|

市场调查报告书

商品编码

1667064

军用雷达市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Military Radar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

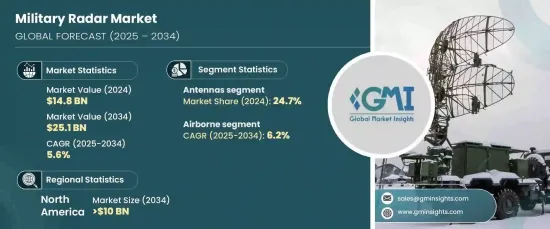

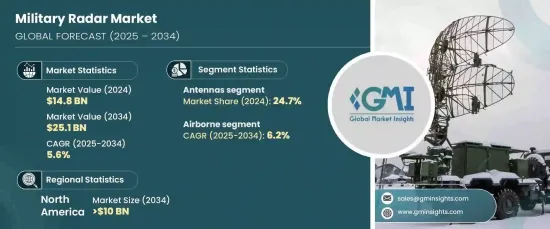

全球军用雷达市场预计将强劲成长,到 2024 年将达到 148 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.6%。 随着各国为应对日益严重的安全问题和地缘政治紧张局势,全球国防预算不断增加,推动了这一增长。各国政府优先投资先进的雷达系统,以实现国防能力的现代化、增强国家安全、应对新出现的威胁。相控阵和主动电子扫描阵列 (AESA) 系统等下一代雷达技术的日益普及,凸显了对提高侦测精度、追踪精度和态势感知能力的重视。远程探测和快速威胁识别等增强的功能使雷达技术成为现代军事战略的基石。此外,国防承包商和政府之间的合作正在激发创新,推动适应不断变化的作战和监视需求的尖端雷达系统的发展。

市场按组件细分,包括天线、发射器、接收器、功率放大器、稳定係统、双工器、数位讯号处理器、图形用户介面等。天线占据这一领域的主导地位,到 2024 年将占有 24.7% 的市场份额。该能力决定了雷达在侦测、追踪和瞄准方面的性能,使得天线对于实现卓越的范围、精度和分辨率至关重要。天线技术的创新,例如轻质材料和改进的波束成形技术,进一步提高了其效率和可靠性,巩固了其在整个雷达生态系统中的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 148亿美元 |

| 预测值 | 251亿美元 |

| 复合年增长率 | 5.6% |

依平台不同,市场还可分为陆基、海军、机载和太空系统。其中,机载部分正在成为成长最快的类别,预计预测期内的复合年增长率为 6.2%。战斗机、侦察机、无人机等装备的机载雷达对提升侦察和作战能力具有重要意义。这些系统在远程探测和追踪方面表现出色,使军队能够对抗包括隐形飞机和飞弹系统在内的先进威胁。相控阵与AESA技术的融合,具有更快的扫描速度、更宽的频率覆盖范围和更高的分辨率,进一步提升了其能力,显着提高了复杂战斗场景中的作战效率和态势感知能力。

北美将主导全球军用雷达市场,预计到 2034 年将创造 100 亿美元的市场价值。该地区优先投资用于监视、预警和作战管理的现代雷达系统。人工智慧整合等新兴技术正在增强雷达能力,使其更适应复杂的军事行动,并更有效。加拿大也发挥着至关重要的作用,透过先进的雷达开发和旨在加强国防基础设施的国际合作做出贡献,进一步推动区域市场的成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增加国防预算和现代化建设力度

- 雷达技术和能力的进步

- 对先进监控系统的需求不断增长

- 增强威胁侦测和对策需求

- 与人工智慧和自主平台的集成

- 产业陷阱与挑战

- 先进雷达系统成本高昂

- 监管和出口管制限制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 天线

- 抛物面反射天线

- 开槽波导天线

- 相控阵天线

- 多输入多输出天线

- 主动扫描阵列天线

- 被动扫描阵列天线

- 发射器

- 微波管发射机

- 固态电子发射器

- 接收器

- 类比接收器

- 数位接收器

- 功率放大器

- 行波管扩大机

- 固态功率放大器

- 砷化镓

- 氮化镓

- 碳化硅

- 固态功率放大器

- 行波管扩大机

- 双工器

- 分支型双工器

- 平衡型双工器

- 循环双工器

- 数位讯号处理器

- 稳定係统

- 图形使用者介面

- 其他的

第六章:市场估计与预测:按波形,2021-2034 年

- 主要趋势

- 调频连续波

- 多普勒

- 常规多普勒

- 脉衝多普勒

第 7 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 软体定义雷达

- 常规雷达

- 量子雷达

第 8 章:市场估计与预测:按范围,2021 年至 2034 年

- 主要趋势

- 短距离(<50 公里)

- 中(50-200 公里)

- 长途(>200 公里)

第 9 章:市场估计与预测:按平台,2021-2034 年

- 主要趋势

- 地面

- 固定雷达

- 车载雷达

- 便携式雷达

- 海军

- 舰载雷达

- 沿海雷达

- 无人水面舰艇上安装的雷达

- 空降

- 载人飞机雷达

- 无人机雷达

- 基于浮空器的雷达

- 空间

- 卫星

- 太空船

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 空域监控与交通管理

- 防空与飞弹防御

- 武器导引

- 地面监视和入侵者侦测

- 船舶交通安全与监控

- 航空测绘

- 导航

- 地雷探测与地下测绘

- 地面部队防护与反制测绘

- 天气监测

- 地面穿透

- 海上巡逻、搜救

- 边境安全

- 空间态势感知

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Aselsan AS

- BAE Systems plc

- Boeing Company

- Cobham plc

- FLIR Systems, Inc.

- General Dynamics Corporation

- Hensoldt AG

- Honeywell International

- Israel Aerospace Industries

- L3Harris Technologies, Inc.

- Leonardo SPA

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Thales Group

The Global Military Radar Market is poised for robust growth, reaching USD 14.8 billion in 2024 and projected to expand at a CAGR of 5.6% between 2025 and 2034. This surge is driven by escalating defense budgets worldwide as nations respond to mounting security concerns and geopolitical tensions. Governments are prioritizing investments in advanced radar systems to modernize their defense capabilities, enhance national security, and counter emerging threats. The growing adoption of next-generation radar technologies, including phased array and active electronically scanned array (AESA) systems, underscores the emphasis on improving detection accuracy, tracking precision, and situational awareness. Enhanced functionality, such as long-range detection and rapid threat identification, positions radar technology as a cornerstone of modern military strategies. In addition, collaborations between defense contractors and governments are spurring innovation, propelling the development of cutting-edge radar systems tailored to evolving combat and surveillance needs.

The market is segmented by components, including antennas, transmitters, receivers, power amplifiers, stabilization systems, duplexers, digital signal processors, graphical user interfaces, and others. Antennas dominate this segment, holding a 24.7% market share in 2024. Their critical role in radar functionality stems from their ability to convert electrical signals into electromagnetic waves and vice versa. This capability determines radar performance in detection, tracking, and targeting, making antennas essential for achieving superior range, accuracy, and resolution. Innovations in antenna technology, such as lightweight materials and improved beamforming techniques, are further enhancing their efficiency and reliability, cementing their importance in the overall radar ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.8 Billion |

| Forecast Value | $25.1 Billion |

| CAGR | 5.6% |

The market is also categorized by platform into ground-based, naval, airborne, and space systems. Among these, the airborne segment is emerging as the fastest-growing category, projected to grow at a CAGR of 6.2% during the forecast period. Airborne radars deployed on fighter jets, surveillance aircraft, and UAVs play a pivotal role in enhancing reconnaissance and combat capabilities. These systems excel in long-range detection and tracking, enabling militaries to counter advanced threats, including stealth aircraft and missile systems. The integration of phased array and AESA technologies further elevates their capabilities by offering faster scanning speeds, wider frequency coverage, and higher resolution, which significantly improve operational efficiency and situational awareness in complex battle scenarios.

North America is set to dominate the global military radar market, expected to generate USD 10 billion by 2034. This leadership, spearheaded by the United States, reflects substantial defense budgets and a strategic focus on technological advancements. The region prioritizes investments in modern radar systems for surveillance, early warning, and combat management. Emerging technologies like AI integration are enhancing radar capabilities, making them more adaptive and effective for sophisticated military operations. Canada also plays a vital role, contributing through advanced radar development and international collaborations aimed at fortifying defense infrastructure, further driving regional market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing defense budgets and modernization efforts

- 3.6.1.2 Advancements in radar technology and capabilities

- 3.6.1.3 Rising demand for advanced surveillance systems

- 3.6.1.4 Enhanced threat detection and countermeasure needs

- 3.6.1.5 Integration with AI and autonomous platforms

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of advanced radar systems

- 3.6.2.2 Regulatory and export control restrictions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Antennas

- 5.2.1 Parabolic reflector antennas

- 5.2.2 Slotted waveguide antennas

- 5.2.3 Phased array antennas

- 5.2.4 Multiple Input-Multiple output antennas

- 5.2.5 Active scanned array antennas

- 5.2.6 Passive scanned array antennas

- 5.3 Transmitters

- 5.3.1 Microwave Tube-Based Transmitters

- 5.3.2 Solid-State electronic transmitters

- 5.4 Receivers

- 5.4.1 Analog receivers

- 5.4.2 Digital receivers

- 5.5 Power amplifiers

- 5.5.1 Traveling wave tube amplifiers

- 5.5.1.1 Solid-State power amplifiers

- 5.5.1.1.1 Gallium arsenide

- 5.5.1.1.2 Gallium nitride

- 5.5.1.1.3 Silicon carbide

- 5.5.1.1 Solid-State power amplifiers

- 5.5.1 Traveling wave tube amplifiers

- 5.6 Duplexers

- 5.6.1 Branch-Type duplexers

- 5.6.2 Balanced-Type duplexers

- 5.6.3 Circulator duplexers

- 5.7 Digital signal processors

- 5.8 Stabilization systems

- 5.9 Graphical user interfaces

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Waveform, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Frequency-Modulated continuous wave

- 6.3 Doppler

- 6.3.1 Conventional doppler

- 6.3.2 Pulse-Doppler

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Software-Defined radars

- 7.3 Conventional radars

- 7.4 Quantum radars

Chapter 8 Market Estimates & Forecast, By Range, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Short (<50 Kms)

- 8.3 Medium (50-200 Kms)

- 8.4 Long (>200 Kms)

Chapter 9 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Ground-Based

- 9.2.1 Fixed radars

- 9.2.2 Vehicle-Based radars

- 9.2.3 Man-Portable radars

- 9.3 Naval

- 9.3.1 Vessel-Based radars

- 9.3.2 Coastal radars

- 9.3.3 USV-Mounted radars

- 9.4 Airborne

- 9.4.1 Manned aircraft radars

- 9.4.2 UAV-Mounted radars

- 9.4.3 Aerostats-Based radar

- 9.5 Space

- 9.5.1 Satellites

- 9.5.2 Spacecraft

Chapter 10 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 Airspace Monitoring & Traffic management

- 10.3 Air & Missile defense

- 10.4 Weapon guidance

- 10.5 Ground Surveillance & Intruder Detection

- 10.6 Vessel Traffic Security & Surveillance

- 10.7 Airborne mapping

- 10.8 Navigation

- 10.9 Mine Detection & Underground mapping

- 10.10 Ground Force Protection & Counter-Mapping

- 10.11 Weather monitoring

- 10.12 Ground penetration

- 10.13 Maritime Patrolling, Search, & Rescue

- 10.14 Border security

- 10.15 Space situational awareness

- 10.16 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Aselsan A.S.

- 12.2 BAE Systems plc

- 12.3 Boeing Company

- 12.4 Cobham plc

- 12.5 FLIR Systems, Inc.

- 12.6 General Dynamics Corporation

- 12.7 Hensoldt AG

- 12.8 Honeywell International

- 12.9 Israel Aerospace Industries

- 12.10 L3Harris Technologies, Inc.

- 12.11 Leonardo S.P.A.

- 12.12 Lockheed Martin Corporation

- 12.13 Northrop Grumman Corporation

- 12.14 Raytheon Technologies Corporation

- 12.15 Rheinmetall AG

- 12.16 Saab AB

- 12.17 Thales Group