|

市场调查报告书

商品编码

1667076

瓦楞设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Corrugated Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

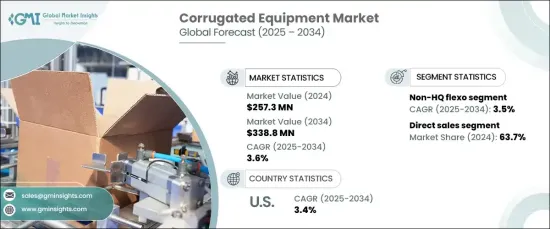

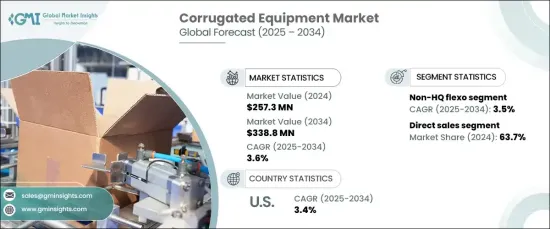

2024 年全球瓦楞设备市场规模达到 2.573 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 3.6%。电子商务的激增进一步增加了对可靠和保护性包装的需求,因为企业的目标是确保货物安全地直接送达客户。

瓦楞纸包装因其重量轻、耐用、可回收等特点而成为首选。製药、食品饮料和电子等行业透过依赖瓦楞纸解决方案来确保产品安全、品牌推广和符合永续性标准,为市场成长做出了巨大贡献。此外,自动化和数位印刷等製造技术的进步正在提高瓦楞设备的效率和质量,巩固其在包装领域的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.573亿美元 |

| 预测值 | 3.388 亿美元 |

| 复合年增长率 | 3.6% |

市场依靠两种主要分销管道蓬勃发展:直接销售和间接销售。直销占了63.7%的市场份额,即製造商直接与客户接触,提供客製化的解决方案和技术支援。对于需要与最终用户密切合作以满足特定要求的大型复杂系统来说,此管道至关重要。相比之下,间接销售利用经销商和代理商渗透更广泛的市场并利用本地化的专业知识。这种方法对于製造商缺乏直接业务的地区尤其有利,可确保更广泛地覆盖和接触不同的客户群。

市场分为非高品质柔印设备和高品质柔印设备,凸显了其多样化的应用。非 HQ 柔印设备的价值在 2024 年为 6,090 万美元,可满足基本包装应用的高速和经济高效的生产需求。该细分市场优先考虑营运效率而不是印刷质量,这使其成为专注于功能性包装的行业的理想选择。另一方面,HQ 柔印设备将于 2024 年创造 1.22 亿美元的收入,提供出色的印刷解析度和色彩准确度,满足高端包装需求。受各行各业强调美观性和品牌效应以增强客户参与度的推动,对高品质包装解决方案的需求持续上升。

2024 年美国瓦楞设备市场价值为 4,770 万美元,预测期内将以 3.4% 的复合年增长率稳定成长。工业扩张、技术进步和基础设施发展是这一成长的主要驱动力。美国製造商越来越多地采用自动化、数位化和高速生产技术来提高营运效率并降低成本。此外,食品、电子和医药等行业对客製化和保护性包装解决方案的需求日益增长,支撑了该地区对瓦楞设备的强劲需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对永续包装解决方案的需求不断增加

- 电子商务行业呈指数级增长

- 产业陷阱与挑战

- 瓦楞设备相关成本高

- 与设计和开发相关的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按设备,2021 年至 2034 年

- 主要趋势

- 非 HQ 柔版印刷

- 平板模切机

- 旋转模切机

- 折迭黏合

- 高品质柔版印刷

- 平板模切机

- 旋转模切机

- 折迭黏合

- 单张纸胶印裱贴机

- 捲筒纸对捲筒纸平版裱贴机

- 排队

- 离线

- 捲筒纸平版裱贴机

- 排队

- 离线

第 6 章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料

- 电气和电子产品

- 家庭和个人护理

- 纺织品

- 纸张和纸浆

- 药品

第 7 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接销售

- 间接销售

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

8.2.1 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Automatan

- Barry-Wehmiller

- BHS Corrugated

- Bobst Group

- Edale UK

- EMBA

- Heidelberger Druckmaschinen

- Lamina System

- Manroland

- Mark Andy

- Mitsubishi Heavy Industries Machinery Systems

- MPS Systems

- OMET

- Oppliger SRL

- Rotatek

- Simon Corrugated Machinery

- Star Flex International

- Sun Automation

- Walco

- Wolverine Flexographic

The Global Corrugated Equipment Market reached USD 257.3 million in 2024 and is projected to grow at a CAGR of 3.6% between 2025 and 2034. This market expansion is fueled by the increasing adoption of sustainable packaging solutions, driven by heightened environmental awareness and regulatory support for eco-friendly practices. The surge in e-commerce further amplifies the demand for reliable and protective packaging, as businesses aim to ensure the safe delivery of goods directly to customers.

Corrugated packaging stands out as a preferred choice due to its lightweight, durability, and recyclability. Industries such as pharmaceuticals, food and beverages, and electronics are significantly contributing to market growth by relying on corrugated solutions for product safety, branding, and compliance with sustainability standards. Furthermore, advancements in manufacturing technologies, including automation and digital printing, are enhancing the efficiency and quality of corrugated equipment, solidifying its position in the packaging sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $257.3 Million |

| Forecast Value | $338.8 Million |

| CAGR | 3.6% |

The market thrives on two primary distribution channels: direct sales and indirect sales. Direct sales, accounting for 63.7% of the market, involve manufacturers directly engaging with customers to provide tailored solutions and technical support. This channel is essential for large and complex systems that demand close collaboration with end-users to meet specific requirements. In contrast, indirect sales leverage distributors and agents to penetrate wider markets and utilize localized expertise. This approach is particularly advantageous in regions where manufacturers lack a direct presence, ensuring broader reach and accessibility to diverse customer bases.

The segmentation of the market into Non-HQ flexo and HQ flexo equipment highlights its diverse applications. Non-HQ flexo equipment, valued at USD 60.9 million in 2024, addresses the need for high-speed and cost-effective production for basic packaging applications. This segment prioritizes operational efficiency over print quality, making it ideal for industries focused on functional packaging. On the other hand, HQ flexo equipment, generating USD 122.0 million in 2024, offers exceptional print resolution and color accuracy, catering to premium packaging needs. The demand for high-quality packaging solutions continues to rise, driven by industries emphasizing aesthetics and branding to enhance customer engagement.

The U.S. corrugated equipment market, valued at USD 47.7 million in 2024, is poised for steady growth at a CAGR of 3.4% over the forecast period. Industrial expansion, technological advancements, and infrastructure development are key drivers of this growth. U.S. manufacturers are increasingly adopting automation, digitalization, and high-speed production technologies to boost operational efficiency and minimize costs. Additionally, the growing need for customized and protective packaging solutions across sectors such as food, electronics, and pharmaceuticals underpins the strong demand for corrugated equipment in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for sustainable packaging solutions

- 3.6.1.2 Exponential growth of e-commerce industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost associated with the corrugated equipment

- 3.6.2.2 Complexities associated with the design and development

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Non-HQ Flexo

- 5.2.1 Flatbed die cutter

- 5.2.2 Rotary die cutter

- 5.2.3 Folding gluing

- 5.3 HQ Flexo

- 5.3.1 Flatbed die cutter

- 5.3.2 Rotary die cutter

- 5.3.3 Folding gluing

- 5.4 Sheet-to-sheet litho-laminators

- 5.5 Web-to-web litho-laminators

- 5.5.1 Inline

- 5.5.2 Offline

- 5.6 Web-to- sheet litho-laminators

- 5.6.1 Inline

- 5.6.2 Offline

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Electrical & electronics

- 6.4 Home & personal care

- 6.5 Textile

- 6.6 Paper & pulp

- 6.7 Pharmaceuticals

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (XXX Units)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Indirect sales

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 United Kingdom

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Automatan

- 9.2 Barry-Wehmiller

- 9.3 BHS Corrugated

- 9.4 Bobst Group

- 9.5 Edale UK

- 9.6 EMBA

- 9.7 Heidelberger Druckmaschinen

- 9.8 Lamina System

- 9.9 Manroland

- 9.10 Mark Andy

- 9.11 Mitsubishi Heavy Industries Machinery Systems

- 9.12 MPS Systems

- 9.13 OMET

- 9.14 Oppliger SRL

- 9.15 Rotatek

- 9.16 Simon Corrugated Machinery

- 9.17 Star Flex International

- 9.18 Sun Automation

- 9.19 Walco

- 9.20 Wolverine Flexographic