|

市场调查报告书

商品编码

1684553

鼻窦组织切除设备市场机会、成长动力、产业趋势分析与预测 2025 - 2034Sinus Tissue Resection Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

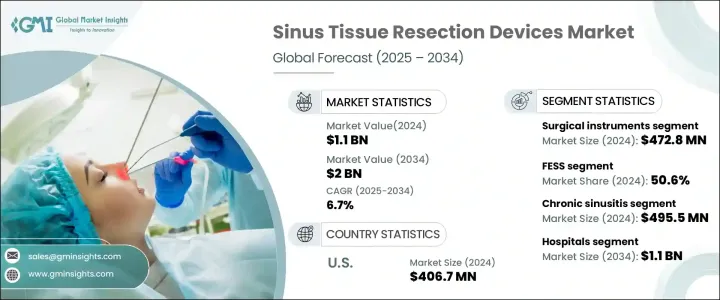

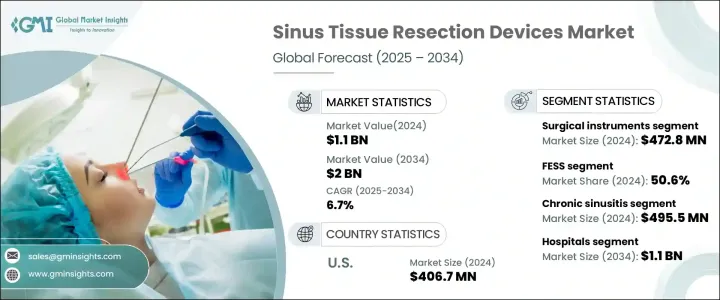

2024 年全球鼻窦组织切除设备市场规模达到 11 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.7%。该市场的成长很大程度上是由人们对微创手术的日益偏好所推动的,先进的技术改变了鼻窦手术的模式。机器人辅助系统和高清内视镜等更精细的手术工具的开发显着提高了鼻窦手术的安全性和效率。随着患者受益于更快的恢復时间和降低的风险,对鼻窦组织切除设备的需求持续攀升,使该领域成为医疗器材行业中最有前景的领域之一。

除了技术创新之外,患者意识的提高和鼻窦相关疾病的日益普及也推动了市场的扩张。人口老化和环境污染物增加导致慢性鼻窦炎发病率上升,进一步刺激了需求。这些设备提供多种解决方案,选项涵盖从传统手术器械到先进的手术导航系统,旨在提高组织移除的准确性。随着治疗效果的改善和对鼻窦健康的认识不断加深,越来越多的患者选择使用涉及这些先进设备的治疗程序,这反过来又支持了市场的上升趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 20亿美元 |

| 复合年增长率 | 6.7% |

市场区隔基于产品类型,包括手术器械、内视镜、手术导航系统和其他相关设备。 2024 年,手术器械引领市场,创造 4.728 亿美元的收入。雷射技术和高清摄影机等技术的进步显着提高了这些工具的精度,使其成为现代鼻窦手术的必备工具。微创手术如功能性内视镜鼻窦手术 (FESS) 的转变继续占据主导地位,到 2024 年将占据 50.6% 的市场份额。

在美国,鼻窦组织切除设备市场在 2024 年的价值为 4.067 亿美元,预计从 2025 年到 2034 年的复合年增长率为 6.1%。这种动态环境促进了尖端技术的早期采用,加速了先进鼻窦切除设备的使用。因此,美国市场将继续扩大,创新的医疗实践和技术将为鼻窦炎患者的治疗选择带来更好的改善。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 鼻窦疾病盛行率不断上升

- 微创技术的进步

- 过敏性鼻炎病例数增加

- 产业陷阱与挑战

- 设备和程序成本高昂

- 併发症和副作用的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 波特的分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 手术器械

- 内视镜

- 手术导航系统

- 其他产品类型

第 6 章:市场估计与预测:按程序,2021 年至 2034 年

- 主要趋势

- 功能性内视镜鼻窦手术(FESS)

- 气囊鼻窦成形术

- 考德威尔·卢克手术

- 开放式鼻窦手术

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 慢性鼻窦炎

- 復发性急性鼻窦炎

- 良性鼻窦肿瘤

- 其他应用

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 专科诊所

- 门诊手术中心

- 其他最终用户

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Acclarent

- B. Braun

- Bien-Air

- Cook Medical

- INTEGRA

- Medtronic

- Meril

- OLYMPUS

- Osteogenics

- PENTAX MEDICAL

- STILLE

- Stryker

- SUMMIT MEDICAL

- SURTEX

- XELPOV SURGICAL

The Global Sinus Tissue Resection Devices Market reached USD 1.1 billion in 2024 and is predicted to expand at a CAGR of 6.7% from 2025 to 2034. These specialized devices are integral in the surgical treatment of conditions like chronic sinusitis and nasal polyps, as they are designed to remove or reduce obstructive tissue from the sinuses. This market's growth is largely driven by the increasing preference for minimally invasive procedures, with advanced technologies transforming the landscape of sinus surgeries. The development of more refined surgical tools, such as robotic-assisted systems and high-definition endoscopes, has significantly improved both the safety and efficiency of sinus procedures. As patients benefit from quicker recovery times and reduced risks, the demand for sinus tissue resection devices continues to climb, making this sector one of the most promising within the medical device industry.

In addition to technological innovations, the rise in patient awareness and the growing prevalence of sinus-related disorders also fuel the market's expansion. The aging population and rising environmental pollutants, which contribute to the increasing incidence of chronic sinusitis, further boost demand. These devices offer a variety of solutions, with options ranging from traditional surgical instruments to advanced surgical navigation systems, all designed to enhance the accuracy of tissue removal. With improved outcomes and a growing understanding of sinus health, more patients are opting for procedures that involve these advanced devices, which, in turn, supports the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2 Billion |

| CAGR | 6.7% |

Segmentation within the market is based on product type, including surgical instruments, endoscopes, surgical navigation systems, and other related devices. In 2024, surgical instruments led the market, generating USD 472.8 million in revenue. Advancements in technology, such as laser technologies and high-definition cameras, have significantly improved the precision of these tools, making them essential for modern sinus surgeries. The shift toward minimally invasive procedures, like functional endoscopic sinus surgery (FESS), continues to dominate, accounting for 50.6% of the market share in 2024. FESS, in particular, benefits from the use of endoscopes, which offer surgeons a detailed view of the sinuses and surrounding structures, improving patient outcomes and reducing complications.

In the U.S., the sinus tissue resection devices market was valued at USD 406.7 million in 2024 and is expected to expand at a CAGR of 6.1% from 2025 to 2034. The U.S. is well-positioned to drive this market due to its highly developed healthcare infrastructure, including state-of-the-art medical facilities and ongoing investments in healthcare research. This dynamic environment fosters the early adoption of cutting-edge technologies, accelerating the use of advanced sinus resection devices. As a result, the market in the U.S. is set for continued expansion, with innovative medical practices and technologies leading the way for improved treatment options for sinus patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of sinus disorders

- 3.2.1.2 Technological advancements in minimally invasive techniques

- 3.2.1.3 Rise in number of allergic rhinitis cases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices and procedures

- 3.2.2.2 Risk of complications and side effects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Gap analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical instruments

- 5.3 Endoscopes

- 5.4 Surgical navigation systems

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Functional endoscopic sinus surgery (FESS)

- 6.3 Balloon sinuplasty

- 6.4 Caldwell Luc surgery

- 6.5 Open sinus surgery

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chronic sinusitis

- 7.3 Recurrent acute sinusitis

- 7.4 Benign sinus tumors

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Acclarent

- 10.2 B. Braun

- 10.3 Bien-Air

- 10.4 Cook Medical

- 10.5 INTEGRA

- 10.6 Medtronic

- 10.7 Meril

- 10.8 OLYMPUS

- 10.9 Osteogenics

- 10.10 PENTAX MEDICAL

- 10.11 STILLE

- 10.12 Stryker

- 10.13 SUMMIT MEDICAL

- 10.14 SURTEX

- 10.15 XELPOV SURGICAL