|

市场调查报告书

商品编码

1667123

基于断路器的转换开关市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Circuit Breaker Based Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

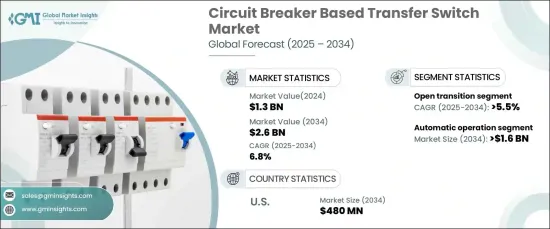

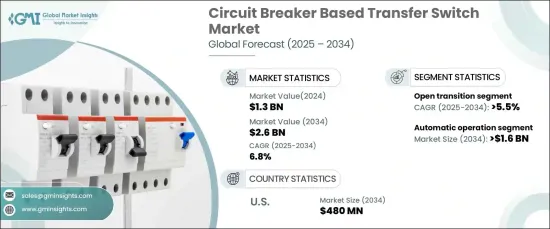

2024资料全球基于断路器的转换开关市场规模达到 13 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.8%。这些产业严重依赖不间断电源,基于断路器的转换开关可确保在停电或故障时实现平稳、高效的电源转换。

对持续高品质电力的日益依赖进一步推动了这些设备的采用。它们能够防止电力中断、处理故障并在恶劣条件下提供无缝性能,这使得它们成为现代电力基础设施中不可或缺的一部分。随着企业和组织继续优先考虑营运连续性,对先进电力传输解决方案的需求正在飙升。这种成长尤其受到再生能源和混合动力系统日益融合的影响,这两者都需要复杂的电源管理解决方案才能有效运作。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 6.8% |

自动化和备用电源系统的激增是推动市场扩张的另一个关键因素。自动转换开关 (ATS) 可在停电期间提供自动、无缝的电力传输,并且正在迅速获得关注,特别是在无法中断电力的环境中。凭藉远端监控、智慧控制和先进自动化等附加优势,ATS 已成为高可靠性要求产业的关键解决方案。

这些系统在停电期间提高营运效率方面发挥着不可或缺的作用,使其在医院、资料中心和工业营运等关键应用中发挥着不可估量的作用。新兴经济体的基础设施发展进一步推动了对这些解决方案日益增长的需求,这些经济体正致力于升级能源基础设施以满足日益增长的持续、稳定电力传输的需求。

预计到 2034 年,自动操作市场的规模将达到 16 亿美元。这些系统在停电期间提供自动备用电源,让企业安心,并降低停机风险。另一方面,基于开放式过渡断路器的转换开关市场因其经济性和可靠性而广受欢迎,预计复合年增长率为 5.5%。这些开关通常用于不太重要的应用场合,这些场合可以接受短暂的电源中断,这使其成为经常遭遇电源中断的商业和工业领域的首选。

在美国,基于断路器的转换开关市场规模预计到 2034 年将达到 4.8 亿美元。美国特别容易受到电力中断的影响,进一步凸显了可靠电力管理系统的必要性。此外,旨在提高能源效率的持续监管努力和自动化技术的进步预计将推动这些基本电力解决方案的持续采用。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:依营运方式,2021 – 2034 年

- 主要趋势

- 手动的

- 非自动

- 自动的

- 旁路隔离

第六章:市场规模与预测:依转型,2021 – 2034 年

- 主要趋势

- 关闭

- 打开

第 7 章:市场规模及预测:依安装量,2021 – 2034 年

- 主要趋势

- 紧急系统

- 法律要求的製度

- 关键操作电力系统

- 可选备用系统

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 中东和非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- AEG Power Solutions

- Briggs & Stratton

- Caterpillar

- Cummins

- DAIER

- Eaton

- Generac Power Systems

- General Electric

- Kohler

- Midwest Electric Products

- One Two Three Electric

- Peterson

- Schneider Electric

- Siemens

- Taylor Power Systems

- Vertiv Group

The Global Circuit Breaker Based Transfer Switch Market reached USD 1.3 billion in 2024 and is expected to exhibit a CAGR of 6.8% from 2025 to 2034. This growth is primarily driven by the increasing demand for reliable power transfer solutions across critical industries such as healthcare, data centers, and industrial facilities. These sectors depend heavily on uninterrupted power supply, and circuit breaker-based transfer switches ensure smooth and efficient power transitions in the event of outages or failures.

The rising reliance on continuous, high-quality power is further boosting the adoption of these devices. Their ability to prevent power disruptions, handle faults, and provide seamless performance under harsh conditions makes them essential in modern power infrastructure. As businesses and organizations continue to prioritize operational continuity, the demand for advanced power transfer solutions is soaring. This growth is particularly influenced by the increasing integration of renewable energy sources and hybrid power systems, both of which require sophisticated power management solutions to operate efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 6.8% |

The surge in automation and backup power systems is another critical factor fueling the market's expansion. Automated transfer switches (ATS), which provide automatic, seamless power transfers during outages, are rapidly gaining traction, especially in environments where power disruptions are not an option. With the added benefits of remote monitoring, smart controls, and advanced automation, ATS has become a key solution for sectors demanding high reliability.

These systems play an integral role in enhancing operational efficiency during power outages, making them invaluable in critical applications like hospitals, data centers, and industrial operations. The growing demand for these solutions is further bolstered by infrastructure developments in emerging economies, which are focusing on upgrading energy infrastructure to meet the increasing need for continuous, stable power delivery.

The automatic operation segment of the market is expected to reach USD 1.6 billion by 2034. The widespread adoption of ATS is a major driver of this growth, particularly in industries with stringent power reliability needs. These systems provide automatic backup power during outages, offering businesses peace of mind and reducing the risk of downtime. On the other hand, the open transition circuit breaker-based transfer switch market, which is popular for its affordability and dependability, is expected to grow at a CAGR of 5.5%. These switches are commonly used in less-critical applications where brief power interruptions are acceptable, making them a go-to option for commercial and industrial sectors that frequently experience power disruptions.

In the U.S., the circuit breaker-based transfer switch market is poised to reach USD 480 million by 2034. This growth is primarily attributed to the nation's increasing focus on modernizing its energy infrastructure and the rising demand for backup power solutions across various sectors. The U.S. is particularly vulnerable to power disruptions, which further underscores the need for reliable power management systems. Additionally, ongoing regulatory efforts aimed at improving energy efficiency and advancements in automation technologies are expected to drive the continued adoption of these essential power solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Operations, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Non-automatic

- 5.4 Automatic

- 5.5 By-pass isolation

Chapter 6 Market Size and Forecast, By Transition, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Closed

- 6.3 Open

Chapter 7 Market Size and Forecast, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 Emergency systems

- 7.3 Legally required systems

- 7.4 Critical operations power systems

- 7.5 Optional standby systems

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 South Africa

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 AEG Power Solutions

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 DAIER

- 9.7 Eaton

- 9.8 Generac Power Systems

- 9.9 General Electric

- 9.10 Kohler

- 9.11 Midwest Electric Products

- 9.12 One Two Three Electric

- 9.13 Peterson

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Taylor Power Systems

- 9.17 Vertiv Group