|

市场调查报告书

商品编码

1667084

益智补充剂市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Nootropic Supplement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

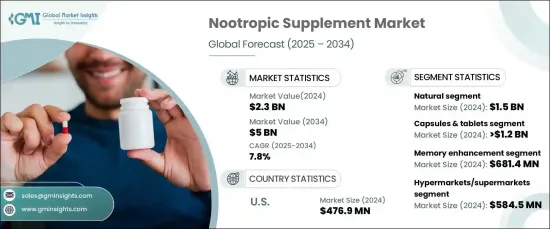

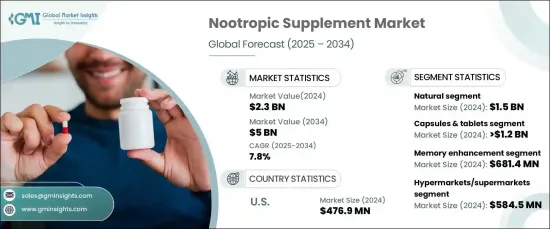

全球益智补充剂市场预计将大幅成长,2024 年估值为 23 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.8%。人们越来越关注保持大脑健康,这推动了需求,特别是随着全球老化人口的增加。世界卫生组织强调了人口结构的重大变化,2015 年至 2050 年间 60 岁以上人口的比例几乎翻了一番。

胶囊和药片占据市场主导地位,2024 年估值超过 12 亿美元,预计到 2032 年復合年增长率将超过 7.6%。随着缓释配方和多种成分组合的创新,这些产品仍然具有很大的吸引力。与粉末和液体等替代品相比,它们的较长的保质期进一步提高了它们的价值。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 50亿美元 |

| 复合年增长率 | 7.8% |

2024 年,天然益智补充剂的市场估值达到 15 亿美元,预计到 2034 年的复合年增长率为 7.6%。此类别的产品专门针对注重健康的人士,他们寻求安全、有机的方法来支持头脑清晰和记忆力。在健康趋势强烈影响购买决策的地区,这一领域的成长尤为强劲。

益智药领域中的记忆增强市场预计到 2034 年将以 7.4% 的复合年增长率增长,2024 年的估值将达到 6.814 亿美元。具有公认益处的天然成分因其有助于记忆力保持和整体大脑功能而受到广泛追捧。

大卖场和超市等零售通路日益重要,提供各式各样的益智产品。预计到 2034 年,这些网点的复合年增长率将达到 7.7%,它们将利用其广泛的网路来确保轻鬆存取。他们展示各种品牌的能力鼓励消费者探索和购买,从而加强他们在市场上的地位。

美国继续引领全球市场,2024 年估值为 4.769 亿美元,预计到 2034 年复合年增长率为 7.9%。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 提高对认知健康的认识

- 人们对心理健康和绩效优化的认识不断提高

- 将益智成分融入运动营养与性能产品中

- 产业陷阱与挑战

- 对安全性和副作用的担忧。

- 缺乏严格、大规模的临床试验

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 胶囊和药片

- 粉末

- 液体

第 6 章:市场估计与预测:依成分类型,2021-2034 年

- 主要趋势

- 自然的

- 合成的

第 7 章:市场估计与预测:按功能,2021 年至 2034 年

- 主要趋势

- 增强记忆

- 情绪和压力管理

- 注意力和专注力

- 改善睡眠

- 抗衰老

- 其他的

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 大卖场/超市

- 专卖店

- 药局

- 其他的

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Double Wood Supplements

- Gaia Herbs

- HVMN

- Kimera Koffee

- Life Extension

- Mental Mojo

- Mind Lab Pro

- Onnit Labs

- Solaray

- Thorne Research

- TruBrain

- Zhou Nutrition

The Global Nootropic Supplement Market is poised for substantial growth, with its valuation of USD 2.3 billion in 2024 expected to expand at a CAGR of 7.8% from 2025 to 2034. These supplements, formulated to boost cognitive performance, have gained traction due to rising consumer awareness of mental wellness and productivity. A growing focus on maintaining brain health is fueling demand, particularly as the aging population increases worldwide. The World Health Organization highlights a significant demographic shift, with the percentage of people over 60 nearly doubling between 2015 and 2050. In the US, this trend is underscored by projections from the Centers for Disease Control and Prevention, which indicate a surge in the older population by 2040, creating a robust market for cognitive-enhancing products.

Capsules and tablets dominate the market, reaching a valuation of over USD 1.2 billion in 2024, and are projected to grow at a CAGR exceeding 7.6% through 2032. These formats are highly favored for their convenience, precise dosing, and portability, making them an ideal choice for busy professionals and health-conscious individuals. With innovations in slow-release formulations and multi-ingredient combinations, these products remain highly appealing. Their long shelf life further enhances their value compared to alternatives like powders and liquids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5 Billion |

| CAGR | 7.8% |

The natural segment of nootropic supplements achieved a market valuation of USD 1.5 billion in 2024, with a projected CAGR of 7.6% through 2034. Consumers increasingly prefer plant-based and sustainable solutions which offer cognitive benefits without adverse effects. Products in this category are tailored to health-focused individuals seeking safe, organic methods to support mental clarity and memory. This segment's growth is particularly robust in regions where wellness trends strongly influence purchasing decisions.

The memory enhancement market within the nootropic segment is expected to grow at a 7.4% CAGR up to 2034, supported by a valuation of USD 681.4 million in 2024. The demand for memory-improving supplements is driven by consumers' need for cognitive support, particularly among older adults and students. Natural ingredients with proven benefits are widely sought after for their ability to aid memory retention and overall brain function.

Retail channels such as hypermarkets and supermarkets are gaining prominence, offering a broad selection of nootropic products. With an anticipated CAGR of 7.7% through 2034, these outlets leverage their extensive networks to ensure easy accessibility. Their ability to showcase a variety of brands encourages consumer exploration and purchasing, strengthening their role in the market.

The United States continues to lead the global market, with a valuation of USD 476.9 million in 2024 and a forecasted CAGR of 7.9% through 2034. Rising interest in brain health among diverse demographics has positioned the region as a dominant player in the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of cognitive health

- 3.6.1.2 Growing awareness about mental well-being and performance optimization

- 3.6.1.3 Integration of nootropic ingredients into sports nutrition and performance products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Concerns about safety and side effects.

- 3.6.2.2 Lack of rigorous, large-scale clinical trials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Capsules & tablets

- 5.3 Powder

- 5.4 Liquid

Chapter 6 Market Estimates & Forecast, By Ingredient Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

Chapter 7 Market Estimates & Forecast, By Function, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Memory enhancement

- 7.3 Mood and stress management

- 7.4 Attention and focus

- 7.5 Sleep enhancement

- 7.6 Anti-Aging

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Hypermarkets/supermarkets

- 8.3 Specialty Stores

- 8.4 Pharmacies

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Double Wood Supplements

- 10.2 Gaia Herbs

- 10.3 HVMN

- 10.4 Kimera Koffee

- 10.5 Life Extension

- 10.6 Mental Mojo

- 10.7 Mind Lab Pro

- 10.8 Onnit Labs

- 10.9 Solaray

- 10.10 Thorne Research

- 10.11 TruBrain

- 10.12 Zhou Nutrition