|

市场调查报告书

商品编码

1667152

太阳能区域供热市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Solar District Heating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

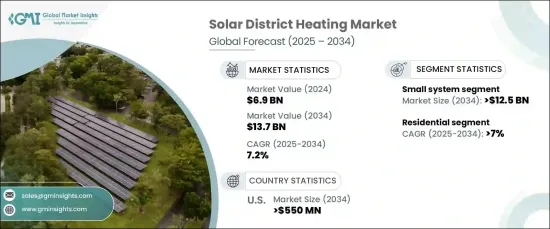

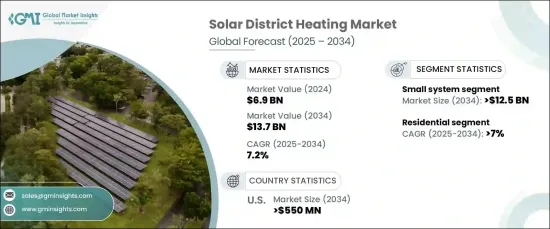

全球太阳能区域供热市场预计将在 2024 年达到 69 亿美元,并将在 2025 年至 2034 年期间以 7.2% 的强劲复合年增长率增长。世界各国政府正在实施更严格的能源效率标准,并鼓励采用再生能源,为太阳能区域供热解决方案创造了动态环境。此外,太阳能热技术的进步(例如高性能收集器和增强型热储存系统的开发)正在使太阳能区域供热更加高效、更具成本效益。这些创新不仅将提高系统性能,还将扩大更广泛的消费者使用范围,进一步加速市场普及。

太阳能区域供热市场的成长也可以归因于太阳能热解决方案的持续发展。能源效率是工业界、政府和消费者关注的首要议题。目前可用的太阳能区域供热系统比以往任何时候都更具成本效益,这使其成为希望减少碳足迹的消费者和企业越来越有吸引力的选择。随着世界越来越接近实现雄心勃勃的气候目标,这些系统在供暖行业脱碳方面发挥关键作用,而供暖行业传统上一直是温室气体排放的重要贡献者。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 69亿美元 |

| 预测值 | 137亿美元 |

| 复合年增长率 | 7.2% |

到 2034 年,小型系统部分预计将创收 125 亿美元。该领域将受益于日益增长的住宅和商业开发需求,这些开发越来越多地采用区域供热(DH)系统。这些小型、高效的系统旨在满足家庭、小型企业和中型工业的供暖需求。随着更严格的温室气体排放法规生效以及越来越多的消费者转向再生能源以获取热能和电力,这一领域将对市场扩张做出重大贡献。

住宅太阳能区域供热市场也有望实现大幅增长,预计到 2034 年复合年增长率将达到 7%。消费者越来越多地寻求可持续的供暖选择,而太阳能区域供热系统是自然的选择。此外,温度控制方面的技术创新、与现有基础设施的无缝整合以及遵守更高的营运标准将进一步促进市场成长。此外,对节能基础设施的大量投资以及将供热网路扩展到独户住宅和公寓大楼将推动其持续采用。

预计到 2034 年,美国太阳能区域供热市场将创造 5.5 亿美元。太阳能集热技术和热能储存系统的进步将进一步增强住宅、商业和工业领域的热传递。预计国家层级的激励措施和对再生能源基础设施的不断增加的投资将刺激太阳能区域供热系统的采用,从而推动美国市场的大幅成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:按系统,2021 – 2034 年

- 主要趋势

- 小型系统

- 大型系统

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 波兰

- 俄罗斯

- 瑞典

- 芬兰

- 义大利

- 丹麦

- 英国

- 奥地利

- 法国

- 亚太地区

- 中国

- 日本

- 韩国

第八章:公司简介

- Aalborg CSP

- Fortum

- Goteborg Energy

- Kelag Energy

- Keppel DHCS

- Korea District Heating

- Logstor

- NRG Energy

- Ramboll Group

- RWE

- Savosolar

- Shinryo

- Statkraft

- STEAG

- Vattenfall

The Global Solar District Heating Market is projected to reach USD 6.9 billion in 2024 and is set to grow at a robust CAGR of 7.2% from 2025 to 2034. This market growth is driven by an increasing shift towards renewable energy, supported by strong policy incentives and regulatory measures that promote the adoption of solar heating systems. Governments worldwide are implementing stricter energy-efficiency standards and incentivizing renewable energy adoption, creating a dynamic environment for solar district heating solutions. In addition, advancements in solar thermal technology-such as the development of high-performance collectors and enhanced thermal storage systems-are making solar district heating more efficient and cost-effective. These innovations will not only improve system performance but also expand access to a broader range of consumers, further accelerating market adoption.

The growth of the solar district heating market can also be attributed to the continuous evolution of solar thermal solutions. Energy efficiency is a primary concern for industries, governments, and consumers alike. The solar district heating systems now available are more cost-effective than ever, making them an increasingly attractive option for consumers and businesses looking to reduce their carbon footprint. As the world moves closer to meeting ambitious climate goals, these systems play a key role in decarbonizing the heating sector, which has traditionally been a significant contributor to greenhouse gas emissions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 7.2% |

By 2034, the small system segment is expected to generate USD 12.5 billion. This segment will benefit from the growing demand for residential and commercial developments, which are increasingly adopting district heating (DH) systems. These small, efficient systems are designed to meet the heating needs of households, small businesses, and medium-sized industries. As stricter greenhouse gas emission regulations come into effect and a growing number of consumers turn to renewable energy for heat and power, this segment will contribute significantly to market expansion.

The residential solar district heating market is also poised for substantial growth, with a projected CAGR of 7% through 2034. Rising demand for eco-friendly building solutions and increasing internal heat loads are key drivers of this growth. Consumers are increasingly seeking sustainable heating options, and solar district heating systems are a natural fit. Moreover, technological innovations in temperature control, seamless integration with existing infrastructure, and adherence to higher operational standards will further bolster market growth. In addition, substantial investments in energy-efficient infrastructure and the expansion of heating networks to single-family homes and apartment complexes will fuel continued adoption.

The U.S. solar district heating market is expected to generate USD 550 million by 2034. Growing consumer demand for sustainable and energy-efficient heating solutions, along with government initiatives focused on reducing greenhouse gas emissions, will shape the market's trajectory. Advancements in solar collector technologies and thermal energy storage systems will further enhance heat delivery across residential, commercial, and industrial sectors. State-level incentives and increasing investments in renewable energy infrastructure are expected to spur the adoption of solar district heating systems, driving significant growth in the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By System, 2021 – 2034 (PJ & USD Million)

- 5.1 Key trends

- 5.2 Small systems

- 5.3 Large systems

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (PJ & USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (PJ & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Poland

- 7.3.3 Russia

- 7.3.4 Sweden

- 7.3.5 Finland

- 7.3.6 Italy

- 7.3.7 Denmark

- 7.3.8 UK

- 7.3.9 Austria

- 7.3.10 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

Chapter 8 Company Profiles

- 8.1 Aalborg CSP

- 8.2 Fortum

- 8.3 Goteborg Energy

- 8.4 Kelag Energy

- 8.5 Keppel DHCS

- 8.6 Korea District Heating

- 8.7 Logstor

- 8.8 NRG Energy

- 8.9 Ramboll Group

- 8.10 RWE

- 8.11 Savosolar

- 8.12 Shinryo

- 8.13 Statkraft

- 8.14 STEAG

- 8.15 Vattenfall