|

市场调查报告书

商品编码

1667072

固定式催化系统市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Stationary Catalytic Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

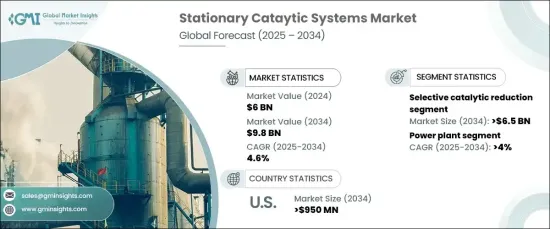

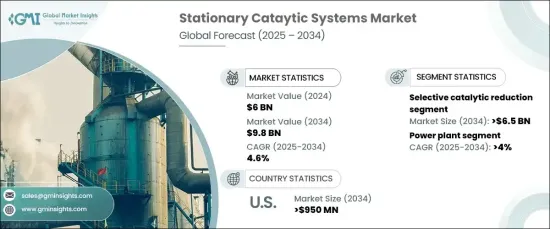

2024 年全球固定式催化系统市场价值为 60 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.6%。固定式催化系统因其能够减少氮氧化物排放并支持清洁能源目标而越来越多地应用于能源密集型产业。受政府关于减少氮氧化物和二氧化碳排放的要求的推动,水泥生产、发电厂、金属加工和製造业开始采用这些技术。

选择性催化还原 (SCR) 领域预计将大幅成长,预计到 2034 年将超过 65 亿美元。这些系统旨在满足严格的监管标准,同时将氨排放量保持在可接受的阈值内,从而增强了其市场需求。 SCR 技术的不断进步,包括适用于各种工业应用的经济高效和紧凑的设计,进一步加速了其应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 60亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 4.6% |

发电厂是固定催化系统的关键应用,预计到 2034 年该领域的复合年增长率将超过 4%。要求减少有害气体排放的监管框架加强了对该行业部署可靠排放控制技术的关注。

随着大气污染物水准的上升,水泥生产产业也增加了对排放控制系统的需求。严格的合规要求和超出排放限制的经济处罚风险增加了 SCR 和氧化催化剂等技术的重要性。随着发展中经济体基础设施不断扩大和建筑活动日益增多,预计将推动这些系统的显着成长。

受製造业活动的增加和从燃煤发电厂向燃气发电厂的转变的推动,美国固定式催化系统市场规模预计到 2034 年将超过 9.5 亿美元。针对氮氧化物和一氧化碳排放的更严格的环境法规,以及对这些污染物的环境影响的认识的提高,正在促进市场的成长。随着各行各业采用更清洁的技术以适应不断发展的环境政策,对固定催化系统的需求将大幅上升。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:依技术,2021 – 2034 年

- 选择性催化还原

- 氧化催化剂

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 发电厂

- 化工及石化

- 水泥

- 金属

- 海洋

- 製造业

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Agriemach

- Babcock & Wilcox

- CECO Environmental

- Cormetech

- DCL International

- Ducon

- Environmental Energy Services

- GE Vernova

- Hug Engineering

- Johnson Matthey

- Kwangsung

- MAN Energy Solutions

- McGill AirClean

- Mitsubishi Heavy Industries

- Thermax

- Yara International

The Global Stationary Catalytic Systems Market was valued at USD 6 billion in 2024 and is projected to expand at a CAGR of 4.6% from 2025 to 2034. This growth is driven by rising energy demands, rapid industrialization, and stricter energy efficiency regulations. Stationary catalytic systems are increasingly used in energy-intensive industries for their ability to reduce nitrogen oxide emissions and support clean energy goals. Their adoption across cement production, power plants, metal processing, and manufacturing industries is being propelled by government mandates focused on minimizing NOx and CO emissions.

The selective catalytic reduction (SCR) segment is poised for significant growth, with projections exceeding USD 6.5 billion by 2034. SCR technology is highly effective in reducing nitrogen oxides, achieving up to 95% NOx emission reduction. These systems are designed to meet stringent regulatory standards while maintaining ammonia emissions within acceptable thresholds, which enhances their market demand. Continuous advancements in SCR technology, including cost-efficient and compact designs suitable for diverse industrial applications, further accelerate adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 4.6% |

Power plants represent a key application for stationary catalytic systems, with the segment expected to grow at a CAGR of over 4% by 2034. The increasing need for effective industrial emission controls, in line with growing electricity demands, encourages power generation facilities to integrate these systems. Regulatory frameworks mandating reduced emissions of harmful gases have intensified the focus on deploying reliable emission control technologies across this sector.

The cement production sector, along with rising levels of atmospheric pollutants, is also bolstering demand for emission control systems. Strict compliance requirements and the risk of financial penalties for exceeding emission limits have amplified the importance of technologies like SCR and oxidation catalysts. Developing economies, with their expanding infrastructure and growing construction activities, are expected to drive significant growth in these systems.

The U.S. stationary catalytic systems market is projected to surpass USD 950 million by 2034, supported by increasing manufacturing activities and the shift from coal-based power plants to gas-fired facilities. Stricter environmental regulations targeting NOx and CO emissions, along with heightened awareness of the environmental impacts of these pollutants, are strengthening market growth. As industries adopt cleaner technologies to align with evolving environmental policies, the demand for stationary catalytic systems is set to rise substantially.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Selective catalytic reduction

- 5.2 Oxidation catalyst

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Power plants

- 6.3 Chemical & petrochemical

- 6.4 Cement

- 6.5 Metal

- 6.6 Marine

- 6.7 Manufacturing

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Agriemach

- 8.2 Babcock & Wilcox

- 8.3 CECO Environmental

- 8.4 Cormetech

- 8.5 DCL International

- 8.6 Ducon

- 8.7 Environmental Energy Services

- 8.8 GE Vernova

- 8.9 Hug Engineering

- 8.10 Johnson Matthey

- 8.11 Kwangsung

- 8.12 MAN Energy Solutions

- 8.13 McGill AirClean

- 8.14 Mitsubishi Heavy Industries

- 8.15 Thermax

- 8.16 Yara International