|

市场调查报告书

商品编码

1667193

医疗保健市场中的生成式人工智慧机会、成长动力、产业趋势分析和 2025 - 2034 年预测Generative AI in Healthcare Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

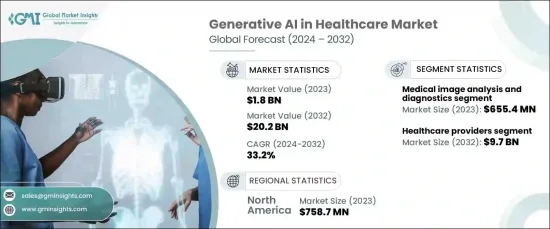

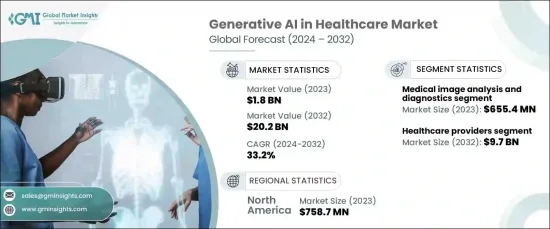

2023 年全球医疗保健领域的生成式人工智慧市场价值为 18 亿美元,预计 2024 年至 2032 年期间将以 33.2% 的强劲复合年增长率增长。 这一快速增长主要得益于深度学习和自然语言处理 (NLP) 的进步、个人化治疗需求的不断增长、对人工智慧的医疗保健解决方案的不断增长、对全球保健数据解决方案的不断增长、对人工智慧的医疗保健资料的不断增长

生成性人工智慧正在透过实现医学影像分析、自动报告和患者参与对话工具等创新应用来改变医疗保健产业。这些技术进步正在鼓励医疗保健提供者和组织将人工智慧解决方案整合到他们的营运中,从而推动市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 202亿美元 |

| 复合年增长率 | 33.2% |

就应用而言,市场分为医学影像分析和诊断、药物发现、病患援助、个人化治疗等部分。由于对能够早期和准确检测疾病的先进工具的需求不断增加,医学影像分析和诊断领域在 2023 年引领市场,创造最高收入。

生成式人工智慧透过在早期阶段识别潜在的健康风险来增强诊断能力,帮助医疗保健提供者改善结果并专注于预防性护理。人工智慧工具提供精确、快速的分析,大大促进了其在医学影像和诊断领域的应用。

市场根据最终用途进一步细分,包括医疗保健提供者、製药公司和医疗保健支付者。其中,医疗保健提供者在 2023 年成为主导领域,预计到预测期结束时将达到 97 亿美元。在这个领域,医院、诊所和诊断中心越来越多地利用人工智慧来简化工作流程、优化患者护理并管理排程和记录保存等行政任务。

生成性人工智慧透过自动执行重复性任务、提高工作流程效率和最大限度地减少人为错误,在降低医疗保健提供者的营运成本方面发挥着至关重要的作用。这些解决方案还有助于更好地分配资源并降低医院再入院率,最终支持具有成本效益的医疗保健服务。

2023 年,北美占据了最大的收入份额,达到 7.587 亿美元,预计到 2032 年将大幅增长。预计这些因素将在未来几年推动市场成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 精准医疗和治疗的需求不断增长

- 更加重视增强医学影像

- 扩大人工智慧的进步

- 增加创投

- 产业陷阱与挑战

- 资料隐私和安全问题

- 监理合规性

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按应用,2023 年至 2032 年

- 主要趋势

- 医学影像分析与诊断

- 药物研发

- 患者协助和监测

- 个人化治疗

- 其他应用

第六章:市场估计与预测:依最终用途,2023 – 2032 年

- 主要趋势

- 医疗保健提供者

- 医疗保健提供者

- 製药和生命科学公司

- 医疗保健付款人

- 製药和生命科学公司

- 医疗保健付款人

第七章:市场估计与预测:按地区,2023 – 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

第八章:公司简介

- Abridge Al

- DiagnaMed Holdings

- ELEKS

- Google LLC (Alphabet)

- Insilico Medicine

- International Business Machines

- Microsoft

- NVIDIA

- Oracle

- Persistent Systems

- Syntegra

The Global Generative AI In Healthcare Market, valued at USD 1.8 billion in 2023, is projected to grow at a robust CAGR of 33.2% from 2024 to 2032. This rapid growth is primarily fueled by advancements in deep learning and natural language processing (NLP), the increasing need for personalized treatments, rising investments in AI-driven healthcare solutions, and the surging volume of healthcare data worldwide.

Generative AI is transforming the healthcare industry by enabling innovative applications such as medical imaging analysis, automated reporting, and conversational tools for patient engagement. These technological advancements are encouraging healthcare providers and organizations to integrate AI solutions into their operations, driving market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 33.2% |

In terms of application, the market is divided into segments such as medical image analysis and diagnostics, drug discovery, patient assistance, personalized treatment, and more. The medical image analysis and diagnostics segment led the market in 2023, generating the highest revenue, owing to the increasing demand for advanced tools that enable early and accurate disease detection.

Generative AI enhances diagnostic capabilities by identifying potential health risks at an earlier stage, helping healthcare providers improve outcomes and focus on preventive care. AI-powered tools offer precise and rapid analysis, significantly boosting their adoption in medical imaging and diagnostics.

The market is further segmented by end use, encompassing healthcare providers, pharmaceutical companies, and healthcare payors. Among these, healthcare providers emerged as the dominant segment in 2023 and are expected to reach USD 9.7 billion by the end of the forecast period. Within this segment, hospitals, clinics, and diagnostic centers are increasingly leveraging AI to streamline workflows, optimize patient care, and manage administrative tasks like scheduling and record keeping.

Generative AI plays a crucial role in reducing operational costs for healthcare providers by automating repetitive tasks, enhancing workflow efficiency, and minimizing human errors. These solutions also contribute to better resource allocation and lower hospital readmission rates, ultimately supporting cost-effective healthcare delivery.

North America accounted for the largest revenue share of USD 758.7 million in 2023 and is anticipated to grow significantly through 2032. The region's advanced healthcare infrastructure, coupled with its rapid adoption of electronic health records (EHR), telemedicine, and other digital tools, creates a fertile ground for generative AI adoption. These factors are expected to drive market growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for precision medicine and treatment

- 3.2.1.2 Increasing focus on enhancing medical imaging

- 3.2.1.3 Expanding advancement in AI

- 3.2.1.4 Increasing venture funding

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Regulatory compliance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2023 – 2032 ($ Mn)

- 5.1 Key trends

- 5.2 Medical image analysis and diagnostics

- 5.3 Drug discovery and development

- 5.4 Patient assistance and monitoring

- 5.5 Personalized treatment

- 5.6 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2023 – 2032 ($ Mn)

- 6.1 Key trends

- 6.2 Healthcare providers

- 6.2.1 Healthcare providers

- 6.2.2 Pharmaceutical and life sciences companies

- 6.2.3 Healthcare payors

- 6.3 Pharmaceutical and life sciences companies

- 6.4 Healthcare payors

Chapter 7 Market Estimates and Forecast, By Region, 2023 – 2032 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

Chapter 8 Company Profiles

- 8.1 Abridge Al

- 8.2 DiagnaMed Holdings

- 8.3 ELEKS

- 8.4 Google LLC (Alphabet)

- 8.5 Insilico Medicine

- 8.6 International Business Machines

- 8.7 Microsoft

- 8.8 NVIDIA

- 8.9 Oracle

- 8.10 Persistent Systems

- 8.11 Syntegra