|

市场调查报告书

商品编码

1684534

二氧化碳培养箱市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Carbon Dioxide Incubators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

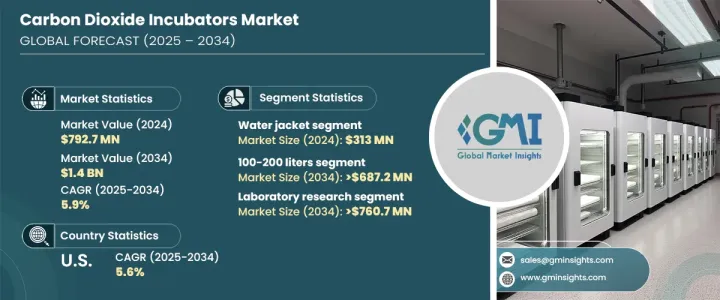

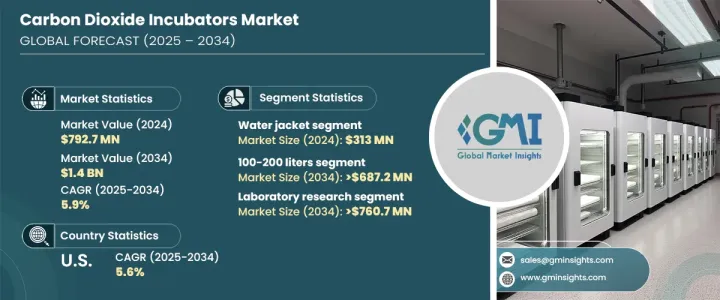

2024 年全球二氧化碳培养箱市场价值为 7.927 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.9%。细胞培养、药物测试和临床研究对稳定孵化环境的需求推动了对先进二氧化碳培养箱的需求。公司和研究机构寻求高精度解决方案来维持可靠结果所需的受控条件。新兴市场的研发投资不断扩大、医疗保健基础设施的进步以及对体外应用的兴趣日益浓厚,进一步加速了市场扩张。此外,包括自动化和感测器创新在内的持续技术发展正在提高效率和性能,促进市场持续成长。

二氧化碳培养箱旨在维持生物培养的最佳条件,确保对温度、湿度和二氧化碳水平的精确控制。根据产品类型,市场包括水套式、空气套式和直热式二氧化碳培养箱。 2024 年,水套式二氧化碳培养箱引领市场,创造 3.13 亿美元的收入。它们能够保持一致的温度调节,这使它们成为长期研究的首选。这些培养箱可减少温度波动,确保敏感科学应用所需的稳定性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.927 亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 5.9% |

根据容量,市场分为三个部分:100公升以下,100-200公升,200公升以上。 100-200 公升类别的复合年增长率预计将达到 6.4%,到 2034 年将超过 6.872 亿美元。其容量和效率的平衡使其成为跨研究应用的有吸引力的选择。

在应用方面,市场涵盖实验室研究、体外应用和其他科学用途。预计实验室研究将保持主导地位,以 6.4% 的复合年增长率增长,到 2034 年将超过 7.607 亿美元。随着全球对基因组学、生物技术和再生医学的兴趣日益增长,实验室需要这些系统来维持生物研究的最佳条件。

感测器技术在维持孵化器内的二氧化碳水平方面发挥着至关重要的作用。市场分为红外线 (IR) 和热导 (TC) CO2 培养箱等。红外线二氧化碳培养箱预计将实现 6.5% 的复合年增长率,到 2034 年将超过 8.636 亿美元。

根据最终用途,市场包括生物技术和製药公司、学术机构和临床实验室。生物技术和製药公司在药物开发、基因研究和临床试验中已广泛应用,占 2024 年总收入的 39.3%。

2024 年,美国市场规模达到 1.693 亿美元,预计到 2034 年将以 5.6% 的复合年增长率增长,这得益于美国先进的医疗保健行业、研究基础设施和持续的医疗创新。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 二氧化碳培养箱在细胞培养和干细胞研究的应用日益广泛

- 慢性病盛行率上升及再生医学需求

- 孵化器技术的进步

- 生物製药和疫苗产量成长

- 产业陷阱与挑战

- 先进的二氧化碳培养箱成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 - 2034 年

- 主要趋势

- 水套二氧化碳培养箱

- 气套二氧化碳培养箱

- 直热式二氧化碳培养箱

- 其他产品类型

第六章:市场估计与预测:按产能,2021 - 2034 年

- 主要趋势

- 100 – 200 公升

- 100公升以下

- 200公升以上

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 实验室研究

- 体外受精(IVF)

- 癌症研究

- 其他应用

第 8 章:市场估计与预测:按感测器技术,2021 - 2034 年

- 主要趋势

- 红外线 (IR) CO2 培养箱

- 热导率 (TC) CO2 培养箱

- 其他感测器技术

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 生物技术和製药公司

- 学术及研究机构

- 临床实验室

- 其他最终用户

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- avantor

- BINDER

- CARON SCIENTIFIC

- ESCO

- HYLAND

- Labotect

- memmert

- NUAIRE

- phcbi

- SHELDON MANUFACTURING

- Thermo Fisher

The Global Carbon Dioxide Incubators Market was valued at USD 792.7 million in 2024 and is projected to expand at a 5.9% CAGR from 2025 to 2034. Market growth is primarily driven by increasing research activities in biotechnology, pharmaceuticals, and medical sciences. The need for stable incubation environments in cell culture, drug testing, and clinical research is fueling the demand for advanced CO2 incubators. Companies and research institutions seek high-precision solutions to maintain controlled conditions essential for reliable results. Expanding R&D investments in emerging markets, advancements in healthcare infrastructure, and rising interest in in vitro applications are further accelerating market expansion. Additionally, continuous technological developments, including automation and sensor innovations, are enhancing efficiency and performance, contributing to sustained market growth.

Carbon dioxide incubators are designed to maintain optimal conditions for biological cultures, ensuring precise control over temperature, humidity, and CO2 levels. Based on product type, the market includes water jacket, air jacket, and direct heat CO2 incubators. Water jacket CO2 incubators led the market in 2024, generating USD 313 million in revenue. Their ability to maintain consistent temperature regulation makes them a preferred choice for long-term research. These incubators reduce temperature fluctuations, ensuring the stability required for sensitive scientific applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $792.7 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 5.9% |

By capacity, the market is divided into three segments: below 100 liters, 100-200 liters, and above 200 liters. The 100-200 liters category is projected to experience a 6.4% CAGR, surpassing USD 687.2 million by 2034. This segment dominates due to its versatility in laboratories, providing ample space for multiple culture vessels without requiring excessive room. Its balance of capacity and efficiency makes it an attractive option across research applications.

In terms of application, the market covers laboratory research, in vitro applications, and other scientific uses. Laboratory research is expected to maintain its dominant position, growing at a 6.4% CAGR and exceeding USD 760.7 million by 2034. The rising demand for controlled environments in genetic, microbiological, and cellular research is increasing reliance on CO2 incubators. As global interest in genomics, biotechnology, and regenerative medicine grows, laboratories require these systems to sustain optimal conditions for biological studies.

Sensor technology plays a crucial role in maintaining CO2 levels within incubators. The market is categorized into infrared (IR) and thermal conductivity (TC) CO2 incubators, among others. IR CO2 incubators are anticipated to achieve a 6.5% CAGR, surpassing USD 863.6 million by 2034. Their high accuracy and rapid response capabilities ensure stable conditions for cell cultures, making them the preferred choice in research and medical applications.

By end use, the market includes biotechnology and pharmaceutical companies, academic institutions, and clinical laboratories. Biotechnology and pharmaceutical firms accounted for 39.3% of total revenue in 2024 due to their extensive use in drug development, genetic studies, and clinical trials.

The U.S. market reached USD 169.3 million in 2024 and is expected to grow at a 5.6% CAGR through 2034, driven by its advanced healthcare sector, research infrastructure, and ongoing medical innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of CO2 incubators in cell culture and stem cell research

- 3.2.1.2 Rising prevalence of chronic diseases and demand for regenerative medicine

- 3.2.1.3 Advancements in incubator technology

- 3.2.1.4 Growth in biopharmaceutical and vaccine production

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced CO2 incubators

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Water jacket carbon dioxide incubators

- 5.3 Air jacket carbon dioxide incubators

- 5.4 Direct heat carbon dioxide incubators

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 100 – 200 liters

- 6.3 Below 100 liters

- 6.4 Above 200 liters

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Laboratory research

- 7.3 In vitro fertilization (IVF)

- 7.4 Cancer research

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Sensor Technology, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Infrared (IR) CO2 incubators

- 8.3 Thermal conductivity (TC) CO2 incubators

- 8.4 Other sensor technologies

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Biotechnology and pharmaceutical companies

- 9.3 Academic and research institutions

- 9.4 Clinical laboratories

- 9.5 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 avantor

- 11.2 BINDER

- 11.3 CARON SCIENTIFIC

- 11.4 ESCO

- 11.5 HYLAND

- 11.6 Labotect

- 11.7 memmert

- 11.8 NUAIRE

- 11.9 phcbi

- 11.10 SHELDON MANUFACTURING

- 11.11 Thermo Fisher