|

市场调查报告书

商品编码

1684549

固体雷射器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Solid-State Laser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

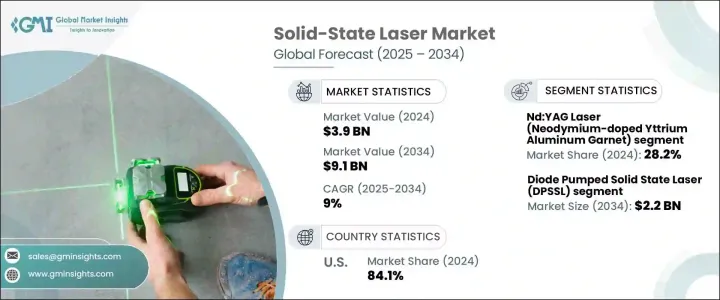

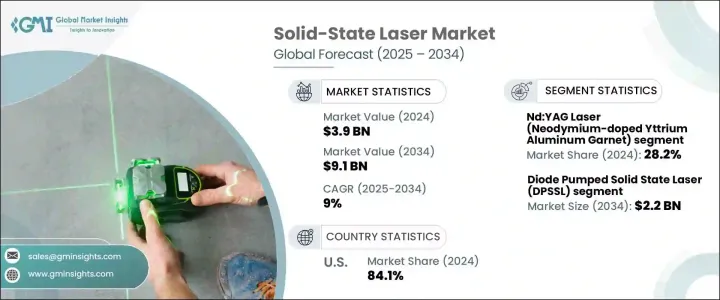

全球固体雷射市场正在快速成长,2024 年估值为 39 亿美元,预计 2025 年至 2034 年的复合年增长率为 9%。研究人员不断致力于突破雷射能力的界限,专注于提高功率输出、缩小雷射尺寸和提高精度。

由于企业被更高性能和更具成本效益的解决方案所吸引,这些进步正在为医疗保健、电信和製造业等各个行业带来大量新应用。固体雷射的创新不仅使得能够以较低的成本生产出高品质、可靠的雷射器,而且还扩大了其在以前未开发的市场的使用范围。因此,由于固体雷射的多功能性和尖端应用,其需求呈现急剧上升趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 91亿美元 |

| 复合年增长率 | 9% |

与传统雷射技术相比,固体雷射具有众多优势,包括更快的加工速度、更高的精度和减少的材料浪费。随着各行各业不断关注自动化和对高品质生产标准的需求,製造业对固体雷射的需求正在上升。对更精确、更有效率的生产流程的日益增长的需求是推动市场快速成长的关键因素之一。此外,这些雷射的经济高效及其改进的性能使其对于希望在不断发展的市场中保持竞争力的企业具有极大的吸引力。

就材料类型而言,市场细分为不同的类别,包括 Nd:YAG 雷射(掺钕钇铝石榴石)、Er:YAG 雷射(掺铒钇铝石榴石)、紫翠玉雷射、Ti:蓝宝石雷射(掺钛蓝宝石)等。截至 2024 年,Nd:YAG 雷射领域占据主导地位,占 28.2% 的市场份额。这些雷射因其多功能性而受到青睐,能够在连续波和脉衝模式下工作,其有效波长为 1064 nm,非常适合深层材料穿透。

在技术方面,市场分为二极管泵浦固体雷射 (DPSSL)、光纤雷射、盘片雷射、薄板雷射和光泵浦半导体雷射 (OPSL) 等细分市场。其中,DPSSL 预计将成为领先技术,到 2034 年其价值估计将达到 22 亿美元。

美国固体雷射市场占据了全球市场的很大一部分,到 2024 年将占据高达 84.1 %的份额。中国蓬勃发展的研发生态系统加上政府对尖端技术的大量投资,刺激了该领域的持续创新。此外,汽车、电子等产业对精密製造的需求不断增长,进一步巩固了美国在全球固体雷射市场的领导地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 技术进步和小型化

- 对基于雷射的製造和加工的需求增加

- 医疗保健应用激增

- 通讯系统中的应用日益增多

- 产业陷阱与挑战

- 初始成本高且整合复杂

- 来自替代技术的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- Nd:YAG 雷射(掺钕钇铝石榴石)

- Er:YAG 雷射(掺铒钇铝石榴石)

- 紫翠玉激光

- Ti:蓝宝石雷射(掺杂钛的蓝宝石)。

- 其他的

第 6 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 二极体泵浦固体雷射 (DPSSL)

- 光纤雷射

- 碟式雷射

- 薄板条雷射器

- 光泵浦半导体雷射 (OPSL)

- 其他的

第 7 章:市场估计与预测:按功率范围,2021 年至 2034 年

- 主要趋势

- 低功率(<100W)

- 中等功率(100 W - 1 kW)

- 高功率(>1kW)

第 8 章:市场估计与预测:依波长范围,2021 年至 2034 年

- 主要趋势

- 紫外线(UV)

- 可见的

- 红外线 (IR)

- 中红外线 (MIR)

第 9 章:市场估计与预测:按营运类型,2021 年至 2034 年

- 主要趋势

- 脉衝操作

- 连续波操作

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 工业的

- 资料储存

- 医疗的

- 国防和航太

- 电信

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- ALPHALAS GmbH

- AMS Technologies Ltd.

- Coherent Inc.

- CrystaLaser, LLC

- Daheng New Epoch Technology, Inc.

- Edgewave

- Hamamatsu Photonics KK

- IPG Photonics

- Jenoptik Laser GmbH

- JENOPTIK

- Jiangsu Lumispot Technology Co., Ltd.

- Laserglow Technologies

- LASEROPTEK Co., Ltd.

- LUMIBIRD

- Lumentum Operations LLC

- Maxphotonics

- nLight

- Northrop Grumman Corporation

- Photonic Solutions Ltd.

- Quanta System SP

The Global Solid-State Laser Market is experiencing rapid growth, with a valuation of USD 3.9 billion in 2024 and a projected CAGR of 9% from 2025 to 2034. This impressive expansion can be attributed to groundbreaking technological advancements, particularly in the areas of miniaturization, energy efficiency, and performance enhancement. Researchers are constantly working to push the boundaries of laser capabilities, focusing on increasing power output, shrinking laser sizes, and enhancing precision.

These advancements are unlocking a multitude of new applications across various industries, such as healthcare, telecommunications, and manufacturing, as businesses are drawn to the promise of higher performance and cost-effective solutions. Innovations in solid-state lasers are not only enabling the production of high-quality, reliable lasers at a lower cost but also expanding the scope of their use in previously untapped markets. As a result, the demand for solid-state lasers is on a steep upward trajectory, driven by their versatility and cutting-edge applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 9% |

Solid-state lasers offer a wide array of benefits when compared to traditional laser technologies, including faster processing speeds, higher precision, and reduced material waste. As industries continue to focus on automation and the need for high-quality production standards, the demand for solid-state lasers in manufacturing is on the rise. This growing need for more precise and efficient production processes is one of the key factors contributing to the market's rapid growth. Additionally, the cost-effective nature of these lasers, along with their improved performance, makes them highly attractive to businesses looking to stay competitive in an ever-evolving marketplace.

In terms of material type, the market is segmented into various categories, including Nd:YAG lasers (Neodymium-doped Yttrium Aluminum Garnet), Er:YAG lasers (Erbium-doped Yttrium Aluminum Garnet), Alexandrite lasers, Ti:Sapphire lasers (Titanium-doped Sapphire), and others. As of 2024, the Nd:YAG laser segment is the dominant force, accounting for 28.2% of the market share. These lasers are favored for their versatility, being able to operate in both continuous-wave and pulsed modes, and their effective wavelength of 1064 nm, which is ideal for deep material penetration.

On the technology front, the market is divided into segments such as Diode Pumped Solid State Lasers (DPSSL), fiber lasers, disk lasers, thin slab lasers, and Optically Pumped Semiconductor Lasers (OPSL). Of these, DPSSLs are expected to be the leading technology, reaching an estimated value of USD 2.2 billion by 2034. Known for their high efficiency, compact design, and stability, DPSSLs are increasingly sought after by industries that require precise, reliable laser beams for their operations.

The U.S. solid-state laser market commands a significant portion of the global market, holding an impressive 84.1% share in 2024. This dominance is fueled by the widespread adoption of solid-state lasers in healthcare, aerospace, and defense sectors. The country's thriving research and development ecosystem, coupled with substantial government investments in cutting-edge technologies, has spurred continued innovation in the field. Furthermore, the growing demand for precision manufacturing in industries such as automotive and electronics further bolsters the U.S.'s leadership position in the global solid-state laser market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements and miniaturization

- 3.6.1.2 Increased demand for laser-based manufacturing and processing

- 3.6.1.3 Surge in medical and healthcare applications

- 3.6.1.4 Rising application in communication systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs and complex integration

- 3.6.2.2 Competition from alternative technologies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nd:YAG Laser (Neodymium-doped Yttrium Aluminum Garnet)

- 5.3 Er:YAG Laser (Erbium-doped Yttrium Aluminum Garnet)

- 5.4 Alexandrite Laser

- 5.5 Ti:Sapphire Laser (Titanium-doped Sapphire).

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Diode Pumped Solid State Laser (DPSSL)

- 6.3 Fiber laser

- 6.4 Disk laser

- 6.5 Thin slab laser

- 6.6 Optically Pumped Semiconductor Laser (OPSL)

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Power Range, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Low power (< 100 W)

- 7.3 Medium power (100 W - 1 kW)

- 7.4 High power (> 1 kW)

Chapter 8 Market Estimates & Forecast, By Wavelength Range, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Ultraviolet (UV)

- 8.3 Visible

- 8.4 Infrared (IR)

- 8.5 Mid-Infrared (MIR)

Chapter 9 Market Estimates & Forecast, By Operation Type, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Pulsed operation

- 9.3 Continuous wave operation

Chapter 10 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Industrial

- 10.4 Data storage

- 10.5 Medical

- 10.6 Defense and aerospace

- 10.7 Telecommunications

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ALPHALAS GmbH

- 12.2 AMS Technologies Ltd.

- 12.3 Coherent Inc.

- 12.4 CrystaLaser, LLC

- 12.5 Daheng New Epoch Technology, Inc.

- 12.6 Edgewave

- 12.7 Hamamatsu Photonics K.K.

- 12.8 IPG Photonics

- 12.9 Jenoptik Laser GmbH

- 12.10 JENOPTIK

- 12.11 Jiangsu Lumispot Technology Co., Ltd.

- 12.12 Laserglow Technologies

- 12.13 LASEROPTEK Co., Ltd.

- 12.14 LUMIBIRD

- 12.15 Lumentum Operations LLC

- 12.16 Maxphotonics

- 12.17 nLight

- 12.18 Northrop Grumman Corporation

- 12.19 Photonic Solutions Ltd.

- 12.20 Quanta System SP