|

市场调查报告书

商品编码

1684551

乳房植入物组织扩张器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Breast Implant Tissue Expanders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

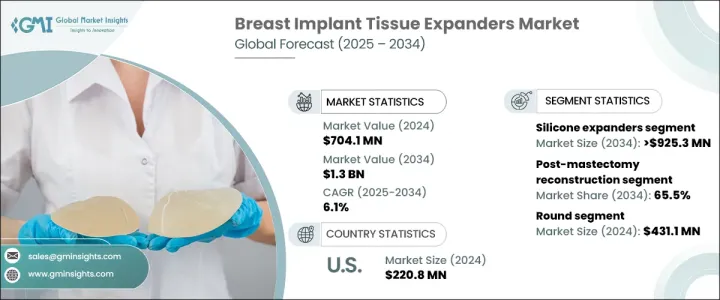

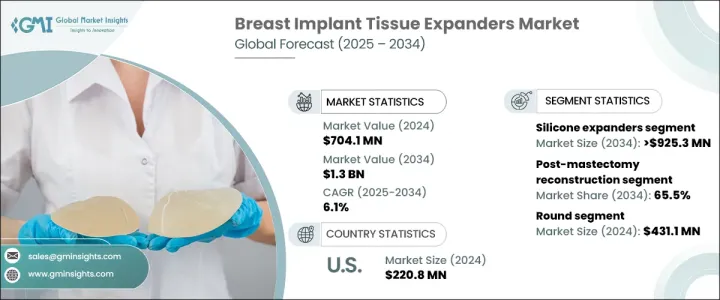

2024 年全球乳房植入物组织扩张器市场价值为 7.041 亿美元,并将经历强劲成长,2025 年至 2034 年的复合年增长率为 6.1%。组织扩张器是关键的医疗设备,在为乳房重建或增大准备皮肤和软组织方面发挥重要作用。这些装置主要用于乳房切除术后、创伤后或治疗先天性畸形。

随着人们对乳房重建的关注度不断提高,特别是乳癌倖存者,以及整容手术需求的不断增加,市场正在经历大幅增长。此外,新兴经济体的认识不断提高和手术选择的可及性改善也极大地促进了这一上升趋势。组织扩张器设计技术的进步也支持了这一成长,确保了患者获得更大的舒适度、安全性和满意度。如今,越来越多的患者选择手术,不仅能满足医疗需求,还能改善美观,进而进一步推动市场的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.041亿美元 |

| 预测值 | 13亿美元 |

| 复合年增长率 | 6.1% |

根据产品类型,市场分为硅胶扩张器和盐水扩张器,其中硅胶基扩张器预计将保持稳定的成长轨迹。硅胶扩张器市场预计将以 6.3% 的复合年增长率扩张,到 2034 年市值将达到 9.253 亿美元。硅胶扩张器因其与人体组织极为相似而备受青睐,使其成为重建和美容用途的理想选择。它们的柔软度、耐用性以及模仿乳房组织自然感觉的能力使它们在患者中越来越受欢迎,从而导致需求不断上升,特别是在人们对手术选择的认识日益增强的新兴市场。

从应用角度来看,市场分为隆乳、乳房切除术后重建等用途。 2024 年,乳房切除术后重建部分占了最大的份额,为 65.5%。随着全球乳癌发生率的持续上升,越来越多的女性接受乳房切除术,这增加了透过重建手术恢復乳房形状和结构的需求。这一领域的成长不仅是由医疗需求推动的,而且还受到这些手术对乳癌倖存者带来的心理和情感益处的推动,使其成为乳癌治疗的一个重要方面。

2024 年美国乳房植入物组织扩张器市场价值为 2.208 亿美元,并将持续成长。美国拥有最多的专注于乳房重建的专业整形外科医生,这使其成为组织扩张器的主要市场。作为全球最大的整容手术市场,尤其是隆乳手术市场,组织扩张器的需求正在上升。此外,美国市场受益于对客製化、符合人体解剖学形状的硅胶扩张器的日益增长的偏好,为患者提供更自然的效果。这些因素,再加上组织扩张器在分阶段隆乳手术中的整合,进一步推动了美国市场的成长,确保了其在全球市场继续占据主导地位。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 隆乳手术数量增加

- 乳癌发生率不断上升

- 技术进步

- 产业陷阱与挑战

- 手术费用高,併发症风险高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 硅胶膨胀剂

- 盐水扩张器

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 乳房切除术后重建

- 隆乳

- 其他应用

第 7 章:市场估计与预测:按形状,2021 – 2034 年

- 主要趋势

- 圆形的

- 解剖

第 8 章:市场估计与预测:按港口类型,2021 年至 2034 年

- 主要趋势

- 整合连接埠

- 远端埠

第 9 章:市场估计与预测:按质地,2021 年至 2034 年

- 主要趋势

- 纹理

- 光滑的

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊所

- 其他最终用户

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Abbvie

- AirXpanders

- Eurosilicone

- GC Aesthetics

- GROUPE SEBBIN SAS

- Guangzhou Wanhe Plastic Materials

- KOKEN

- Mentor Worldwide

- Oxtex

- PMT Corporation

- POLYTECH Health & Aesthetics GmbH

- Sientra

- Silimed

The Global Breast Implant Tissue Expanders Market was valued at USD 704.1 million in 2024 and is set to experience robust growth, with a CAGR of 6.1% from 2025 to 2034. Tissue expanders are critical medical devices that play an essential role in preparing the skin and soft tissue of the breast for reconstruction or augmentation. These devices are predominantly used after mastectomy, trauma, or to address congenital deformities.

With the increasing focus on breast reconstruction, particularly among breast cancer survivors, and rising cosmetic surgery demand, the market is witnessing substantial growth. Moreover, expanding awareness and improved accessibility to surgical options in emerging economies contribute significantly to this upward trend. This growth is also supported by technological advancements in tissue expander design, ensuring greater patient comfort, safety, and satisfaction. Patients today are increasingly opting for surgeries that not only address medical needs but also enhance their aesthetic appearance, further propelling the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $704.1 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 6.1% |

The market is categorized by product type into silicone and saline expanders, with silicone-based expanders projected to maintain a steady growth trajectory. The silicone expander segment is expected to expand at a CAGR of 6.3%, reaching a market value of USD 925.3 million by 2034. Silicone expanders are highly favored due to their superior resemblance to human tissue, making them ideal for both reconstructive and cosmetic purposes. Their softness, durability, and ability to mimic the natural feel of breast tissue have made them increasingly popular among patients, leading to rising demand, particularly in emerging markets where awareness of surgical options is growing.

When looking at applications, the market is divided into breast augmentation, post-mastectomy reconstruction, and other uses. The post-mastectomy reconstruction segment accounted for the largest share of 65.5% in 2024. With the ongoing rise in breast cancer incidences worldwide, more women are undergoing mastectomy procedures, which increases the need for reconstructive surgeries to restore breast shape and structure. This segment's growth is not only driven by medical necessity but also by the psychological and emotional benefits these surgeries offer to breast cancer survivors, making it an essential aspect of breast cancer treatment.

The U.S. breast implant tissue expander market is valued at USD 220.8 million in 2024 and continues to experience growth. The U.S. has the largest concentration of specialized plastic surgeons focusing on breast reconstruction, making it a key market for tissue expanders. As the world's largest market for cosmetic surgeries, particularly breast augmentation, the demand for tissue expanders is on the rise. Additionally, the U.S. market benefits from an increasing preference for customized and anatomically shaped silicone expanders, offering patients more natural-looking outcomes. These factors, coupled with the integration of tissue expanders in staged breast augmentation surgeries, are further fueling the growth of the U.S. market, ensuring its continued dominance in the global landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in number of breast augmentation procedures

- 3.2.1.2 Increasing prevalence of breast cancer

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procedure cost and risk of complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Silicone expanders

- 5.3 Saline expanders

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Post-mastectomy reconstruction

- 6.3 Breast augmentation

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Shape, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Round

- 7.3 Anatomical

Chapter 8 Market Estimates and Forecast, By Port Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Integrated port

- 8.3 Remote port

Chapter 9 Market Estimates and Forecast, By Texture, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Textured

- 9.3 Smooth

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Clinics

- 10.4 Other end users

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbvie

- 12.2 AirXpanders

- 12.3 Eurosilicone

- 12.4 GC Aesthetics

- 12.5 GROUPE SEBBIN SAS

- 12.6 Guangzhou Wanhe Plastic Materials

- 12.7 KOKEN

- 12.8 Mentor Worldwide

- 12.9 Oxtex

- 12.10 PMT Corporation

- 12.11 POLYTECH Health & Aesthetics GmbH

- 12.12 Sientra

- 12.13 Silimed