|

市场调查报告书

商品编码

1667139

飞机健康监测系统市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Aircraft Health Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

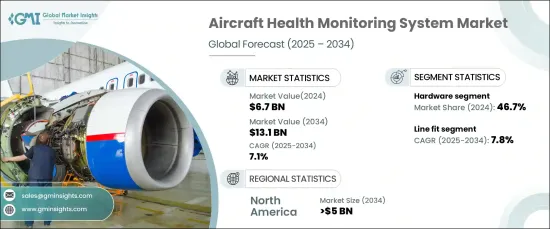

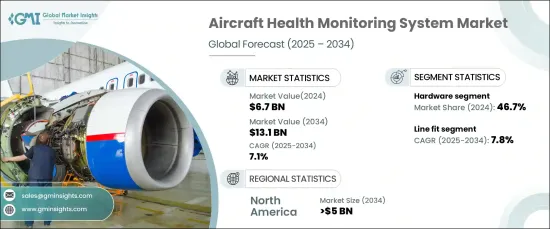

2024 年全球飞机健康监测系统市场价值为 67 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.1%。先进的技术可以实现即时资料收集和分析,使操作员能够识别潜在故障并采取预防措施。这一演变是由物联网 (IoT) 设备和巨量资料分析的整合所推动的,它们提供了全面的监控和预测见解。航空公司和机队营运商越来越多地采用这些系统来确保安全、优化维护计划并降低成本。

安装在飞机上的物联网感测器可以捕获关键运行资料,例如引擎性能、温度、振动和燃油效率。这些资讯透过基于云端的分析平台进行处理,以识别异常、预测维护需求并提高整体系统可靠性。飞机系统和地面操作之间的无缝通讯促进了综合航空网路的发展,改善了决策过程和营运效率。随着这些技术变得越来越先进,其在商业、私人和军用航空领域的应用预计将大幅成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 67亿美元 |

| 预测值 | 131亿美元 |

| 复合年增长率 | 7.1% |

市场按解决方案细分为硬体、软体和服务,其中硬体部分占据最大份额,到 2024 年将达到 46.7%。这些设备可以精确测量温度、压力和振动等参数,可提前发现潜在问题。硬体技术的进步使得组件变得更小、更轻、更耐用,从而提高了效率和安装的简易性。与物联网系统的整合可实现无缝资料共享和基于云端的分析,进一步提高功能。营运商优先考虑可靠、经济高效且易于维护的硬体解决方案。

根据适配情况,市场分为线路适配和改造适配,其中线路适配部分预计在预测期内以 7.8% 的复合年增长率增长。线路适配涉及在飞机製造过程中安装健康监测系统,确保与特定型号的兼容性,并增强系统整合。这种方法降低了实施成本并简化了维护,使其成为营运商和製造商的首选。随着对新飞机的需求不断增长,线装部分将经历显着的成长。

在美国航太业蓬勃发展的推动下,北美市场规模预计到 2034 年将超过 50 亿美元。该地区受益于主要航空公司、原始设备製造商的存在以及机器学习和物联网技术的进步,从而促进了飞机健康监测系统的采用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 航空业对预测性维护的需求不断增加

- 物联网与巨量资料分析整合的进步

- 飞机机队规模不断扩大,营运效率需求不断提高

- 严格的安全法规推动健康监测的采用

- 诊断即时资料分析日益受到关注

- 产业陷阱与挑战

- 高昂的实施成本限制了小型航空公司的采用

- 资料安全问题影响系统可靠性和信任

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按解决方案,2021 年至 2034 年

- 主要趋势

- 硬体

- 感应器

- 发动机和辅助动力装置

- 飞机结构

- 辅助系统

- 航空电子设备

- 飞行资料管理系统

- 互联飞机解决方案

- 地面伺服器

- 感应器

- 软体

- 板载软体

- 诊断飞行资料分析

- 预测飞行资料分析软体

- 服务

第 6 章:市场估计与预测:按系统,2021 年至 2034 年

- 主要趋势

- 引擎健康监测

- 结构健康监测

- 组件健康监测

第 7 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 诊断

- 预测

- 自适应控制

- 规定性

第 8 章:市场估计与预测:按营运模式,2021 年至 2034 年

- 主要趋势

- 即时的

- 非即时

第 9 章:市场估计与预测:按适合度,2021 年至 2034 年

- 主要趋势

- 线拟合

- 復古版型

第 10 章:市场估计与预测:按安装量,2021 年至 2034 年

- 主要趋势

- 在船上

- 地面

第 11 章:市场估计与预测:按平台,2021-2034 年

- 主要趋势

- 民事

- 军队

- 先进的空中机动性

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 13 章:公司简介

- Air France KLM

- Airbus SE

- Boeing

- Curtiss-Wright Corporation

- Embraer

- FLYHT Aerospace Solutions Ltd.

- General Electric

- Honeywell International Inc

- Lufthansa

- Meggitt PLC

- Rolls-Royce PLC

- Safran Group

- Teledyne Controls LLC

The Global Aircraft Health Monitoring System Market was valued at USD 6.7 billion in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2034. Increasing emphasis on predictive maintenance within the aviation sector is revolutionizing operational efficiency while minimizing unplanned downtime. Advanced technologies are enabling real-time data collection and analysis, allowing operators to identify potential failures and take preventive actions. This evolution is being driven by the integration of Internet of Things (IoT) devices and big data analytics, which provide comprehensive monitoring and predictive insights. Airlines and fleet operators are increasingly adopting these systems to ensure safety, optimize maintenance schedules, and reduce costs.

IoT sensors installed on aircraft capture critical operational data, such as engine performance, temperature, vibration, and fuel efficiency. This information is processed through cloud-based analytics platforms to identify anomalies, forecast maintenance needs, and enhance overall system reliability. The seamless communication between aircraft systems and ground operations fosters an integrated aviation network, improving decision-making processes and operational efficiency. As these technologies become more advanced, their adoption across commercial, private, and military aviation is expected to grow significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $13.1 Billion |

| CAGR | 7.1% |

The market is segmented by solution into hardware, software, and services, with the hardware segment holding the largest share at 46.7% in 2024. Hardware components, including sensors and data acquisition devices, play a critical role in monitoring engine performance. These devices provide precise measurements of parameters such as temperature, pressure, and vibration, enabling early detection of potential issues. Advancements in hardware technology have resulted in smaller, lighter, and more durable components, enhancing efficiency and ease of installation. Integration with IoT systems further improves functionality by enabling seamless data sharing and cloud-based analysis. Operators prioritize hardware solutions that are reliable, cost-effective, and simple to maintain.

By fit, the market is divided into line fit and retrofit, with the line fit segment expected to grow at a CAGR of 7.8% during the forecast period. Line fit involves installing health monitoring systems during the aircraft manufacturing process, ensuring compatibility with specific models, and enhancing system integration. This approach reduces implementation costs and simplifies maintenance, making it a preferred choice for operators and manufacturers alike. As the demand for new aircraft rises, the line fit segment is set to experience significant growth.

The North American market is projected to exceed USD 5 billion by 2034, driven by a robust aerospace sector in the United States. The region benefits from the presence of major airlines, original equipment manufacturers, and advancements in machine learning and IoT technologies, bolstering the adoption of aircraft health monitoring systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for predictive maintenance in aviation sector

- 3.6.1.2 Advancements in IoT and big data analytics integration

- 3.6.1.3 Rising aircraft fleet size and operational efficiency needs

- 3.6.1.4 Stringent safety regulations driving health monitoring adoption

- 3.6.1.5 Growing focus on real-time data analysis for diagnostics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High implementation costs limiting adoption in smaller airlines

- 3.6.2.2 Data security concerns impacting system reliability and trust

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.1.1 Engines and auxiliary power units

- 5.2.1.2 Aerostructures

- 5.2.1.3 Ancillary systems

- 5.2.2 Avionics

- 5.2.3 Flight data management systems

- 5.2.4 Connected aircraft solutions

- 5.2.5 Ground servers

- 5.2.1 Sensors

- 5.3 Software

- 5.3.1 Onboard software

- 5.3.2 Diagnostic flight data analysis

- 5.3.3 Prognostic flight data analysis software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By System, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Engine health monitoring

- 6.3 Structural health monitoring

- 6.4 Component health monitoring

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Diagnostic

- 7.3 Prognostic

- 7.4 Adaptive control

- 7.5 Prescriptive

Chapter 8 Market Estimates & Forecast, By Operation Mode, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Real time

- 8.3 Non-Real time

Chapter 9 Market Estimates & Forecast, By Fit, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Line fit

- 9.3 Retro fit

Chapter 10 Market Estimates & Forecast, By Installation, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 On board

- 10.3 On ground

Chapter 11 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 11.1 Key trends

- 11.2 Civil

- 11.3 Military

- 11.4 Advanced air mobility

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Air France KLM

- 13.2 Airbus SE

- 13.3 Boeing

- 13.4 Curtiss-Wright Corporation

- 13.5 Embraer

- 13.6 FLYHT Aerospace Solutions Ltd.

- 13.7 General Electric

- 13.8 Honeywell International Inc

- 13.9 Lufthansa

- 13.10 Meggitt PLC

- 13.11 Rolls-Royce PLC

- 13.12 Safran Group

- 13.13 Teledyne Controls LLC