|

市场调查报告书

商品编码

1667049

库存管理软体市场机会、成长动力、产业趋势分析与预测 2025 - 2034Inventory Management Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

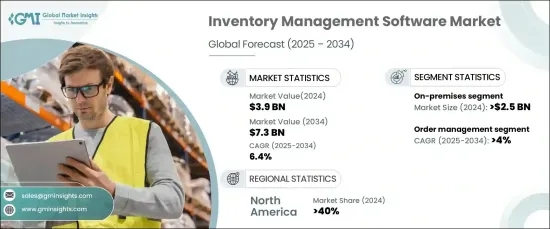

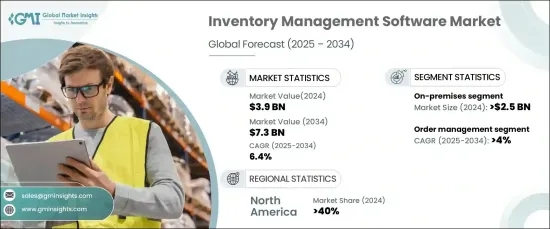

2024 年全球库存管理软体市场价值为 39 亿美元,预计将实现大幅增长,预计 2025 年至 2034 年的复合年增长率为 6.4%。各行各业的企业都在迅速采用先进的库存管理工具,以透过全面的资料洞察来简化营运、削减成本并改善决策。随着竞争加剧,企业正在利用这些技术来保持领先地位,确保能够快速适应不断变化的市场需求和客户期望。

该软体提供了许多好处,包括增强的库存追踪、无缝订单履行以及深入的分析和报告功能。透过自动化手动流程并提供可操作的见解,库存管理工具可协助企业优化库存水准、减少浪费并提高客户满意度。这些解决方案在零售、製造和物流等行业尤其重要,因为有效的库存控制对于营运成功和客户忠诚度至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 73亿美元 |

| 复合年增长率 | 6.4% |

市场按部署模式细分,主要是内部部署和基于云端的解决方案。 2024 年,内部部署部分占据了相当大的份额,价值达到 25 亿美元。企业青睐这种模式,因为它具有强大的安全性和对敏感资料的更强的控制力。对于具有严格合规标准或管理专有或关键任务资料的行业组织而言,此选项尤其具有吸引力。对于零售和製造公司来说,内部部署系统提供增强订单管理和维持平稳营运所需的精确库存控制。

库存管理软体的应用涉及多个领域,包括订单管理、资产追踪、服务管理、产品差异化和库存优化。受对高效订单处理和履行的日益重视推动,订单管理领域预计在 2025 年至 2034 年期间的复合年增长率为 4%。这些解决方案使企业能够更好地了解库存水平,从而能够做出有关补货和订单分配的明智决策。这不仅优化了营运工作流程,还提高了客户服务和满意度,使企业在当今快节奏的市场中占据竞争优势。

2024年北美领先库存管理软体市场,占全球份额的40%。该地区的主导地位源于零售业和製造业等行业对先进技术解决方案的高需求。基于云端的系统的日益普及尤其引人注目,因为这些平台提高了库存可视性,实现了数据驱动的决策,并简化了供应链管理。北美的公司越来越多地利用这些工具来实现流程自动化、减少错误并适应不断变化的市场需求,确保长期成长和获利能力。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 软体供应商

- 云端服务供应商

- 系统整合商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 库存管理软体的演变

- 库存管理与仓库管理的分析

- 衝击力

- 成长动力

- 全通路零售日益普及

- RFID 技术需求不断成长

- 智慧型手机和行动装置的普及

- 电子商务普及率飙升

- 产业陷阱与挑战

- 软体实施成本高昂

- 新软体与旧系统的集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按解决方案,2021 - 2034 年

- 主要趋势

- 手动管理库存系统

- 条码扫描系统

- 先进的射频系统

第六章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 云

第 7 章:市场估计与预测:按组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 订单管理

- 资产追踪

- 服务管理

- 产品差异化

- 库存最佳化

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 製造业

- 卫生保健

- 零售

- 汽车

- 石油和天然气

- 其他的

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Alterity

- Archon Systems

- Blue Yonder Group

- Cin7

- Clear Spider

- Fishbowl Inventory

- International Business Machines (IBM)

- Intuit

- Lightspeed Venture Partners

- Manhattan Associates

- Microsoft

- Monday.com

- NCR

- Oracle

- Revel Systems

- Sage

- SAP SE

- SkuVault (Marlin Equity Partners)

- Wasp Barcode

- Zoho

The Global Inventory Management Software Market, valued at USD 3.9 billion in 2024, is poised for significant growth, with a projected CAGR of 6.4% from 2025 to 2034. This robust expansion is fueled by the increasing need for operational efficiency, real-time visibility into inventory levels, and solutions to manage the growing complexity of modern supply chains. Businesses across industries are rapidly adopting advanced inventory management tools to streamline operations, cut costs, and improve decision-making through comprehensive data insights. As competition intensifies, organizations are leveraging these technologies to stay ahead, ensuring they can adapt quickly to fluctuating market demands and customer expectations.

This software delivers a host of benefits, including enhanced inventory tracking, seamless order fulfillment, and in-depth analytics and reporting capabilities. By automating manual processes and providing actionable insights, inventory management tools help businesses optimize stock levels, reduce waste, and improve customer satisfaction. These solutions are particularly vital in sectors such as retail, manufacturing, and logistics, where effective inventory control is critical for operational success and customer loyalty.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 6.4% |

The market is segmented by deployment models, primarily on-premises and cloud-based solutions. In 2024, the on-premises segment commanded a significant share, valued at USD 2.5 billion. Businesses favor this model for its robust security and greater control over sensitive data. This option is especially appealing to organizations in industries with stringent compliance standards or those managing proprietary or mission-critical data. For retail and manufacturing companies, on-premises systems provide the precise inventory control needed to enhance order management and maintain smooth operations.

Applications of inventory management software span several areas, including order management, asset tracking, service management, product differentiation, and inventory optimization. The order management segment is anticipated to grow at a CAGR of 4% between 2025 and 2034, driven by the increasing emphasis on efficient order processing and fulfillment. These solutions offer businesses improved visibility into inventory levels, enabling informed decisions about restocking and order allocation. This not only optimizes operational workflows but also boosts customer service and satisfaction, giving businesses a competitive edge in today's fast-paced marketplace.

North America led the inventory management software market in 2024, accounting for 40% of the global share. The region's dominance stems from a high demand for advanced technological solutions across industries like retail and manufacturing. The growing adoption of cloud-based systems is particularly notable, as these platforms enhance inventory visibility, enable data-driven decision-making, and streamline supply chain management. Companies in North America are increasingly leveraging these tools to automate processes, reduce errors, and adapt to evolving market needs, ensuring long-term growth and profitability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Software providers

- 3.2.2 Cloud service providers

- 3.2.3 System integrators

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Inventory management software evolution

- 3.8 Analysis of inventory management vs. warehouse management

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of omnichannel retailing

- 3.9.1.2 Growing demand for RFID technology

- 3.9.1.3 Proliferation of smartphones and mobile devices

- 3.9.1.4 Surge in e-commerce popularity

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs associated with software implementation

- 3.9.2.2 Integration of new software with legacy systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Manually managed inventory system

- 5.3 Barcode scanning system

- 5.4 Advanced radio frequency system

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprise

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Order management

- 8.3 Asset tracking

- 8.4 Service management

- 8.5 Product differentiation

- 8.6 Inventory optimization

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Healthcare

- 9.4 Retail

- 9.5 Automotive

- 9.6 Oil & gas

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Alterity

- 11.2 Archon Systems

- 11.3 Blue Yonder Group

- 11.4 Cin7

- 11.5 Clear Spider

- 11.6 Fishbowl Inventory

- 11.7 International Business Machines (IBM)

- 11.8 Intuit

- 11.9 Lightspeed Venture Partners

- 11.10 Manhattan Associates

- 11.11 Microsoft

- 11.12 Monday.com

- 11.13 NCR

- 11.14 Oracle

- 11.15 Revel Systems

- 11.16 Sage

- 11.17 SAP SE

- 11.18 SkuVault (Marlin Equity Partners)

- 11.19 Wasp Barcode

- 11.20 Zoho