|

市场调查报告书

商品编码

1667112

电动潜水帮浦市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Electric Submersible Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

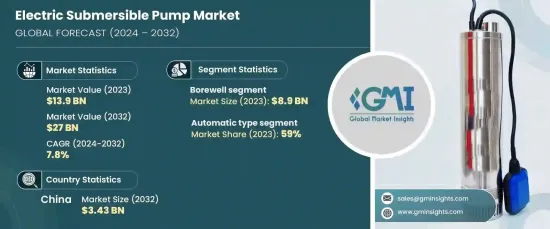

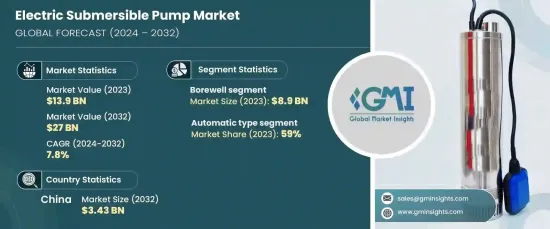

2023 年全球电动潜水帮浦市场价值为 139 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 7.8%。

全球能源消耗的增加正推动对石油和天然气勘探的大量投资。这一趋势在海上和深水项目中尤其明显,在这些项目中,ESP对于高效开采至关重要。这些帮浦经过精心设计,可以在极端深度和压力等严苛条件下处理大容量作业。它们的可靠性和性能使得它们对于满足偏远和难以到达地区的能源需求至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 139亿美元 |

| 预测值 | 270亿美元 |

| 复合年增长率 | 7.8% |

水资源短缺问题的日益严峻和对废水管理的日益关注也推动了 ESP 的采用。都市化和人口成长加剧了对永续供水系统的需求,特别是在缺水地区。 ESP 在市政、农业和工业用途的地下水提取和输水方面发挥着至关重要的作用,为有效解决全球水资源短缺问题提供了支持。

就产品类型而言,市场分为井泵和裸井泵。 2023 年,井内 ESP 的收入约为 89 亿美元,预计到 2032 年将以 7.9% 的复合年增长率增长。节能马达和耐用材料等技术的进步进一步提高了它们在农村和城市应用的可靠性和吸引力。

根据操作类型,市场还可分为自动 ESP 和半自动 ESP。自动 ESP 在 2023 年占据 59% 的主导市场份额,预计在预测期内以 8% 的复合年增长率成长。这些泵因其易于使用、控制系统先进以及透过即时调整优化能耗的能力而受到青睐。它们的远端监控功能和低维护特性使其成为需要连续、高效运作的行业的理想选择。

在亚太地区,中国占据市场主导地位,2023 年创造了 16.9 亿美元的收入,预计到 2032 年将达到 34.3 亿美元。其对创新和效率的重视进一步巩固了其在区域市场的领导地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 石油和天然气勘探增加

- 都市化和基础设施成长

- 关注再生和替代能源

- 水资源短缺和废水管理需求日益增加

- 产业陷阱与挑战

- 安装和维护成本高

- 油价波动

- 成长动力

- 技术概览

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2032 年

- 主要趋势

- 钻孔

- 开好

第六章:市场估计与预测:依阶段,2021-2032

- 主要趋势

- 单级

- 多级

第 7 章:市场估计与预测:按类型,2021 年至 2032 年

- 主要趋势

- 自动的

- 半自动

第 8 章:市场估计与预测:按安装量,2021 年至 2032 年

- 主要趋势

- 立式泵浦

- 水平泵浦

第 9 章:市场估计与预测:按最终用途,2021-2032 年

- 主要趋势

- 住宅

- 商业的

- 工业的

- 石油和天然气

- 水和废水

- 农业和灌溉

- 建造

- 矿业

- 其他的

第 10 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 直接销售

- 间接销售

第 11 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Aqua Group

- Atlas Copco

- Baker Hughes

- Dab Pumps

- EBARA

- Flexachem

- Pedrollo

- Pleuger

- Proril Pumps

- SLB

- SPP Pumps

- Sumak Pump

- Weir Group

- Whisper Pumps

- Xylem

The Global Electric Submersible Pump Market, valued at USD 13.9 billion in 2023, is projected to expand at a CAGR of 7.8% from 2024 to 2032. The growing demand for energy and the need for advanced water management solutions are key factors driving this growth.

Increasing energy consumption worldwide is encouraging significant investments in oil and gas exploration. This trend is especially pronounced in offshore and deepwater projects, where ESPs are essential for efficient extraction. These pumps are engineered to handle high-volume operations under challenging conditions, such as extreme depths and pressures. Their reliability and performance make them indispensable in meeting the energy demands of remote and difficult-to-access locations.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $13.9 Billion |

| Forecast Value | $27 Billion |

| CAGR | 7.8% |

The escalating challenge of water scarcity and the rising focus on wastewater management are also boosting the adoption of ESPs. Urbanization and population growth are intensifying the demand for sustainable water supply systems, particularly in regions experiencing water stress. ESPs play a vital role in groundwater extraction and water transportation for municipal, agricultural, and industrial purposes, supporting efforts to address global water scarcity effectively.

In terms of product type, the market is segmented into borewell and open-well pumps. Borewell ESPs accounted for approximately USD 8.9 billion in revenue in 2023 and are expected to grow at a CAGR of 7.9% through 2032. Their versatility, cost-effectiveness, and efficiency make them highly popular for extracting groundwater across various sectors. Advancements in technology, such as energy-efficient motors and durable materials, further enhance their reliability and appeal for both rural and urban applications.

The market is also categorized by operation type into automatic and semi-automatic ESPs. Automatic ESPs held a dominant market share of 59% in 2023 and are forecast to grow at a CAGR of 8% over the forecast period. These pumps are favored for their ease of use, advanced control systems, and ability to optimize energy consumption through real-time adjustments. Their remote monitoring capabilities and low-maintenance features make them ideal for industries requiring continuous, efficient operations.

In the Asia-Pacific region, China dominates the market, generating USD 1.69 billion in revenue in 2023, with expectations to reach USD 3.43 billion by 2032. The country's focus on large-scale infrastructure development, including water management and energy projects, is driving demand for ESPs. Its emphasis on innovation and efficiency further solidifies its leadership in the regional market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increase in oil & gas exploration

- 3.6.1.2 Urbanization and infrastructure growth

- 3.6.1.3 Focus on renewable and alternative energy

- 3.6.1.4 Rising water scarcity and wastewater management needs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High installation and maintenance costs

- 3.6.2.2 Fluctuating oil prices

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Borewell

- 5.3 Open well

Chapter 6 Market Estimates & Forecast, By Stage, 2021-2032 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single stage

- 6.3 Multistage

Chapter 7 Market Estimates & Forecast, By Type, 2021-2032 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

Chapter 8 Market Estimates & Forecast, By Installation, 2021-2032 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Vertical pump

- 8.3 Horizontal pump

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2032 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

- 9.4.1 Oil & Gas

- 9.4.2 Water & wastewater

- 9.4.3 Agricultural & irrigation

- 9.4.4 Construction

- 9.4.5 Mining

- 9.4.6 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Aqua Group

- 12.2 Atlas Copco

- 12.3 Baker Hughes

- 12.4 Dab Pumps

- 12.5 EBARA

- 12.6 Flexachem

- 12.7 Pedrollo

- 12.8 Pleuger

- 12.9 Proril Pumps

- 12.10 SLB

- 12.11 SPP Pumps

- 12.12 Sumak Pump

- 12.13 Weir Group

- 12.14 Whisper Pumps

- 12.15 Xylem