|

市场调查报告书

商品编码

1684519

动脉插管市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Arterial Cannula Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

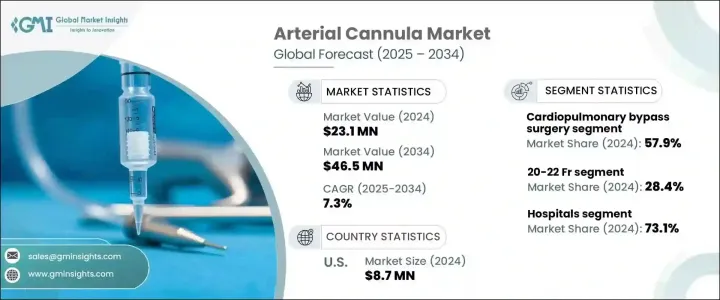

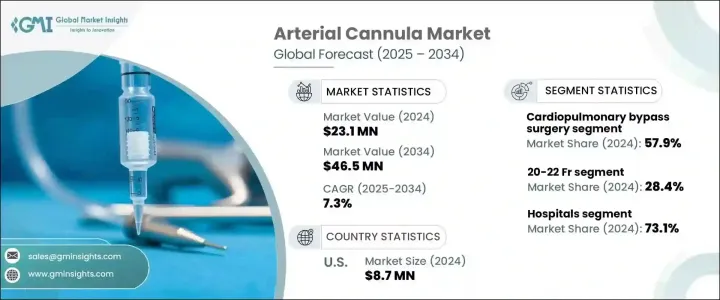

2024 年全球动脉插管市场价值为 2,310 万美元,预计将经历显着增长,2025 年至 2034 年的复合年增长率为 7.3%。此外,心臟手术报销政策的推出也促进了动脉套管的更广泛使用,从而促进了整体市场的成长。

冠状动脉疾病、心臟衰竭和中风等心血管疾病在全球范围内的负担日益加重,增加了对动脉插管等先进医疗设备的需求,这些设备对于各种心臟手术、ECMO(体外膜氧合)程序和其他救生干预措施至关重要。这些设备在改善手术和重症监护治疗期间的患者结果方面发挥着至关重要的作用,从而促进了它们在医院和外科中心的广泛使用。套管技术的创新提高了安全性、有效性和病患舒适度,也有助于推动市场需求。此外,随着医疗保健系统继续投资于最新的医疗技术和外科手术,动脉套管仍然是治疗方案的核心组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2310 万美元 |

| 预测值 | 4650 万美元 |

| 复合年增长率 | 7.3% |

市场按尺寸细分,包括 14-16 Fr、17-19 Fr、20-22 Fr、23-25 Fr、26-28 Fr、29-31 Fr、32-34 Fr 和 35-36 Fr 等。 20-22 Fr 尺寸类别在 2024 年占据了最大的市场份额,为 28.4%。 20-22 Fr 套管针提供了有效性和安全性的最佳组合,可减少插入过程中的血管损伤和出血等併发症,确保与成人动脉结构的兼容性。与较大尺寸的套管相比,它的侵入性较小,使其成为成年患者动脉插管的首选。

就最终用户而言,市场分为医院、门诊手术中心和其他。 2024 年,医院占据了 73.1% 的市场份额,占据了市场主导地位。动脉插管是心肺分流术和 ECMO 等救命治疗的重要工具,这两种治疗在医院环境中都已广泛应用。随着对先进外科手术和重症监护治疗的需求不断上升,医院预计将保持其作为最大终端用户群的地位。

在美国动脉插管市场,该产业在 2024 年创造了 870 万美元的收入。这两种治疗方法都严重依赖动脉套管,巩固了该设备在国家医疗保健系统中的关键作用,并进一步推动市场成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率不断上升

- 重症监护环境中呼吸和心臟支持的使用日益增多

- 套管设计的进步

- 心臟和重症监护手术的报销和保险覆盖范围

- 产业陷阱与挑战

- 严格的监管要求

- 与 ECMO 和心肺手术相关的复杂性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望

第五章:市场估计与预测:依规模,2021 – 2034 年

- 主要趋势

- 14-16 星期五

- 17-19 星期五

- 20-22 星期五

- 23-25 星期五

- 26-28 星期五

- 29-31 星期五

- 32-34 星期五

- 35-36 星期五

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 心肺旁路手术

- 体外膜氧合

- 其他应用

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Andocor

- B. Braun

- Becton, Dickinson and Company

- Edward Lifesciences

- Freelife Medical

- Fresenius Medical Care

- Getinge

- ICU Medical

- Kangxin Medical

- LivaNova

- Medtronic

- Nipro Corporation

- Polymedicure

- Surgical Holdings

- Terumo Corporation

The Global Arterial Cannula Market was valued at USD 23.1 million in 2024 and is projected to experience significant growth with an anticipated CAGR of 7.3% from 2025 to 2034. Several key factors are driving this market expansion, including the rising prevalence of cardiovascular diseases, advancements in cannula technology, and the increasing adoption of respiratory and cardiac support systems in critical care settings. Additionally, the availability of reimbursement policies for cardiac procedures is fostering the wider use of arterial cannulas, contributing to the overall market growth.

The growing global burden of cardiovascular diseases, including coronary artery disease, heart failure, and stroke, has heightened the demand for advanced medical devices such as arterial cannulas, which are critical for various cardiac surgeries, ECMO (extracorporeal membrane oxygenation) procedures, and other life-saving interventions. These devices play a crucial role in improving patient outcomes during surgeries and critical care treatments, thereby spurring their widespread use across hospitals and surgical centers. Innovations in cannula technology, which improve safety, effectiveness, and patient comfort, are also helping propel market demand. Furthermore, as healthcare systems continue to invest in the latest medical technologies and surgical interventions, arterial cannulas remain a core component of treatment protocols.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.1 Million |

| Forecast Value | $46.5 Million |

| CAGR | 7.3% |

The market is segmented by size, with options such as 14-16 Fr, 17-19 Fr, 20-22 Fr, 23-25 Fr, 26-28 Fr, 29-31 Fr, 32-34 Fr, and 35-36 Fr. The 20-22 Fr size category held the largest market share of 28.4% in 2024. This size is particularly favored due to its balanced performance during ECMO procedures and cardiac surgeries, especially for adult patients. Offering an optimal mix of effectiveness and safety, the 20-22 Fr cannula reduces complications like vascular damage and bleeding during insertion, ensuring compatibility with adult arterial structures. Its less invasive nature, compared to larger cannula sizes, makes it the preferred choice for arterial cannulation in adult patients.

In terms of end-users, the market is categorized into hospitals, ambulatory surgical centers, and others. Hospitals dominated the market with a 73.1% share in 2024. The increasing number of critical cardiac and intensive care procedures being performed in hospitals is a major factor contributing to this segment's dominance. Arterial cannulas are an essential tool in life-saving treatments such as cardiopulmonary bypass and ECMO, both of which are extensively used in hospital settings. As the demand for advanced surgical interventions and critical care treatments continues to rise, hospitals are expected to maintain their position as the largest end-user segment.

In the U.S. arterial cannula market, the sector generated USD 8.7 million in 2024. The high prevalence of cardiovascular diseases such as coronary artery disease, heart failure, and stroke plays a significant role in driving the demand for ECMO procedures and cardiac surgeries. Both of these treatments heavily rely on arterial cannulas, solidifying the device's critical role in the country's healthcare system and further fueling market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular disorders

- 3.2.1.2 Growing use of respiratory and cardiac support in critical care settings

- 3.2.1.3 Advancements in cannula design

- 3.2.1.4 Availability of reimbursements and coverage for cardiac and critical care procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements

- 3.2.2.2 Complexity associated with ECMO and cardiopulmonary procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Size, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 14-16 Fr

- 5.3 17-19 Fr

- 5.4 20-22 Fr

- 5.5 23-25 Fr

- 5.6 26-28 Fr

- 5.7 29-31 Fr

- 5.8 32-34 Fr

- 5.9 35-36 Fr

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiopulmonary bypass surgery

- 6.3 Extracorporeal membrane oxygenation

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Andocor

- 9.2 B. Braun

- 9.3 Becton, Dickinson and Company

- 9.4 Edward Lifesciences

- 9.5 Freelife Medical

- 9.6 Fresenius Medical Care

- 9.7 Getinge

- 9.8 ICU Medical

- 9.9 Kangxin Medical

- 9.10 LivaNova

- 9.11 Medtronic

- 9.12 Nipro Corporation

- 9.13 Polymedicure

- 9.14 Surgical Holdings

- 9.15 Terumo Corporation