|

市场调查报告书

商品编码

1667184

公用事业太阳能光电 EPC 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Utility Solar PV EPC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

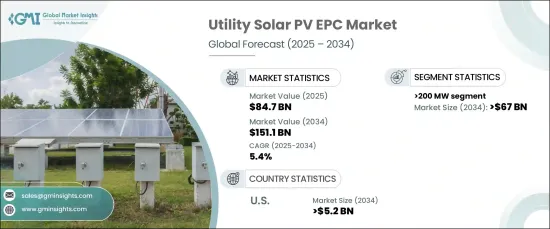

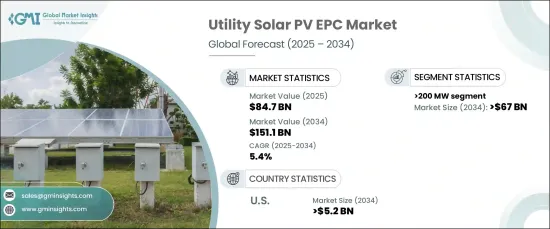

2024 年全球公用事业太阳能光电 EPC 市场价值 847 亿美元,预计 2024 年至 2034 年的复合年增长率为 5.4%。市场的成长得益于创新融资方式的采用,包括税收股权融资和绿色债券,这些方式支持了公用事业规模太阳能专案的扩张。

过去十年,太阳能电池组件和EPC服务的成本大幅降低,随着规模经济的提高,成本持续下降,从而降低整体成本并增加市场竞争。此外,电池储能係统 (BESS) 与公用事业规模太阳能专案的整合正变得越来越普遍。这种搭配有助于减轻太阳能发电的间歇性并确保电网稳定性,使太阳能发电成为更可靠的能源。此外,人们对社区太阳能专案的兴趣日益浓厚,特别是在屋顶太阳能采用有限的地区,这也推动了对公用事业太阳能 EPC 服务的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 847亿美元 |

| 预测值 | 1511亿美元 |

| 复合年增长率 | 5.4% |

预计市场对 200 兆瓦以上容量领域的需求将大幅增加,到 2034 年预计将超过 670 亿美元。在持续的技术创新、政府支持和对再生能源日益增长的投入的推动下,美国公用事业太阳能光电 EPC 服务市场规模预计到 2034 年将超过 52 亿美元。太阳能专案税收抵免等关键政策(包括 ITC 提供的 30% 税收抵免)进一步促进了市场的成长。在美国,加州、德州和纽约州等州都推出了再生能源强制规定,要求公用事业公司从再生能源中获取一定比例的能源,从而进一步刺激需求。太阳能板效率的进步,例如双面和异质结太阳能电池,正在透过提高能量产量和降低太阳能专案的平准化能源成本 (LCOE) 来推动产业向前发展。

在政府上网电价计画和再生能源拍卖等措施的支持下,亚太地区的公用事业太阳能光电 EPC 市场将持续成长。在澳洲等国家,电力成本的上升,加上再生能源技术成本的下降,正在推动大规模太阳能光电专案的部署。此外,该地区的政府正致力于透过软体和数位技术的整合来提高太阳能光电发电能力,进一步推动太阳能解决方案的采用。

目录

第 1 章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依产能,2021 – 2034 年

- 主要趋势

- ≤ 10 兆瓦

- > 10 兆瓦至 50 兆瓦

- > 50 兆瓦至 200 兆瓦

- > 200 兆瓦

第六章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 荷兰

- 义大利

- 德国

- 西班牙

- 俄罗斯

- 瑞典

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- ACME Solar

- Bharat Heavy Electricals Limited (BHEL)

- BELECTRIC

- COBRA Group

- Canadian Solar

- First Solar

- JUWI AG

- KEC International Limited

- Larsen & Toubro Limited

- Power Construction Corporation of China, Ltd.

- Risen Energy Co. Ltd.

- Ritis Meera Infra Energy LLP

- STEAG GmbH

- Swinerton Renewable Energy

- Sterling and Wilson

- SunPower Corporation

- SUNGROW

- TBEA Co., Ltd.

- Tata Power Solar Systems Ltd.

- Topsun Energy Limited

- Trina Solar

The Global Utility Solar PV EPC Market, valued at USD 84.7 billion in 2024, is expected to grow at a CAGR of 5.4% from 2024 to 2034. Utility Solar PV EPC services are critical for large-scale solar photovoltaic (PV) power plants that supply electricity to the grid, typically ranging from tens to hundreds of megawatts. The market's growth is fueled by the adoption of innovative financing methods, including tax equity financing and green bonds, which have supported the expansion of utility-scale solar projects.

Over the past decade, there has been a significant reduction in the costs of solar modules and EPC services, which continue to decline as economies of scale improve, driving down overall costs and increasing market competition. Additionally, the integration of battery energy storage systems (BESS) with utility-scale solar projects is becoming more common. This pairing helps mitigate the intermittent nature of solar power and ensures grid stability, making solar power a more reliable source of energy. Furthermore, the rising interest in community solar projects, particularly in areas with limited rooftop solar adoption, is contributing to the demand for utility solar EPC services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $84.7 Billion |

| Forecast Value | $151.1 Billion |

| CAGR | 5.4% |

The market is expected to see a substantial demand in the >200 MW capacity segment, projected to surpass USD 67 billion by 2034. As companies worldwide work to increase their renewable energy share, utility-scale solar PV projects are becoming more competitive due to the growing availability of resources, increased capacity potential, and more affordable technologies. The U.S. market for utility solar PV EPC services is forecasted to exceed USD 5.2 billion by 2034, driven by continued technological innovations, government support, and a growing commitment to renewable energy. Key policies such as tax credits for solar projects, including the ITC offering a 30% tax credit, further enhance the market's growth. In the U.S., states like California, Texas, and New York have renewable energy mandates that require utilities to obtain a percentage of their energy from renewable sources, further boosting demand. Advancements in solar panel efficiency, such as bifacial and heterojunction solar cells, are driving the industry forward by increasing energy yield and lowering the Levelized Cost of Energy (LCOE) for solar projects.

The Asia Pacific region will see continued growth in the utility solar PV EPC market, supported by government initiatives like feed-in tariff schemes and renewable energy auctions. In countries like Australia, the rising cost of electricity, combined with the decreasing costs of renewable technologies, is encouraging the deployment of large-scale solar PV projects. Additionally, governments in the region are focusing on enhancing solar PV capacity through the integration of software and digital technologies, further boosting the adoption of solar energy solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 ≤ 10 MW

- 5.3 > 10 MW to 50 MW

- 5.4 > 50 MW to 200 MW

- 5.5 > 200 MW

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 France

- 6.3.2 UK

- 6.3.3 Netherlands

- 6.3.4 Italy

- 6.3.5 Germany

- 6.3.6 Spain

- 6.3.7 Russia

- 6.3.8 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.5.4 Egypt

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ACME Solar

- 7.2 Bharat Heavy Electricals Limited (BHEL)

- 7.3 BELECTRIC

- 7.4 COBRA Group

- 7.5 Canadian Solar

- 7.6 First Solar

- 7.7 JUWI AG

- 7.8 KEC International Limited

- 7.9 Larsen & Toubro Limited

- 7.10 Power Construction Corporation of China, Ltd.

- 7.11 Risen Energy Co. Ltd.

- 7.12 Ritis Meera Infra Energy LLP

- 7.13 STEAG GmbH

- 7.14 Swinerton Renewable Energy

- 7.15 Sterling and Wilson

- 7.16 SunPower Corporation

- 7.17 SUNGROW

- 7.18 TBEA Co., Ltd.

- 7.19 Tata Power Solar Systems Ltd.

- 7.20 Topsun Energy Limited

- 7.21 Trina Solar