|

市场调查报告书

商品编码

1667066

水性聚氨酯分散体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Waterborne Polyurethane Dispersions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

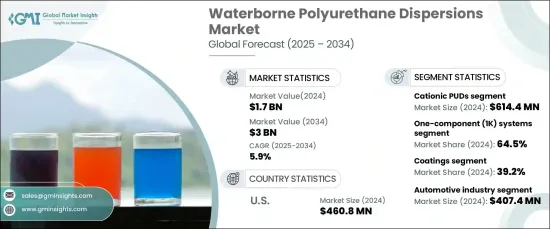

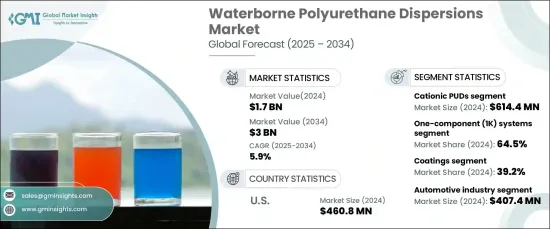

2024 年全球水性聚氨酯分散体市场价值为 17 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.9%。各行各业越来越重视永续和低VOC解决方案,以顺应全球向环境负责实践的转变。水性聚氨酯分散体具有出色的性能、多功能性和环保性,成为各行业的理想选择。此外,聚合物技术的进步和更严格的环境法规进一步推动了这些分散体的采用。人们越来越重视减少碳足迹和满足严格的永续性标准,这使得水性聚氨酯分散体成为各行业转型为绿色技术的关键解决方案。

根据类型,市场分为阴离子、阳离子、非离子、自交联和混合聚氨酯分散体。 2024 年,阳离子 PUD 占据市场主导地位,为整体收入贡献了 6.144 亿美元。阳离子聚氨酯分散体 (PUD) 以其带正电荷的结构而闻名,具有优异的附着力,这使其在纺织品和包装等需要持久可靠粘合的应用中特别有价值。它们独特的性能使其成为需要高性能黏合解决方案的领域中不可或缺的材料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 5.9% |

市场也依功能分类,分为单组分(1K)系统和双组分(2K)系统。 2024 年,单组分系统将占据 64.5% 的份额。这些预先配製的系统无需额外的固化成分,简化了应用程式并提高了效率。它们具有用户友好的特性,因此成为建筑、汽车和家具製造等精简操作至关重要的行业的首选。

受低 VOC、环保产品需求不断增长的推动,美国水性聚氨酯分散体市场在 2024 年的收入为 4.608 亿美元。汽车、纺织和建筑等关键产业在推动市场成长方面发挥了关键作用。随着监管部门对绿色化学和永续生产的日益重视,美国对水性聚氨酯分散体的采用持续上升。中国在工业创新方面的领导地位,加上聚合物技术的进步,使其成为水性聚氨酯分散体开发和应用的主要中心。汽车、包装和木材涂料等领域的需求很高,因为各行各业都优先考虑环保材料,同时不影响性能。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对高性能产品的需求不断增长

- 日益严格的环境法规和对永续产品的需求

- 产业陷阱与挑战

- 成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:按类型,2021-2034 年

- 主要趋势

- 阴离子聚氨酯分散体

- 阳离子聚氨酯分散体

- 非离子聚氨酯分散体

- 自交联聚氨酯分散体

- 混合型聚氨酯分散体

第 6 章:市场规模与预测:按功能,2021-2034 年

- 主要趋势

- 单组分(1K)体系

- 双组分(2K)体系

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 黏合剂和密封剂

- 涂料

- 合成皮革生产

- 软包装

- 其他的

第 8 章:市场规模与预测:依最终用途产业,2021-2034 年

- 主要趋势

- 汽车

- 建造

- 纺织品

- 家具

- 包装

- 其他的

第 9 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- BASF

- Cargill

- Covestro

- DIC Corporation

- Dow

- Evonik

- HMG Paints

- Huntsman

- Lanxess

- Nippon Polyurethane

- PPG Industries

- RPM International

- Toyo Kasei

- Wacker Chemie

The Global Waterborne Polyurethane Dispersions Market was valued at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2034. This robust growth is fueled by the rising demand for eco-friendly and high-performance materials in diverse applications such as coatings, adhesives, paints, and sealants. Industries increasingly prioritize sustainable and low-VOC solutions to align with global shifts toward environmentally responsible practices. Waterborne polyurethane dispersions offer an exceptional combination of performance, versatility, and eco-friendliness, making them an attractive choice across industries. Additionally, advancements in polymer technology and stricter environmental regulations are further driving the adoption of these dispersions. The growing emphasis on reducing carbon footprints and meeting stringent sustainability standards has positioned waterborne PUDs as a key solution for industries transitioning to greener technologies.

By type, the market is segmented into anionic, cationic, nonionic, self-crosslinking, and hybrid polyurethane dispersions. In 2024, cationic PUDs dominated the market, contributing USD 614.4 million to the overall revenue. Known for their positively charged structure, cationic PUDs deliver superior adhesion, making them particularly valuable in applications such as textiles and packaging, where durable and reliable bonding is critical. Their unique properties position them as an indispensable material in sectors that demand high-performance adhesion solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3 Billion |

| CAGR | 5.9% |

The market is also categorized based on functionality, dividing into one-component (1K) and two-component (2K) systems. In 2024, one-component systems captured a significant share of 64.5%. These pre-formulated systems eliminate the need for additional curing components, simplifying application processes and enhancing efficiency. Their user-friendly nature makes them a preferred choice in industries where streamlined operations are essential, including construction, automotive, and furniture manufacturing.

The U.S. waterborne polyurethane dispersions market generated USD 460.8 million in 2024, driven by the growing demand for low-VOC, eco-conscious products. Key industries, such as automotive, textiles, and construction, have played a pivotal role in boosting market growth. With increasing regulatory emphasis on green chemistry and sustainable production, the adoption of waterborne PUDs in the U.S. continues to rise. The country's leadership in industrial innovation, coupled with advancements in polymer technology, positions it as a major hub for the development and application of waterborne PUDs. High demand is evident in sectors like automotive, packaging, and wood coatings, as industries prioritize environmentally friendly materials without compromising performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for high-performance products

- 3.6.1.2 Increasing environmental regulations & demand for sustainable products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Anionic PUDs

- 5.3 Cationic PUDs

- 5.4 Nonionic PUDs

- 5.5 Self-crosslinking PUDs

- 5.6 Hybrid PUDs

Chapter 6 Market Size and Forecast, By Functionality, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 One-component (1K) systems

- 6.3 Two-component (2K) systems

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Adhesives & sealants

- 7.3 Coatings

- 7.4 Synthetic leather production

- 7.5 Flexible packaging

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Construction

- 8.4 Textile

- 8.5 Furniture

- 8.6 Packaging

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 BASF

- 10.2 Cargill

- 10.3 Covestro

- 10.4 DIC Corporation

- 10.5 Dow

- 10.6 Evonik

- 10.7 HMG Paints

- 10.8 Huntsman

- 10.9 Lanxess

- 10.10 Nippon Polyurethane

- 10.11 PPG Industries

- 10.12 RPM International

- 10.13 Toyo Kasei

- 10.14 Wacker Chemie