|

市场调查报告书

商品编码

1684529

草坪和草皮曝气机市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Lawn and Turf Aerators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

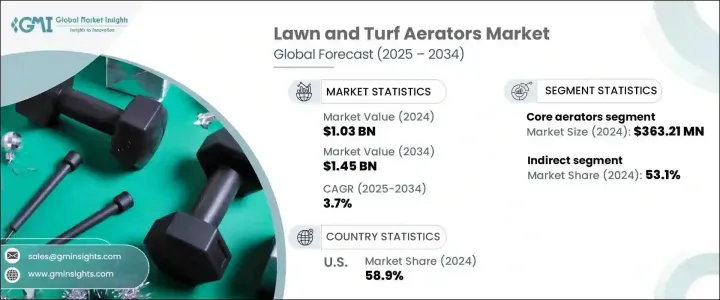

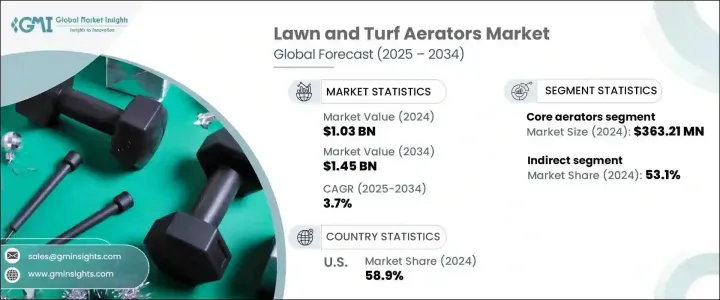

2024 年全球草坪和草皮曝气机市场价值为 10.3 亿美元,预计在预测期内的复合年增长率为 3.7%。曝气系统在改善草坪健康、管理景观需求和维护运动场方面发挥关键作用,因此其应用日益广泛。曝气机因其减轻土壤压实、改善水分渗透、促进养分吸收和支持根系更强健发育的能力而受到广泛认可。这些优势导致住宅、商业和娱乐应用的需求激增。此外,对永续和高效的草坪护理实践的日益重视,加上曝气技术的进步,进一步推动了市场成长。消费者越来越重视确保草坪健康且外观美观的草坪护理解决方案,这使得曝气机成为草坪管理策略的基本组成部分。

市场依曝气器类型分类,包括核心曝气器、尖刺曝气器、液体曝气器、滚动曝气器和拖曳式曝气器。核心曝气机预计将在 2025 年至 2034 年间经历最显着的成长。这个过程可以促进根系生长得更健康、更强壮,使得核心曝气机成为住宅和商业草坪护理的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10.3亿美元 |

| 预测值 | 14.5亿美元 |

| 复合年增长率 | 3.7% |

市场也按分销管道细分,包括直接销售和间接销售。间接通路包括零售商、专业商家和经销商,占据 2024 年 53.1% 的市场份额。曝气器透过不同的零售平台广泛供应,大大促进了市场扩张。消费者受益于获得各种各样的曝气产品的便利,培养积极的购买体验并推动整体市场成长。

2024 年,美国草坪和草皮曝气机市场占据 58.9% 的份额,主要归因于住宅、商业和公共空间对曝气解决方案的广泛需求。美国的公园、运动场和私人草坪需要持续的维护,这为曝气机创造了强劲的市场。预计在预测期内,美国市场将以 4.1% 的速度成长,这得益于人们越来越意识到曝气在各种应用中实现更健康、更具视觉吸引力的草坪方面的好处。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 草坪和草皮维护需求不断增长

- 增加草坪和花园 DIY 活动

- 越来越多采用永续做法

- 产业陷阱与挑战

- 初期投资高

- 操作复杂度

- 成长动力

- 成长潜力分析

- 技术概览

- 消费者行为分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021-2034 年

- 主要趋势

- 核心曝气器

- 尖刺曝气机

- 液体曝气器

- 滚动曝气机

- 拖曳式曝气机

第 6 章:市场估计与预测:按电源,2021 年至 2034 年

- 主要趋势

- 手动曝气机

- 电动曝气机

- 动力曝气机

- 瓦斯动力机

第 7 章:市场估计与预测:按应用 2021-2034

- 主要趋势

- 住宅草坪

- 高尔夫球场

- 运动场

- 商业景观

- 农业用地

- 公共场所和公园

第 8 章:市场估计与预测:依最终用途 2021-2034

- 主要趋势

- 住宅

- 体育和休閒

- 商业草坪管理

- 高尔夫球场管理

- 其他的

第 9 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第 11 章:公司简介

- 1st Products

- Aerworx

- Billy Goat

- Classen

- Clark

- Ecolawn

- Groundsman

- Jacobsen

- John Deere

- Millcreek

- Salford

- Toro

- Tracmaster

- Turfco

- Turftime

The Global Lawn And Turf Aerators Market, valued at USD 1.03 billion in 2024, is projected to grow at a CAGR of 3.7% during the forecast period. The increasing adoption of aeration systems is fueled by their critical role in enhancing turf health, managing landscaping needs, and maintaining sports fields. Aerators are widely recognized for their ability to alleviate soil compaction, improve water infiltration, promote nutrient absorption, and support stronger root development. These benefits have led to a surge in demand across residential, commercial, and recreational applications. Additionally, the growing emphasis on sustainable and efficient lawn care practices, coupled with advancements in aeration technology, is further driving market growth. Consumers are increasingly prioritizing lawn care solutions that ensure healthy and visually appealing turf, making aerators a fundamental part of turf management strategies.

The market is categorized by aerator type, including core aerators, spike aerators, liquid aerators, rolling aerators, and tow-behind aerators. Core aerators are anticipated to experience the most significant growth from 2025 to 2034. In 2024, this segment generated USD 363.21 million in revenue and is forecasted to reach USD 536.67 million by 2034. Core aerators are particularly valued for their ability to extract small plugs of soil, which effectively reduces soil compaction while improving water and nutrient retention. This process encourages healthier and more robust root systems, making core aerators a preferred choice for residential and commercial lawn care alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.03 Billion |

| Forecast Value | $1.45 Billion |

| CAGR | 3.7% |

The market is also segmented by distribution channels, encompassing both direct and indirect sales. Indirect channels, which include retailers, specialized merchants, and resellers, accounted for 53.1% of the market share in 2024. These channels cater to a broad audience, ranging from professional landscapers to DIY enthusiasts. The widespread availability of aerators through diverse retail platforms has significantly contributed to market expansion. Consumers benefit from the convenience of accessing a wide array of aeration products, fostering a positive purchasing experience and driving overall market growth.

In 2024, the U.S. lawn and turf aerators market held a commanding 58.9% share, largely due to the extensive demand for aeration solutions across residential, commercial, and public spaces. Parks, sports fields, and private lawns in the United States require consistent maintenance, creating a robust market for aerators. The U.S. market is expected to grow at a rate of 4.1% during the forecast period, supported by increasing awareness of aeration's benefits in achieving healthier and more visually appealing turf across various applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier Landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for lawn and turf maintenance

- 3.6.1.2 Increased lawn and garden DIY activities

- 3.6.1.3 Rising adoption of sustainable practices

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment

- 3.6.2.2 Complexity of operation

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Consumer behavior analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million) (Units in Thousand)

- 5.1 Key trends

- 5.2 Core aerators

- 5.3 Spike aerators

- 5.4 Liquid aerators

- 5.5 Rolling aerators

- 5.6 Tow-Behind aerators

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Million) (Units in Thousand)

- 6.1 Key trends

- 6.2 Manual aerators

- 6.3 Electric aerators

- 6.4 Powered aerators

- 6.5 Gas-Powered aerators

Chapter 7 Market Estimates & Forecast, By Application 2021-2034 (USD Million) (Units in Thousand)

- 7.1 Key trends

- 7.2 Residential lawns

- 7.3 Golf courses

- 7.4 Sports fields

- 7.5 Commercial landscapes

- 7.6 Agricultural land

- 7.7 Public spaces and parks

Chapter 8 Market Estimates & Forecast, By End Use 2021-2034 (USD Million) (Units in Thousand)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Sports and leisure

- 8.4 Commercial turf management

- 8.5 Golf Course management

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Units in Thousand)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Units in Thousand)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 United States

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 United Kingdom

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East & Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 United Arab Emirates

Chapter 11 Company Profiles

- 11.1 1st Products

- 11.2 Aerworx

- 11.3 Billy Goat

- 11.4 Classen

- 11.5 Clark

- 11.6 Ecolawn

- 11.7 Groundsman

- 11.8 Jacobsen

- 11.9 John Deere

- 11.10 Millcreek

- 11.11 Salford

- 11.12 Toro

- 11.13 Tracmaster

- 11.14 Turfco

- 11.15 Turftime