|

市场调查报告书

商品编码

1684558

钙调磷酸酶抑制剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Calcineurin Inhibitors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

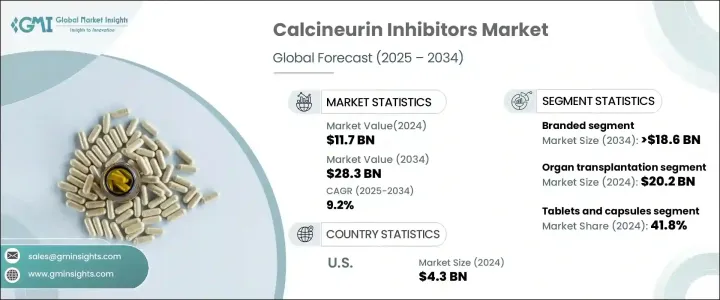

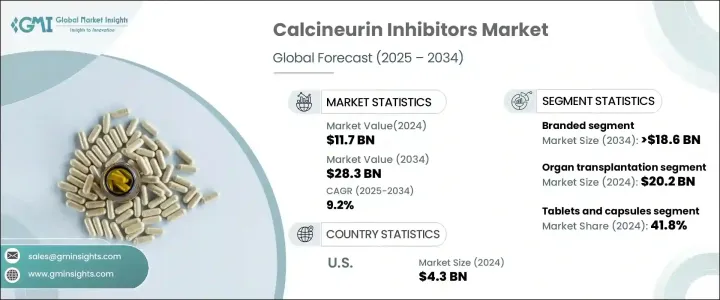

2024 年全球钙调磷酸酶抑制剂市值为 117 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.2%。这一市场成长主要受全球自体免疫疾病盛行率上升和器官移植数量增加的推动。钙调神经磷酸酶抑制剂在移植医学中至关重要,因为它们可以抑制免疫系统以防止器官排斥,特别是在肾臟、肝臟、心臟和肺移植等高需求手术。这些药物在确保移植成功方面发挥的关键作用继续推动其应用,从而增强其市场需求。随着全球医疗保健格局的发展,由于人口老化和器官衰竭发生率上升等因素,需要器官移植的人数不断增加,进一步巩固了对这些免疫抑制药物的需求。

在钙调神经磷酸酶抑制剂市场中,竞争分为品牌药物和仿製药。占据市场很大份额的品牌细分市场预计将以 9% 的成长率领先。到2034年预计将达到186亿美元。品牌钙调神经磷酸酶抑制剂由于其经过验证的疗效、强大的安全性以及临床试验资料的坚实支持,仍然是医疗保健专业人士的首选。这些产品的製造符合严格的品质标准,确保一致性和可靠性。这使得它们成为关键移植方案的首选方案,其成功取决于最大限度地降低器官排斥的风险。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 117亿美元 |

| 预测值 | 283亿美元 |

| 复合年增长率 | 9.2% |

钙调神经磷酸酶抑制剂主要用于三个领域:器官移植、自体免疫疾病和其他专门应用。预计 2025 年至 2034 年间,器官移植领域将创收 202 亿美元,凸显了这些药物在移植后照护中的核心角色。它们管理人体免疫反应的能力有效地确保了移植器官的存活,使它们在世界各地的移植医学中成为不可或缺的一部分。由于免疫抑制疗法仍然是预防器官排斥的基石,钙调神经磷酸酶抑制剂继续占据这一领域的主导地位。

在美国,钙调神经磷酸酶抑制剂市场价值在 2024 年为 43 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.4%。美国是这些药物的主要市场,拥有世界领先的移植中心、强大的报销政策以及对研发的强劲投资,推动市场向前发展。此外,糖尿病和高血压等慢性病发生率高,常常导致器官衰竭,进一步增加了对钙调神经磷酸酶抑制剂的需求。这些因素使美国成为全球市场的主导力量,确保了该行业的持续成长和创新。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 器官移植手术数量不断增加

- 自体免疫疾病盛行率上升

- 免疫抑制研发活动激增

- 产业陷阱与挑战

- 副作用和替代疗法的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 报销场景

- 管道分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 品牌

- 他克莫司

- 环孢菌素

- 其他品牌产品

- 通用的

- 他克莫司

- 环孢菌素

- 其他通用产品

第六章:市场估计与预测:按剂量,2021 - 2034 年

- 主要趋势

- 片剂和胶囊

- 软膏

- 注射

- 其他剂型

第 7 章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 器官移植

- 自体免疫疾病

- 其他适应症

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- abbvie

- astellas

- Aurinia

- Biocon

- Dr. Reddy's

- Glenmark

- LUPIN

- Novartis

- Roche

- VIATRIS

The Global Calcineurin Inhibitors Market, valued at USD 11.7 billion in 2024, is projected to expand at a CAGR of 9.2% from 2025 to 2034. This market growth is primarily fueled by the increasing prevalence of autoimmune disorders and the rising number of organ transplants across the globe. Calcineurin inhibitors are essential in transplant medicine, as they suppress the immune system to prevent organ rejection, particularly in high-demand procedures such as kidney, liver, heart, and lung transplants. The critical role these medications play in ensuring transplant success continues to drive their adoption, thus enhancing their market demand. As the global healthcare landscape evolves, the increasing number of individuals requiring organ transplants-due to factors like aging populations and the rising incidence of organ failure-has further solidified the demand for these immunosuppressive drugs.

Within the calcineurin inhibitors market, the competition is segmented into branded and generic options. The branded segment, accounting for a significant portion of the market, is anticipated to lead with a growth rate of 9%. By 2034, it is expected to reach USD 18.6 billion. Branded calcineurin inhibitors remain the preferred choice among healthcare professionals because of their proven efficacy, strong safety profiles, and solid backing from clinical trial data. These products are manufactured to meet rigorous quality standards, ensuring consistency and reliability. This makes them the go-to option in critical transplant protocols, where success depends on minimizing the risk of organ rejection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.7 Billion |

| Forecast Value | $28.3 Billion |

| CAGR | 9.2% |

Calcineurin inhibitors are utilized primarily in three areas: organ transplantation, autoimmune diseases, and other specialized applications. The organ transplantation segment is expected to generate USD 20.2 billion between 2025 and 2034, underlining the central role of these drugs in post-transplant care. Their ability to manage the body's immune response effectively ensures the survival of transplanted organs, making them indispensable in transplant medicine worldwide. As immunosuppressive therapy remains the cornerstone of preventing organ rejection, calcineurin inhibitors continue to dominate this segment.

In the United States, the calcineurin inhibitors market, valued at USD 4.3 billion in 2024, is projected to grow at a CAGR of 8.4% from 2025 to 2034. The U.S. is a key market for these medications, with the presence of world-leading transplant centers, strong reimbursement policies, and a robust investment in research and development driving the market forward. Moreover, the high rates of chronic conditions such as diabetes and hypertension, which often lead to organ failure, further amplify the demand for calcineurin inhibitors. These factors position the U.S. as a dominant force in the global market, ensuring continued growth and innovation within the sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of organ transplant procedures

- 3.2.1.2 Rising prevalence of autoimmune diseases

- 3.2.1.3 Surge in immunosuppressive research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and the availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Branded

- 5.2.1 Tacrolimus

- 5.2.2 Cyclosporine

- 5.2.3 Other branded products

- 5.3 Generic

- 5.3.1 Tacrolimus

- 5.3.2 Cyclosporine

- 5.3.3 Other generic products

Chapter 6 Market Estimates and Forecast, By Dosage, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets and capsules

- 6.3 Ointments

- 6.4 Injections

- 6.5 Other dosage forms

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Organ transplantation

- 7.3 Autoimmune disease

- 7.4 Other indications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 abbvie

- 9.2 astellas

- 9.3 Aurinia

- 9.4 Biocon

- 9.5 Dr. Reddy’s

- 9.6 Glenmark

- 9.7 LUPIN

- 9.8 Novartis

- 9.9 Roche

- 9.10 VIATRIS