|

市场调查报告书

商品编码

1667110

零排放飞机市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Zero Emission Aircraft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

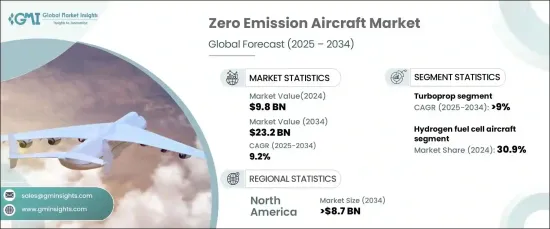

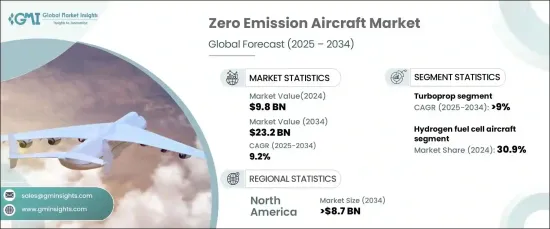

2024 年全球零排放飞机市场规模将达到 98 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 9.2%。随着人们环境问题日益严重以及消费者对可持续出行选择的需求激增,对环保航空解决方案的需求比以往任何时候都高。随着旅客越来越多地寻求更环保的替代品,航空公司优先考虑零排放飞机以符合永续发展目标。企业也正在采用这些环保解决方案来实现其社会责任目标,而投资者也在推动遵守环境、社会和治理 (ESG) 标准,加速采用更清洁的技术。

市场按飞机类型细分为电池电动飞机、氢燃料电池飞机、混合电动飞机和太阳能电动飞机。 2024年,氢燃料电池领域将以30.9%的市占率领先市场。氢动力飞机利用燃料电池发电,为传统喷射燃料提供可持续的替代品。此技术特别适用于短程至中程航班,运行过程中实现零排放。燃料电池系统的持续创新正在提高其效率,使氢气成为大幅减少航空碳足迹的关键解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 98亿美元 |

| 预测值 | 232亿美元 |

| 复合年增长率 | 9.2% |

根据飞机类型,市场还分为涡轮螺旋桨飞机、涡轮风扇飞机、翼身融合飞机(BWB)和全电动概念飞机。其中,涡轮螺旋桨飞机市场成长最快,2025-2034年期间的复合年增长率为9%。涡轮螺旋桨飞机以其燃油效率和与较短跑道的兼容性而闻名,它透过结合电力推进和永续燃料正在发生革命性的变化。这些技术进步使涡轮螺旋桨飞机成为区域和短途航线的理想选择。混合电动和电池技术的整合进一步减少了排放,同时确保飞机保持这些应用所需的性能。

在大量投资和政府旨在减少航空相关碳排放的措施的推动下,北美零排放飞机市场预计到 2034 年将创收 87 亿美元。该地区在电动和氢动力飞机的发展方面处于领先地位,并得到了老牌製造商和创新新创企业的大力贡献。这些进步不仅支持了区域航空旅行的可持续性,也促进了整个行业更广泛地采用更清洁的技术。北美在这一领域的领导地位对于制定全球航空标准和实现全球减排目标至关重要。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 政府加强对清洁航空技术的支持

- 对永续和环保航空解决方案的需求不断增长

- 电池和燃料电池系统的技术进步

- 航空公司减少碳排放的压力越来越大

- 扩大绿色航空基础设施和充电网络

- 产业陷阱与挑战

- 零排放飞机的开发和生产成本高

- 目前电池技术的续航里程和能量密度有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依飞机类型,2021-2034 年

- 主要趋势

- 电池电电动飞机

- 氢燃料电池飞机

- 油电混合飞机

- 太阳能电动飞机

第 6 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 涡轮螺旋桨

- 涡轮风扇系统

- 翼身融合(BWB)

- 全电动概念

第 7 章:市场估计与预测:按产能,2021-2034 年

- 主要趋势

- 9 至 30

- 31 至 60

- 61 至 100

- 101 至 150

- 超过 150

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 商业的

- 军队

- 一般的

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Ampaire Inc.

- Aurora Flight Sciences (The Boeing Company)

- BETA Technologies, Inc.

- Bye Aerospace

- Equator Aircraft AS

- Evektor, spol. s ro

- Eviation

- Heart Aerospace

- Joby Aero, Inc.

- Lilium GmbH

- PIPISTREL doo

- Rolls-Royce plc

- Wright Electric

- ZeroAvia, Inc.

The Global Zero Emission Aircraft Market reached USD 9.8 billion in 2024 and is projected to grow at a robust CAGR of 9.2% from 2025 to 2034. With rising environmental concerns and a surge in consumer demand for sustainable travel options, the need for eco-friendly aviation solutions is higher than ever. As travelers increasingly seek greener alternatives, airlines prioritize zero-emission aircraft to align with sustainability goals. Corporations are also embracing these eco-conscious solutions to meet their social responsibility targets, while investors are pushing for adherence to environmental, social, and governance (ESG) standards, accelerating the adoption of cleaner technologies.

The market is segmented by aircraft type into battery electric, hydrogen fuel cell, hybrid electric, and solar electric aircraft. In 2024, the hydrogen fuel cell segment leads the market with a 30.9% share. Hydrogen-powered aircraft utilize fuel cells to generate electricity, providing a sustainable alternative to traditional jet fuels. This technology is especially suitable for short- to medium-haul flights, producing zero emissions during operation. Ongoing innovations in fuel cell systems are improving their efficiency, establishing hydrogen as a key solution to drastically reduce carbon footprints in aviation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 billion |

| Forecast Value | $23.2 billion |

| CAGR | 9.2% |

By aircraft type, the market is also divided into turboprop, turbofan, blended-wing body (BWB), and fully electric concepts. Among these, the turboprop segment is the fastest-growing, with a CAGR of 9% during 2025-2034. Known for its fuel efficiency and compatibility with shorter runways, the turboprop aircraft is being revolutionized through the incorporation of electric propulsion and sustainable fuels. These technological advancements are making turboprops ideal for regional and short-haul routes. The integration of hybrid-electric and battery technologies further reduces emissions while ensuring the aircraft maintains the performance required for these applications.

North America zero emission aircraft market is expected to generate USD 8.7 billion by 2034, fueled by significant investments and government initiatives aimed at reducing aviation-related carbon emissions. The region is leading the way in the development of electric and hydrogen-powered aircraft, with strong contributions from both established manufacturers and innovative startups. These advancements are not only supporting regional air travel sustainability but also contributing to the wider adoption of cleaner technologies across the industry. North America's leadership in this space is instrumental in shaping global aviation standards and achieving global emission reduction goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing government support for clean aviation technologies

- 3.6.1.2 Rising demand for sustainable and eco-friendly aviation solutions

- 3.6.1.3 Technological advancements in battery and fuel cell systems

- 3.6.1.4 Growing pressure for airlines to reduce carbon emissions

- 3.6.1.5 Expansion of green aviation infrastructure and charging networks

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and production costs of zero-emission aircraft

- 3.6.2.2 Limited range and energy density of current battery technology

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Battery electric aircraft

- 5.3 Hydrogen fuel cell aircraft

- 5.4 Hybrid electric aircraft

- 5.5 Solar electric aircraft

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Turboprop

- 6.3 Turbofan system

- 6.4 Blended-Wing Body (BWB)

- 6.5 Fully electrical concept

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 9 to 30

- 7.3 31 to 60

- 7.4 61 to 100

- 7.5 101 to 150

- 7.6 More than 150

Chapter 8 Market Estimates & Forecast, By End-use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Military

- 8.4 General

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ampaire Inc.

- 10.2 Aurora Flight Sciences (The Boeing Company)

- 10.3 BETA Technologies, Inc.

- 10.4 Bye Aerospace

- 10.5 Equator Aircraft AS

- 10.6 Evektor, spol. s r. o.

- 10.7 Eviation

- 10.8 Heart Aerospace

- 10.9 Joby Aero, Inc.

- 10.10 Lilium GmbH

- 10.11 PIPISTREL d.o.o.

- 10.12 Rolls-Royce plc

- 10.13 Wright Electric

- 10.14 ZeroAvia, Inc.