|

市场调查报告书

商品编码

1667085

基于接触器的转换开关市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Contactor Based Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

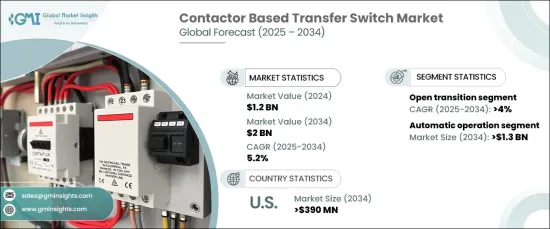

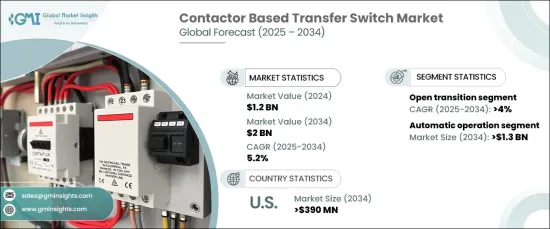

2024 年全球基于接触器的转换开关市场价值为 12 亿美元,预计 2025 年至 2034 年期间将实现 5.2% 的稳定复合年增长率。随着工业和住宅领域都认识到需要高效的电力传输系统来确保营运的连续性,市场正在不断发展。随着对能源弹性的需求迅速增长,特别是在关键设施中,基于接触器的转换开关市场已成为在各种应用中提供不间断电力供应的关键参与者。

市场分为几种类型,例如自动操作和基于开放式转换接触器的转换开关。预计到 2034 年,自动操作部门将产生 13 亿美元的收入。自动转换开关 (ATS) 在医疗中心、资料中心和製造工厂等设施中变得越来越不可或缺。它们能够检测电源中断并切换到备用电源而无需人工干预,这使得它们在这些高优先级领域至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 20亿美元 |

| 复合年增长率 | 5.2% |

开放式转换开关领域预计也将经历强劲成长,到 2034 年预计复合年增长率为 4%。开放式转换开关通常用于较不重要的应用,例如商业建筑和轻工业设施,这些场合可以接受瞬时电源中断。随着越来越多的地区面临电网不稳定和频繁停电的情况,对包括开放式转换开关在内的备用电源系统的需求正在增加。

在美国,基于接触器的转换开关市场预计到 2034 年将产生 3.9 亿美元的产值。电网老化以及电力中断情况的增多,加速了这些领域采用转换开关。再生能源的整合和分散式能源资源的兴起进一步推动了市场需求,因为这些技术需要先进、高效的电力传输解决方案。随着电源备用电源成为现代化基础设施的重要组成部分,对转换开关的需求将随着能源格局的变化而不断增长。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:依营运方式,2021 – 2034 年

- 主要趋势

- 手动的

- 非自动

- 自动的

- 旁路隔离

第六章:市场规模与预测:依转型,2021 – 2034 年

- 主要趋势

- 关闭

- 打开

第 7 章:市场规模及预测:依安装量,2021 – 2034 年

- 主要趋势

- 紧急系统

- 法律要求的製度

- 关键操作电力系统

- 可选备用系统

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 亚太地区

- 日本

- 韩国

- 印度

- 澳洲

- 中东和非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- AEG Power Solutions

- Blue Square Group

- Briggs & Stratton

- Caterpillar

- Cummins

- Eaton

- Generac Power Systems

- General Electric

- Kohler

- Midwest Electric Products

- One Two Three Electric

- Peterson

- Schneider Electric

- Siemens

- Taylor Power Systems

- Vertiv Group

The Global Contactor Based Transfer Switch Market was valued at USD 1.2 billion in 2024 and is projected to experience a steady growth rate of 5.2% CAGR from 2025 to 2034. This growth is largely driven by an increasing demand for reliable power backup solutions, with power outages becoming more frequent and unpredictable due to aging infrastructure and environmental factors. The market is evolving as both industries and residential sectors recognize the need for efficient power transfer systems that ensure continuity in operations. With a rapidly expanding need for energy resilience, particularly in critical facilities, the contactor-based transfer switch market has emerged as a key player in providing uninterrupted electricity supply across various applications.

The market is segmented into several types, such as automatic operation and open transition contactor-based transfer switches. The automatic operation segment is expected to generate USD 1.3 billion by 2034. This significant growth is attributed to the rising need for seamless and uninterrupted power transfer in industries where reliability is paramount. Automatic transfer switches (ATS) are becoming indispensable in facilities like healthcare centers, data centers, and manufacturing plants. Their ability to detect power interruptions and switch to backup sources without requiring manual intervention has made them crucial in these high-priority sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2 Billion |

| CAGR | 5.2% |

The open transition transfer switches segment is also expected to experience robust growth, with a forecasted CAGR of 4% through 2034. These switches are popular for their cost-effectiveness, ease of operation, and dependability. Open transition switches are typically used in less critical applications, such as commercial buildings and light industrial setups, where a momentary power interruption is acceptable. As more regions face grid instability and frequent power outages, the demand for backup power systems, including open transition transfer switches, is on the rise.

In the U.S., the contactor-based transfer switch market is anticipated to generate USD 390 million by 2034. This surge is driven by the growing need for reliable power systems in residential, commercial, and industrial sectors. The aging power grid, along with increasing instances of power interruptions, is accelerating the adoption of transfer switches in these sectors. The integration of renewable energy sources and the rise of distributed energy resources are further boosting market demand, as these technologies require advanced and efficient solutions for power transfer. As power backup becomes an essential part of modern infrastructure, the demand for transfer switches will continue to grow in response to these shifting energy landscapes.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Operations, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Non-automatic

- 5.4 Automatic

- 5.5 By-pass isolation

Chapter 6 Market Size and Forecast, By Transition, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Closed

- 6.3 Open

Chapter 7 Market Size and Forecast, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 Emergency systems

- 7.3 Legally required systems

- 7.4 Critical operations power systems

- 7.5 Optional standby systems

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 India

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 South Africa

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 AEG Power Solutions

- 9.3 Blue Square Group

- 9.4 Briggs & Stratton

- 9.5 Caterpillar

- 9.6 Cummins

- 9.7 Eaton

- 9.8 Generac Power Systems

- 9.9 General Electric

- 9.10 Kohler

- 9.11 Midwest Electric Products

- 9.12 One Two Three Electric

- 9.13 Peterson

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Taylor Power Systems

- 9.17 Vertiv Group