|

市场调查报告书

商品编码

1667119

异麦芽低聚醣市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Isomalto-oligosaccharide Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

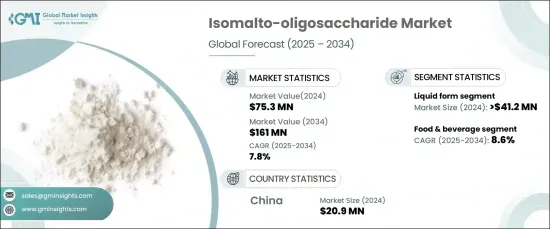

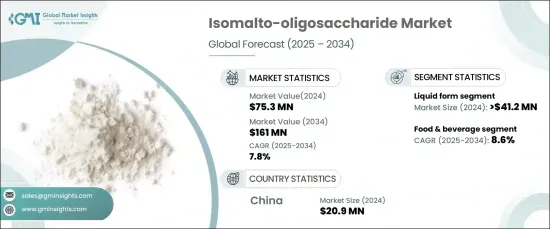

2024 年全球异麦芽寡糖市场价值为 7,530 万美元,预计 2025 年至 2034 年的复合年增长率为 7.8%。 IMO 以低热量甜味剂和益生元纤维而闻名,在这种背景下越来越受欢迎。与生活方式相关的健康问题(包括消化问题和肥胖症)日益普遍,推动了对 IMO 等功能性成分的需求。此外,烘焙食品、乳製品和膳食补充剂等类别向更健康、功能性的食品转变正在加速市场成长。然而,製造商必须满足复杂的监管要求,包括不同地区不同的标准。遵守这些规定至关重要,特别是在产品标籤和健康声明方面。不符合这些规定可能会阻碍IMO在食品业的广泛使用,并减缓市场采用。

从形式来看,IMO 市场的液体部分在 2024 年的收入超过 4,120 万美元,预计复合年增长率为 8.6%。异麦芽寡糖的液态形式具有多功能性和便利性,使其成为食品和饮料製造商的首选。液态 IMO 可以轻鬆加入糖浆、饮料和液体营养补充品等各种产品中,因此广受欢迎。此外,液态 IMO 可以使产品配方更加一致,对成分剂量的控制也更加精确,这对于保持最终产品的风味和质地至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7,530 万美元 |

| 预测值 | 1.61亿美元 |

| 复合年增长率 | 7.8% |

食品和饮料行业是异麦芽低聚醣的最大应用领域,2024 年该领域的收入将超过 4560 万美元。 IMO 还具有益生元功效,有助于肠道健康,因此成为注重健康的消费者的热门选择。由于其用途广泛,因此可以用于各种食品,包括糖果、乳製品、烘焙食品以及饮料。

由于玉米的广泛供应和加工基础设施的完善,预计预测期内玉米基异麦芽寡糖将显着增长。玉米衍生的 IMO 为製造商提供了一种经济可行的选择,并且由于其中性的味道而受到青睐,这使得它们可以轻鬆地融入各种食品和饮料应用中。

以中国和日本等国为首的亚太地区是IMO市场的主要地区,无论从生产量或消费量来看。由于对清洁标籤产品和保健品的需求不断增长,北美和欧洲也经历了强劲增长。特别是亚太地区长期以来在食品中使用天然成分的传统,这项传统在IMO被从传统糖果到现代饮料等各种食品应用广泛接受的过程中发挥了关键作用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增强健康意识

- 不断扩大的功能性食品市场

- 食品配方创新

- 产业陷阱与挑战

- 监管挑战和标籤问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:依形式,2021-2034 年

- 主要趋势

- 液体

- 粉末

- 其他的

第 6 章:市场规模与预测:按来源,2021-2034 年

- 主要趋势

- 玉米

- 小麦

- 马铃薯

- 木薯

- 其他的

第 7 章:市场规模与预测:依技术,2021-2034 年

- 主要趋势

- 食品和饮料

- 功能性食品

- 乳製品

- 婴儿配方奶粉

- 其他的

- 膳食补充剂

- 体重减轻

- 运动营养

- 整体幸福感

- 其他的

- 动物饲料添加剂

- 家禽

- 猪

- 牛

- 水产养殖

- 宠物食品

- 马

- 其他的

- 其他的

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Nikon Shikuhin KaKo Co., Ltd.

- BioNeutra North America

- Baolingbao Biology Co., Ltd.

- Luzhou Bio-chem Technology Co., Ltd.

- Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

- Shandong Tianmei Bio-Tech Co., Ltd.

- Shandong Tianjiao Bio-engineering Co., Ltd.

The Global Isomalto-Oligosaccharide Market, valued at USD 75.3 million in 2024, is anticipated to expand at a CAGR of 7.8% from 2025 to 2034. As consumers grow more health-conscious, they increasingly seek products that offer nutritional benefits. IMOs, known for being low-calorie sweeteners and prebiotic fibers, have gained popularity in this context. The rising prevalence of lifestyle-related health issues, including digestive problems and obesity, has fueled the demand for functional ingredients such as IMO. In addition, the shift towards healthier, functional foods in categories such as bakery, dairy, and dietary supplements is accelerating market growth. However, manufacturers must navigate complex regulatory requirements, including varying standards across different regions. Compliance with these regulations is essential, particularly when it comes to product labeling and health claims. Failure to meet these regulations could hinder the widespread use of IMO in the food industry and slow down market adoption.

In terms of form, the liquid segment of the IMO market accounted for over USD 41.2 million in revenue in 2024 and is projected to grow at a CAGR of 8.6%. The liquid form of isomalto-oligosaccharides offers versatility and convenience, which makes it a preferred choice for food and beverage manufacturers. The ease with which liquid IMOs can be incorporated into a range of products, such as syrups, beverages, and liquid nutritional supplements, drives its popularity. Additionally, liquid IMOs allow for better consistency in product formulations and more precise control over ingredient dosages, which is crucial for maintaining flavor and texture in end products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $75.3 Million |

| Forecast Value | $161 Million |

| CAGR | 7.8% |

The food and beverage sector is the largest application for isomalto-oligosaccharides, generating over USD 45.6 million in revenue in 2024. This segment is expected to grow at a CAGR of 8.6% by 2034. As consumers demand healthier options, food manufacturers are increasingly turning to IMO as a low-calorie sweetener that can reduce sugar content without sacrificing taste. IMOs also offer prebiotic benefits, which contribute to gut health, making them a popular choice for health-conscious consumers. Their versatility allows them to be used in a wide variety of food products, including confectionery, dairy, and bakery items, as well as beverages.

Corn-based isomalto-oligosaccharides are expected to experience significant growth during the forecast period due to the widespread availability of corn and the established infrastructure for processing it. Corn-derived IMOs provide an economically viable option for manufacturers and are preferred for their neutral taste, which allows them to be easily integrated into various food and beverage applications.

Asia-Pacific, led by countries such as China and Japan, is the dominant region in the IMO market, both in terms of production and consumption. North America and Europe are also witnessing strong growth, driven by an increasing demand for clean-label products and health supplements. In particular, the Asia-Pacific region's long-standing tradition of using natural ingredients in food has played a key role in the widespread acceptance of IMOs across various food applications, from traditional sweets to modern beverages.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing Health Consciousness

- 3.6.1.2 Expanding Functional Food Market

- 3.6.1.3 Innovation in Food Formulations

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Regulatory Challenges and Labeling Issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Liquid

- 5.3 Powder

- 5.4 Others

Chapter 6 Market Size and Forecast, By Source, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Corn

- 6.3 Wheat

- 6.4 Potato

- 6.5 Tapioca

- 6.6 Others

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Functional food

- 7.2.2 Dairy products

- 7.2.3 Infant formula

- 7.2.4 Others

- 7.3 Dietary supplements

- 7.3.1 Weight loss

- 7.3.2 Sports nutrition

- 7.3.3 General Well-Being

- 7.3.4 Others

- 7.4 Animal feed additives

- 7.4.1 Poultry

- 7.4.2 Swine

- 7.4.3 Cattle

- 7.4.4 Aquaculture

- 7.4.5 Pet Food

- 7.4.6 Equine

- 7.4.7 Others

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Nikon Shikuhin KaKo Co., Ltd.

- 9.2 BioNeutra North America

- 9.3 Baolingbao Biology Co., Ltd.

- 9.4 Luzhou Bio-chem Technology Co., Ltd.

- 9.5 Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

- 9.6 Shandong Tianmei Bio-Tech Co., Ltd.

- 9.7 Shandong Tianjiao Bio-engineering Co., Ltd.