regulatory

- 3.10.8 Information technology

- 3.10.9 Climate

- 3.10.10 Financial

- 3.11 Porter's analysis

- 3.12 Gap analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Unilateral implants

- 5.3 Bilateral implants

Chapter 6 Market Estimates and Forecast, By Patient Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 ENT clinics

- 7.4 Ambulatory surgical centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cochlear

- 9.2 Envoy Medical

- 9.3 MED-EL

- 9.4 Nurotron

- 9.5 Sonova