|

市场调查报告书

商品编码

1684554

建筑电力租赁市场机会、成长动力、产业趋势分析与预测 2025 - 2034Construction Power Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

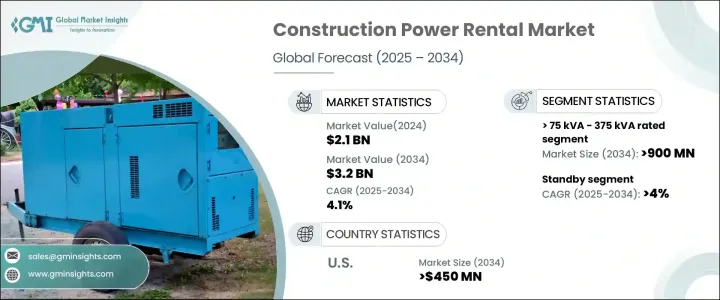

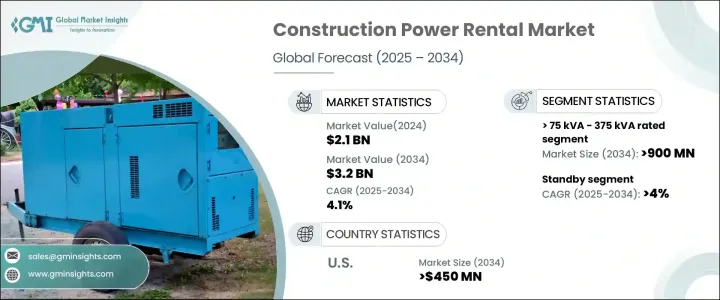

2024 年全球建筑电力租赁市场价值为 21 亿美元,预计将在 2025 年至 2034 年期间以 4.1% 的复合年增长率强劲增长。随着建筑项目变得越来越复杂和环保,对高效、环保电源的需求变得越来越优先。太阳能和风能等再生能源不断融入临时电力系统,为市场提供了动力。数位技术可以实现更好的能源管理和远端监控,在提高电力租赁服务的效率和可靠性方面也发挥着至关重要的作用。此外,人们对将柴油等传统燃料与更清洁的能源选择相结合的混合动力系统的需求日益增长,以符合全球永续发展目标。

建筑电力租赁市场中最有前景的部分之一是对额定功率在 75 kVA 至 375 kVA 之间的发电机的需求。预计到 2034 年,该领域将创收 9 亿美元,反映出适用于中型建筑工地的中檔发电机的需求日益增长。这些发电机旨在为重型建筑设备和机械提供稳定可靠的电源,确保连续运作而不间断。随着越来越多的建筑公司寻求减少停工时间和提高生产力,这些多功能发电机对于确保专案顺利进行变得至关重要。同时,随着建筑公司面临越来越大的减少环境影响的压力,对使用柴油和再生能源的混合发电机的需求正在迅速增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 4.1% |

备用建筑电力租赁市场也正在经历显着增长,预计到 2034 年将实现 4% 的复合年增长率。飓风和洪水等极端天气事件发生的频率日益增加,进一步凸显了可靠的电源备用系统的重要性。此外,大型基础设施项目和智慧城市发展通常需要在建设阶段采用临时电力解决方案,这也导致备用电源的需求不断增加。

在美国,受技术创新、严格的环境法规以及临时电力解决方案需求不断增长的推动,建筑电力租赁市场预计到 2034 年将创收 4.5 亿美元。预计交通、能源和公用事业等领域建筑业的快速成长将继续支持这一扩张。严格的排放法规也鼓励使用更清洁、更永续的能源。此外,自然灾害发生的频率不断增加,对模组化、可扩展的电源解决方案的需求也越来越大,这对于灾难復原工作至关重要。随着建设项目的发展,对灵活、高效的电力租赁服务的需求也在不断增长,以满足多样化和不断增长的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 – 2034 年

- 主要趋势

- ≤ 75 千伏安

- > 75 千伏安 - 375 千伏安

- > 375 千伏安 - 750 千伏安

- >750千伏安

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 支援

- 调峰

- 初始/连续

第 7 章:市场规模与预测:按燃料,2021 – 2034 年

- 主要趋势

- 柴油引擎

- 气体

- 其他的

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第九章:公司简介

- Aggreko

- APR Energy

- Atlas Copco

- Bredenoord

- Byrne Equipment Rental

- Caterpillar

- Cummins

- Generac Power Systems

- Herc Rentals

- HIMOINSA

- Paikane

- Perennial Technologies

- Powermak

- Rehlko

- Shenton Group

- Sudhir Power

- Teksan

- United Rentals

The Global Construction Power Rental Market, valued at USD 2.1 billion in 2024, is set to experience robust growth at a CAGR of 4.1% from 2025 to 2034. This expansion is largely attributed to key factors such as technological advancements, the growing demand for sustainable energy solutions, and an increase in infrastructure financing projects. As construction projects become more complex and environmentally conscious, the need for efficient, eco-friendly power sources is becoming a priority. The ongoing integration of renewable energy sources, such as solar and wind power, into temporary power systems is fueling the market. Digital technologies, which allow for better energy management and remote monitoring, are also playing a crucial role in improving the efficiency and reliability of power rental services. Moreover, there is a rising demand for hybrid power systems that combine traditional fuel sources like diesel with cleaner energy options, aligning with global sustainability goals.

One of the most promising segments within the construction power rental market is the demand for generators rated between 75 kVA and 375 kVA. This segment is projected to generate USD 900 million by 2034, reflecting the growing need for mid-range generators suitable for medium-scale construction sites. These generators are designed to provide a consistent and reliable power supply for heavy construction equipment and machinery, ensuring continuous operations without interruptions. With more construction companies seeking to reduce downtime and boost productivity, these versatile generators are becoming essential for keeping projects on track. At the same time, as construction companies face increasing pressure to reduce their environmental footprint, the demand for hybrid generators, which use both diesel and renewable energy, is rapidly increasing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 4.1% |

The standby construction power rental market is also witnessing notable growth and is projected to achieve a CAGR of 4% through 2034. As the need for backup power intensifies, especially in remote and developing regions, more construction projects are relying on reliable power systems to avoid costly delays. The growing frequency of extreme weather events, such as hurricanes and floods, further underscores the importance of dependable power backup systems. Additionally, large-scale infrastructure projects and smart city developments, which often require temporary power solutions during the construction phase, are contributing to the rising demand for standby power.

In the U.S., the construction power rental market is expected to generate USD 450 million by 2034, driven by technological innovations, stringent environmental regulations, and a rising demand for temporary power solutions. The rapid growth in construction across sectors like transportation, energy, and utilities is expected to continue supporting this expansion. Strict emissions regulations are also encouraging the use of cleaner, more sustainable power sources. Furthermore, the increasing frequency of natural disasters is leading to a greater demand for modular, scalable power solutions, which are essential for disaster recovery efforts. As construction projects evolve, so too does the need for flexible, efficient power rental services to meet diverse and growing demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 75 kVA

- 5.3 > 75 kVA - 375 kVA

- 5.4 > 375 kVA - 750 kVA

- 5.5 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Peak shaving

- 6.4 Prime/continuous

Chapter 7 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Gas

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Aggreko

- 9.2 APR Energy

- 9.3 Atlas Copco

- 9.4 Bredenoord

- 9.5 Byrne Equipment Rental

- 9.6 Caterpillar

- 9.7 Cummins

- 9.8 Generac Power Systems

- 9.9 Herc Rentals

- 9.10 HIMOINSA

- 9.11 Paikane

- 9.12 Perennial Technologies

- 9.13 Powermak

- 9.14 Rehlko

- 9.15 Shenton Group

- 9.16 Sudhir Power

- 9.17 Teksan

- 9.18 United Rentals