|

市场调查报告书

商品编码

1667165

电錶后固定电池储存市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Behind the Meter Stationary Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

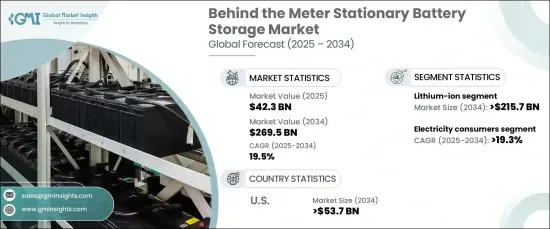

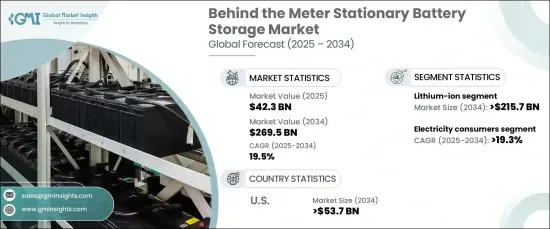

2024 年全球电錶后固定电池储存市场价值为 423 亿美元,预计在 2025 年至 2034 年期间实现 19.5% 的复合年增长率。

随着电价不断上涨,停电日益频繁,消费者开始转向储能技术,确保不间断供电,并利用太阳能等再生能源产生的剩余能源。世界各国政府正透过激励措施和补贴来鼓励采用再生能源和能源储存解决方案,从而加强这一趋势。电池技术的进步和製造成本的下降正在进一步改变市场,使其更容易被住宅、商业和工业消费者所接受。全球向永续能源实践的转变凸显了电錶后电池储存在满足未来能源需求方面的重要作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 423亿美元 |

| 预测值 | 2695亿美元 |

| 复合年增长率 | 19.5% |

根据电池类型,市场分为锂离子电池和铅酸电池,其中锂离子电池因其优越的能量密度、效率和寿命而占据主导地位。预计到 2034 年,该领域的收入将实现 2,157 亿美元,反映出其在住宅和商业领域的应用日益广泛。锂离子电池结构紧凑、耐用且价格越来越便宜,成为寻求高效能能源储存解决方案的消费者的首选。该领域的持续技术创新正在降低生产成本并提高效能,进一步推动对这些电池的需求。

电錶后固定电池储存的应用涵盖电力消费者、系统营运商和微电网,其中电力消费者部分预计到 2034 年将以 19.3% 的复合年增长率增长。电力成本的上涨和对能源自给自足的重视促使家庭和企业整合电池储存解决方案,使他们能够有效地储存和管理电力。这些系统使用户能够实现能源弹性,特别是在电网基础设施不可靠的地区。

在美国,电錶后固定电池储存市场规模预计到 2034 年将达到 537 亿美元。透过储存多余的能源以供日后使用,特别是在高峰时段或停电期间,这些系统与联邦和州级促进清洁能源和电网弹性的倡议保持一致。再生能源系统日益廉价的价格,加上优惠的政策,使得美国成为全球市场扩张的关键参与者。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:按电池,2021 – 2034 年

- 主要趋势

- 锂离子

- 铅酸

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 电力消费者

- 系统操作

- 迷你电网

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- C&D Technologies

- Duracell

- Enersys

- Exide Industries

- Furukawa Battery

- GS Yuasa International

- Johnson Controls

- Lockheed Martin

- Narada

- Panasonic

- Ritar International Group

- Siemens

The Global Behind The Meter Stationary Battery Storage Market, valued at USD 42.3 billion in 2024, is poised for remarkable growth at a CAGR of 19.5% between 2025 and 2034. This surge is driven by the growing demand for energy independence, cost-efficient solutions, and reliable energy storage systems.

As electricity prices continue to rise and power outages become increasingly frequent, consumers are turning to energy storage technologies to ensure uninterrupted power supply and capitalize on surplus energy generated from renewable sources like solar power. Governments worldwide are bolstering this trend through incentives and subsidies that encourage the adoption of renewable energy and energy storage solutions. Advancements in battery technology, in line with decreasing manufacturing costs, are further transforming the market, making it more accessible to residential, commercial, and industrial consumers. The global shift toward sustainable energy practices underscores the essential role of behind-the-meter battery storage in meeting future energy needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.3 Billion |

| Forecast Value | $269.5 Billion |

| CAGR | 19.5% |

The market is categorized by battery type into lithium-ion and lead-acid batteries, with lithium-ion dominating due to its superior energy density, efficiency, and longevity. This segment is forecasted to achieve USD 215.7 billion in revenue by 2034, reflecting its growing adoption across residential and commercial sectors. Lithium-ion batteries are compact, durable, and increasingly affordable, making them the preferred choice for consumers seeking efficient energy storage solutions. Continuous technological innovation in this space is reducing production costs and enhancing performance, further driving demand for these batteries.

Applications of behind-the-meter stationary battery storage span electricity consumers, system operators, and mini-grids, with the electricity consumers segment expected to grow at a CAGR of 19.3% through 2034. The adoption of renewable energy sources such as solar is a primary driver, necessitating efficient storage systems to optimize energy utilization. Rising electricity costs and the emphasis on energy self-sufficiency are prompting households and businesses to integrate battery storage solutions, enabling them to store and manage power effectively. These systems empower users to achieve energy resilience, particularly in regions with unreliable grid infrastructures.

In the United States, the behind-the-meter stationary battery storage market is projected to reach USD 53.7 billion by 2034. Widespread adoption of renewable energy technologies like solar and wind has catalyzed demand for battery storage among residential and commercial users. By storing surplus energy for later use, particularly during peak hours or outages, these systems align with federal and state-level initiatives promoting clean energy and grid resilience. The increasing affordability of renewable energy systems, coupled with favorable policies, positions the U.S. as a key player in the global market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Battery, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Lithium-ion

- 5.3 Lead acid

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Electricity consumers

- 6.3 System operations

- 6.4 Mini grids

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 C&D Technologies

- 8.2 Duracell

- 8.3 Enersys

- 8.4 Exide Industries

- 8.5 Furukawa Battery

- 8.6 GS Yuasa International

- 8.7 Johnson Controls

- 8.8 Lockheed Martin

- 8.9 Narada

- 8.10 Panasonic

- 8.11 Ritar International Group

- 8.12 Siemens