|

市场调查报告书

商品编码

1667130

CY 控制电缆市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测CY Control Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

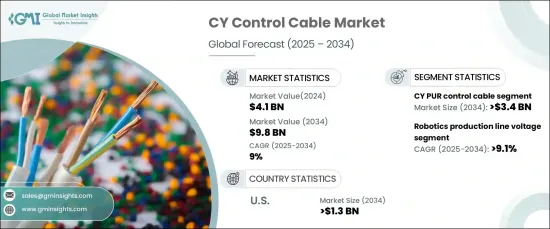

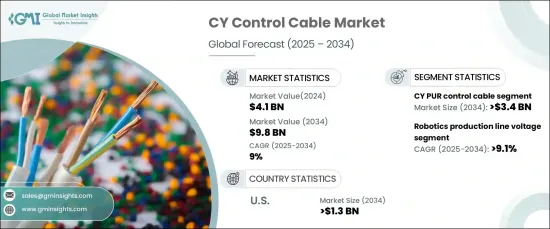

2024 年全球 CY 控制电缆市场价值为 41 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9%。 CY 控制电缆以其灵活性、卓越的屏蔽能力和可靠的讯号传输而闻名,对于精确操作和减少电磁干扰 (EMI) 至关重要。

人们对自动化和技术进步(包括智慧製造和工业 4.0)的日益关注正在推动其应用。这些电缆对于实现机器之间的无缝通讯和确保复杂系统的效率至关重要。此外,正在进行的基础设施建设(特别是在新兴地区)正在加速 CY 电缆在 HVAC 系统、电梯和楼宇管理解决方案中的安装。强调安全性和可靠讯号传输的监管框架进一步刺激了市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 9% |

预计到 2034 年,CY PUR 控制电缆领域将创造超过 34 亿美元的收入,这得益于其在智慧工厂和自动化流程中的关键作用。这些电缆具有防止 EMI 的屏蔽性能,因此在自动化机械和机器人系统中可提供稳定的性能。它们在维持设备间不间断通讯方面的精确性和效率使得它们在註重高性能和运作可靠性的工业环境中成为不可或缺的一部分。

在应用方面,预计到 2034 年,机器人生产线电压部分的复合年增长率将超过 9.1%。这些电缆有助于将控制讯号传输到各种自动化系统,确保现代生产线的效率。这种不断增长的需求得益于自动化技术的进步,因此需要耐用、高效能的布线解决方案。

到 2034 年,美国 CY 控制电缆市场规模将超过 13 亿美元。由于自动化是提高生产力的基石,这些电缆对于确保自动化机械和机器人的有效通讯和电力传输至关重要。这一趋势反映出各工业部门越来越依赖自动化系统来简化操作并提高精度。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:按类型,2021 – 2034 年

- 主要趋势

- CY PVC控制电缆

- CY PUR 控制电缆

- CY PE控制电缆

- CY LSZH 控制电缆

- 其他的

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 输送系统

- 组装连结

- 机器人生产线

- 空调系统

- 机器

- 工具製造

- 配电

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Belden

- Brugg Cables

- Eland Cables

- Furukawa Electric

- KEC International

- KEI Industries

- Klaus Faber

- LS Cable & System

- Nexans

- NKT

- Prysmian Group

- RR Kabel

- Southwire Company

- Sumitomo Electric Industries

- Universal Cables

The Global CY Control Cable Market was valued at USD 4.1 billion in 2024 and is expected to grow at a CAGR of 9% between 2025 and 2034. The growth is attributed to the rising demand for these cables across industrial automation, manufacturing, and infrastructure sectors. Known for their flexibility, superior shielding capabilities, and reliable signal transmission, CY control cables have become essential for precise operations and reducing electromagnetic interference (EMI).

The increasing focus on automation and technological advancements, including smart manufacturing and Industry 4.0, is driving adoption. These cables are critical for enabling seamless communication between machines and ensuring efficiency in complex systems. Additionally, ongoing infrastructure development, particularly in emerging regions, is accelerating the installation of CY cables in HVAC systems, elevators, and building management solutions. Regulatory frameworks emphasizing safety and reliable signal transmission further boost market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 9% |

The CY PUR control cable segment is predicted to generate revenues exceeding USD 3.4 billion by 2034, driven by its critical role in smart factories and automation processes. These cables deliver consistent performance in automated machinery and robotic systems thanks to their shielding properties that prevent EMI. Their precision and efficiency in maintaining uninterrupted communication between equipment have made them indispensable in industrial settings focused on high performance and operational reliability.

In terms of application, the robotics production line voltage segment is forecasted to grow at a CAGR of over 9.1% through 2034. The increasing integration of automation across industries has amplified the need for reliable control cables that support high voltages while minimizing EMI. These cables facilitate control signal transmission to various automated systems, ensuring efficiency in modern production lines. This rising demand is supported by advancements in automation, which necessitate durable and high-performance cabling solutions.

The United States CY control cable market is poised to surpass USD 1.3 billion by 2034. The rapid adoption of automation technologies and Industry 4.0 principles in the country is fueling the demand for advanced control cables. With automation being a cornerstone of productivity enhancement, these cables are becoming essential for ensuring efficient communication and power transmission in automated machinery and robotics. This trend reflects the growing reliance on automated systems to streamline operations and improve precision across industrial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 CY PVC control cable

- 5.3 CY PUR control cable

- 5.4 CY PE control cable

- 5.5 CY LSZH control cable

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Conveyor systems

- 6.3 Assembly links

- 6.4 Robotics production lines

- 6.5 Air conditioning systems

- 6.6 Machine

- 6.7 Tool manufacturing

- 6.8 Power distribution

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Belden

- 8.2 Brugg Cables

- 8.3 Eland Cables

- 8.4 Furukawa Electric

- 8.5 KEC International

- 8.6 KEI Industries

- 8.7 Klaus Faber

- 8.8 LS Cable & System

- 8.9 Nexans

- 8.10 NKT

- 8.11 Prysmian Group

- 8.12 RR Kabel

- 8.13 Southwire Company

- 8.14 Sumitomo Electric Industries

- 8.15 Universal Cables